October 31, 2025

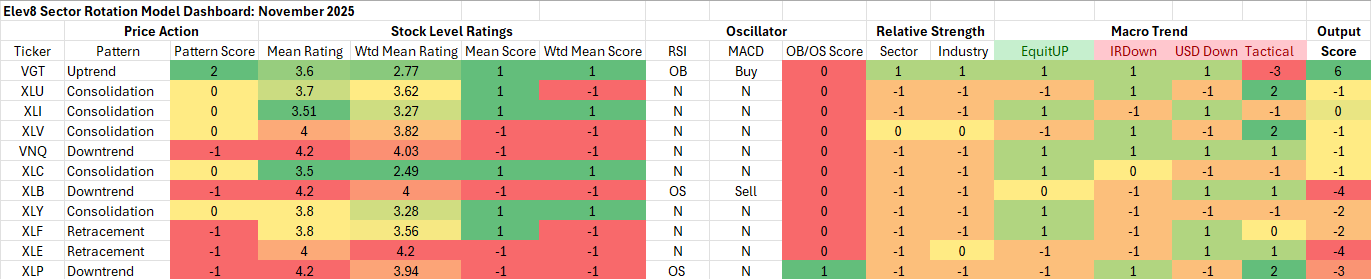

Elev8 Model Input Scores: November 2025

The table below shows the Elev8 model’s scores for November. With buying concentrated in the Information Technology Sector to the expense of all others, our scoring reflects that wide dispersion. The Tech. sector remains our largest overweight exposure. We are out of Consumer Staples, Energy and Materials sectors as they have faced stiff headwinds from global trade developments and lack of buyer interest. We have implemented a slight bias towards risk off positioning to complement our Tech Sector overweight given weakening index level breadth measures and a backdrop of slowing economic growth.

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buy/sell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Model Input Commentary

The AI trade continues to dominate investor interest and given strong earnings results and coincident outperformance, we think the trade is likely to persist as investors have been quick to accumulate any near-term weakness. However, deteriorating breadth measures and continued pressure on the US consumer have us de-risking the rest of the portfolio. Our tactical overlay is put on due to elevated performance dispersion and structurally oversold conditions across low vol. sectors despite a backdrop of falling interest rates. Notably, Technology Sector technicals are so strong the overlay doesn’t impact the strong buy rating from the model inputs. In the case we are respecting the strength of the bull trend in Tech despite some concerns.

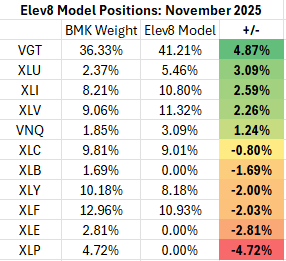

Elev8 Sector Rotation Model Portfolio: November Positioning vs. Benchmark Simulated S&P 500 (data as of 10/30)

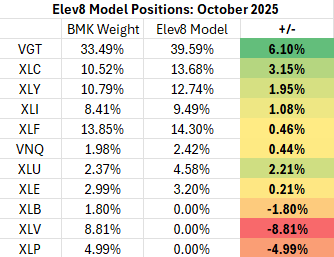

Previous Positioning as of last Rebalance: September 29, 2025

For November we’re “bar-belling” our Tech exposure with increase low vol. hedges. We’ve funded that by taking Discretionary, Financial and Comm. Services allocations to below market weight. Our zero-weight sectors (Staples, Materials, Energy) continue to be challenged both by global trade developments and weak operating results.

Conclusion

Despite the AI trade creating a rather narrow leadership profile for equities, the near-term operating results for AI exposed companies show powerful fundamental demand with enthusiastic buyers taking any signs of near-term weakness as a cue to accumulate. We are entering November positioned with the bull trend and long AI themes. We have tried to de-risk the rest of the portfolio due to some deterioration in market internals and sluggish economic data.

About Elev8

We introduced the Elev8 Sector Rotation Model in November of 2024. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for April and our resulting positions. The model includes up to 14 indicators that range from:

- Stock Level Technical Characteristics

- Macro-overlays:

- equity trend (S&P 500)

- interest rate trend (10yr US Treasury Yield)

- commodities trend (Bloomberg Commodities Index)

- USD trend (vs. EUR & Broad Currency Indices)

- Relative performance vs. the benchmark S&P 500

- Overbought/Oversold oscillator studies

We use the largest passive sector-based ETF by AUM ($) for each sector as our proxy for Elev8 sector positions. We select 8 out of 11 Sectors each month and have no exposure to the 3 with the lowest scores in our model.

Data from Factset Research Systems Inc.