October 31, 2025

S&P futures up 0.7% in Friday morning trading after U.S. equities finished near session lows Thursday, weighed by META and weakness across QSRs, managed care, airlines, and ag chemicals. Retail favorites and most-shorted names also underperformed. Despite narrow breadth, stocks remain on track for a third straight weekly gain and a sixth consecutive monthly advance. Treasuries steady to slightly weaker, Dollar Index flat, gold +0.2%, Bitcoin +2.5%, and WTI crude −0.7%.

Earnings and AI optimism remain the dominant themes. AAPL gained on stronger December-quarter iPhone guidance, while AMZN rallied on accelerating AWS growth. The blended Q3 S&P 500 earnings growth rate has climbed to +10.5%, up from +7.9% at the start of earnings season, with 82% of companies beating estimates. Seasonal buybacks and AI adoption continue to provide key tailwinds.

Outside of big tech, AI enthusiasm drove cross-sector gains even as breadth remained narrow.

Notable Gainers:

- WDC-US – Jumped on better-than-expected results and improved NAND pricing trends.

- TEAM-US (Atlassian) – Surged on strong cloud growth and upbeat FY guidance.

- MSTR-US (MicroStrategy) – Rose with strength in Bitcoin and AI software commentary.

- RDDT-US (Reddit) – Rallied after revenue and engagement beat expectations.

- TWLO-US (Twilio) – Advanced on cost controls and improving margins.

- COIN-US (Coinbase) – Gained on crypto rally and higher trading volumes.

- ILMN-US (Illumina) – Up on better sequencing demand and cost-cut progress.

- FSLR-US (First Solar) – Higher on strong EPS and bookings momentum.

- BHF-US (Brighthouse Financial) – Spiked on reports of $4B go-private talks.

Notable Decliners:

- META-US – Fell sharply on 2026 opex growth concerns despite strong engagement trends.

- SYK-US (Stryker) – Declined after mixed Q3 results and cautious procedural outlook.

- GILD-US (Gilead Sciences) – Weaker on light HIV revenue and lower FY guide.

- ROKU-US (Roku) – Dropped on soft Q4 outlook and rising content costs.

- MPWR-US (Monolithic Power Systems) – Down after margin pressure commentary.

- DXCM-US (Dexcom) – Slipped on cautious tone about competitive pricing.

- IR-US (Ingersoll Rand) – Lower after guidance came in below expectations.

- AJG-US (Arthur J. Gallagher) – Fell on modest organic growth and expense commentary.

- COLM-US (Columbia Sportswear) – Declined on weak outdoor apparel demand.

Other Headlines:

- NVDA-US CEO said the company still hopes to sell Blackwell chips to China but has no immediate plans.

- META-US saw record demand (~$125B in orders) for its $30B bond sale.

- NFLX-US announced a 10-for-1 stock split and is exploring a bid for WBD-US studio assets.

- INTC-US reportedly in talks to acquire AI chip startup SambaNova Systems.

Macro & Policy Notes:

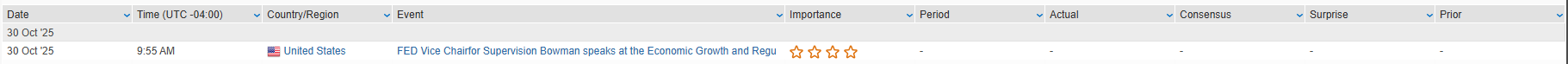

No major data today, though sell-side estimates put initial jobless claims for week-ended Oct. 25 at ~218–219K (below prior week’s 231K) with continuing claims still elevated. Fed’s Logan, Bostic, and Hammack speak later today. OPEC+ meets this weekend and may announce another production hike. Next week’s focus shifts to October ISM manufacturing (Mon), ISM services and ADP payrolls (Wed), and University of Michigan sentiment (Fri), along with Supreme Court hearings on IEEPA tariffs and several major U.S. mayoral elections.

Stocks fell on Thursday as investors digested a hawkish-leaning Fed cut, mixed mega-cap earnings, and a fragile U.S.–China trade truce. Breadth improved modestly (RSP > SPX by ~55 bp) after five sessions of cap-weighted dominance, but the Dow −0.23%, S&P 500 −0.99%, Nasdaq −1.57%, Russell 2000 −0.76% all finished lower. Rates rose again (curve steepening; +1–4 bp after ~+10 bp Wed), the DXY +0.3% (adding to Wed’s +0.6%), gold +0.4% (back >$4k/oz), BTC −3.3% (~$107k), and WTI +0.1%.

Big tech prints underscored elevated AI capex and capacity constraints, keeping scrutiny on near-term monetization vs. spend. Corporate commentary continued to flag a more cautious consumer. The Trump–Xi meeting delivered a one-year truce broadly in line with leaks (rare-earth controls deferred; fentanyl tariff cut to 10%), lowering immediate tariff tail risk but leaving structural frictions unresolved. Despite Wednesday’s 25 bp cut and QT end signaled for Dec-1, Powell’s “December cut not a foregone conclusion” tone pushed the market toward a flatter 2026 cutting path.

Sector Performance Highlights

Outperformers: Real Estate +0.65%, Financials +0.32%, Health Care +0.22%, Energy +0.68% (Utilities −0.40%, Industrials −0.25%, Consumer Staples 0.00%).

Underperformers: Consumer Discretionary −2.56%, Communication Services −2.14%, Information Technology −1.41%, Materials −1.00%.

Communication Services

- Alphabet (GOOGL): Cloud +33.5% y/y; ~50% q/q backlog jump (~$155B); $1B-plus deals ramp; AI Overviews reach >2B users with comparable monetization.

- Meta (META): Engagement tailwind (IG time spent >+30% y/y; Reels $50B+ ARR proxy), but 2026 opex growth “significantly faster” than 2025 and “notably higher” capex weighed.

- Comcast (CMCSA): Beat on earnings/revenue; softer adj. EBITDA in Connectivity & Platforms; better net adds in broadband/video/wireless.

- Roblox (RBLX): Bookings/EBITDA beat; ABPDAU light; FY25 bookings raised but mgmt cautious on hit timing/comps.

Information Technology

- Microsoft (MSFT): FQ1 beat; Azure +39% y/y beats guidance/Street but below buyside; FYQ2 guide ~in line; capacity constraints, not demand, cited.

- KLA (KLAC): AI investment tailwind reiterated; uncertainty around ramp timing.

- ServiceNow (NOW): EPS/revenue beat; cRPO/RPO ahead; Q4 sub-revenue guide raised; strong net-new deals momentum.

- Entg / CDNS / FFIV (implied from peer group): Mixed prints; some underwhelming guides vs high bars.

Consumer Discretionary

- Chipotle (CMG): Miss; third straight comp guide cut; noted weaker 100k-income cohort, food-cost pressure, elevated promos.

- eBay (EBAY): Beat on Q3, FY26 guide below Street; GMV deceleration expected; GM −90 bp.

- Caesars (CZR): Miss; LV visitation/table hold weaker; leisure volumes below prior year.

- Housing-linked retail/homebuilders were relative winners despite traffic pressure at select chains.

Consumer Staples

- Kraft Heinz (KHC): EPS beat; revenue/OP a bit light; FY25 growth guides trimmed; challenging operating backdrop.

- Hershey (HSY): Beat; raised FY26; embeds ~$160–170M tariff costs.

- Sprouts (SFM): EPS beat; revenue/comps miss; FY25 EPS/OP midpoints below Street; macro/competition cited.

- Altria (MO): Revenue light; EPS slightly better; MST volumes soft vs. ZYN competition.

Health Care

- Eli Lilly (LLY): Big top/bottom-line beat; Mounjaro/Zepbound strong; FY raised; pipeline progress.

- Merck (MRK): Keytruda a bit light vs. high bar.

- Cardinal Health (CAH): EPS/revenue beat; FY EPS/FCF raised; Pharm/Specialty strength.

- Guardant (GH): Beat; FY revenue/GM/OM raised; oncology growth acceleration continues.

- Baxter (BAX): EPS beat; revenue/margins miss; Q4 well below; FY25 outlook cut.

Financials

- Mastercard (MA): Healthy consumer/business spend trends.

- Banks/Insurers/Brokers broadly bid as rates rose and credit angst stayed contained.

Industrials

- EMCOR (EME): Post-earnings weakness despite broader E&C resilience.

- Road/Rail outperformed on volume/pricing discipline; Airlines lagged on mixed demand signals.

- Huntington Ingalls (HII): Beat across segments; FY25 FCF raised.

- C.H. Robinson (CHRW): Beat; 2026 EBIT target raised; +$2B buyback; productivity/tech traction.

Energy

- E&Ps outperformed with crude steady and crack spreads stabilizing; WTI +0.1% on the day.

- Select services and midstream benefited from higher activity visibility; integrateds mixed.

Materials

- International Paper (IP): Miss; NA packaging EBITDA down; soft volumes; FY25 guide/ FY27 targets cut.

- FMC: Revenue ex-India below guide; volumes/pricing down (LatAm generics); FY cuts, big FCF guide cut; dividend slashed to prioritize deleveraging.

- Steel broadly softer with macro and China sentiment.

Real Estate

- Sector outperformed (+0.65%) as long end steadied; quality balance sheets and FCF visibility favored.

Utilities

- Slight relative strength (−0.40% vs SPX −0.99%); rate sensitivity tempered by safer-haven bid and improving fuel mix.

Eco Data Releases | Friday October 31st, 2025

S&P 500 Constituent Earnings Announcements | Friday October 31st, 2025

Data sourced from FactSet Research Systems Inc.