November 6, 2025

S&P futures +0.1% Thursday morning after U.S. equities rebounded Wednesday from the biggest one-day pullback since the Oct-10 U.S.–China trade flare-up. The recovery was broad, led by semiconductors, airlines, regional banks, hotels, casinos, and apparel retail, while small caps, retail favorites, and heavily shorted names also outperformed.

Overseas, Asia rallied sharply (Tokyo, Shenzhen, Hong Kong, and Seoul among the standouts), while Europe traded mixed. Treasuries were firmer (yields −2 bp), Dollar Index −0.2%, gold +0.6%, Bitcoin −0.6%, and WTI crude +0.8%.

No major directional catalysts are in play. Markets remain focused on valuation fatigue, AI-related capex scrutiny, and the lack of reward for earnings beats — with Qualcomm (QCOM) the latest example. Labor-market concerns resurfaced after Challenger job cuts surged to 150K in October, the highest monthly total in over 20 years, pushing YTD cuts above 1M. Debate continues around the Supreme Court’s IEEPA tariff case, where perceived skepticism toward the White House argument lifted retail shares but prolonged uncertainty remains a drag. The government shutdown continues with little progress toward compromise, and new flight groundings could intensify pressure.

A busy day of Fed commentary includes Williams, Barr, Hammack, Waller, Paulson, and Musalem, with several officials expected to address labor softness and inflation risks. Friday’s University of Michigan sentiment and inflation expectations headline the data calendar.

Corporate highlights:

- QCOM beat and guided higher on Android strength but faces concerns over Apple share loss.

- ARM rallied on strong AI-related royalties and licensing revenue.

- AppLovin (APP) rose on another beat and raise, aided by gaming ad demand.

- DoorDash (DASH) beat expectations but flagged 2026 investment-related margin pressure.

- Fortinet (FTNT) fell sharply on another weak Services result.

- Robinhood (HOOD) gained after beating estimates and highlighting new prediction-market growth.

- FICO declined on light FY26 guidance.

- HubSpot (HUBS) lagged as expectations from its September analyst day proved too high.

- Coherent (COHR) surged on record bookings and strong data-comms demand.

- Paycom (PAYC) slipped after in-line results failed to clear high expectations.

- Duolingo (DUOL) dropped on softer Q4 bookings guidance.

- Lyft (LYFT) gained after reaffirming 2026 growth acceleration targets.

- Snap (SNAP) jumped on a $400M partnership with Perplexity AI.

- e.l.f. Beauty (ELF) fell on weaker FY26 guidance.

- Dutch Bros (BROS) rallied on a strong comp beat and demand strength into October.

- Coty (COTY) advanced on better sequential trends

Stocks rebounded Wednesday (Dow +0.48% | S&P 500 +0.37% | Nasdaq +0.65% | Russell 2000 +1.54%), with gains broadening to small caps and “most-shorted” baskets. Treasuries weakened and the curve steepened (yields +5–7 bp). The dollar was flat; gold +0.8%, Bitcoin +3.2% (after a ~6% slide Tuesday), and WTI −1.6% (back below $60).

On data, ADP +42K (vs. 38K cons; prior revised to +29K) showed services-led hiring at large firms, while ISM Services 52.5 (new orders 56.2) hit an eight-month high. The Prices subindex jumped to 70.0, helping push yields higher. Treasury’s refunding was largely status quo (no auction size changes; bills to rise). Fed Governor Miran flagged tariff uncertainty as a potential drag.

Earnings remain busy (~80% of the S&P reported): blended EPS growth near +12.5% (vs. +7.9% expected at Q3 end) with an ~82% beat rate. High bars persist—beats aren’t always rewarded amid valuation and AI ROI scrutiny.

Sector Highlights

Leadership broadened: Communication Services (+1.63%), Consumer Discretionary (+1.12%), Materials (+0.54%), Health Care (+0.44%), and Industrials (+0.40%) outperformed. Laggards/soft spots: Consumer Staples (−0.25%), Technology (−0.08%), Real Estate (−0.06%), with Utilities (+0.04%), Energy (+0.18%), and Financials (+0.29%) trailing the tape. The mix reflects a bounce in cyclicals and small caps, while mega-cap tech remained mixed.

Technology

- AMD: Beat; Q4 revenue guide above on Data Center and AI GPUs.

- Lumentum (LITE) +23.6%: Beat/raise; AI transceiver momentum; demand > supply.

- Arista (ANET −8.6%): Beat, guided above; still sold on elevated expectations/white-box concerns.

- Super Micro (SMCI −11.3%): Revenue slightly above, EPS light; margin pressure, higher R&D, FCF concerns.

- Toast (TOST +9.5%): Beat; strong net adds, FY outlook raised.

- Cirrus Logic (CRUS): Upside on stronger iPhone shipments.

- Dynatrace (DT −4.5%)/Tempus (TEM −2.6%): Beats, but guidance/valuation kept a lid on moves.

- Apple / Google: AAPL nearing a $1B deal to power Siri with Gemini.

Communication Services

- Meta/Alphabet: Mixed; ad peers steadier as cyclicals rallied.

- Pinterest (PINS −21.8%): MAUs and EPS beat; Q4 rev guide light.

- Netflix: Ads reportedly reached 190M viewers in October; expanding metrics.

- Live Nation (LYV −10.6%): Q3 revenue light; 2026 indicators still positive.

- Warner Bros. Discovery: Potential sale update expected mid-to-late December.

Consumer Discretionary

- McDonald’s (MCD): Post-print strength aided discretionary tone.

- Rivian (RIVN +23.4%): Beat; reaffirmed FY deliveries; R2 line on track for 1H26.

- Tesla: Reuters said Musk’s pay package likely to pass despite opposition.

- Monro (MNRO): Higher on Icahn stake commentary.

Health Care

- Amgen (AMGN +7.8%): Beat/raise; focus turning to upcoming GLP-1 (MariTide) readouts.

- Teva (TEVA +?) / Exelixis (EXEL +6.5%): Beats; TEVA raised FY view; EXEL raised revenue midpoint.

- Humana (HUM −6.0%): Beat; MA membership outlook trimmed (less negative than prior).

- Zimmer Biomet (ZBH −15.2%): Organic growth missed; hips/SET soft.

- Novo/Metsera: FTC flagged concerns around NVO’s improved MTSR bid; Pfizer removed some bid conditions.

Financials

- Bank of America (BAC −2.0%): Outlined medium-term targets; ROTCE higher but seen as largely in-line.

- Insurers/Payments: Mixed; Wednesday’s winners were more cyclically geared (regionals), consistent with small-cap strength.

Industrials

- Johnson Controls (JCI +8.8%): Beat; data-center cooling, EPS guide above; margin optimism.

- Emerson (EMR −3.8%): FQ4 revenue miss; next-Q and FY26 below Street on software renewal headwinds.

- Kratos (KTOS −14.2%): Beat, but light near-term guides; to acquire Orbit Technologies.

- A&D / E&Cs / Machinery: Group bid supported the cyclical rebound; rails lagged.

Materials

- Corteva (CTVA) and Mosaic (MOS): “Better-than-feared” prints aided ag-chemicals.

- IFF +4.0%: Beat; strength in Taste & Scent; FY guidance reaffirmed.

- Metals mixed; building products weak on TREX (−31.1%) miss and guidance cut.

Energy

- Crude −1.6%: Below $60/bbl pressured some upstream; refiners/midstream mixed.

- Group underperformed the rally, tracking the move in oil and recent margin normalization.

Real Estate & Utilities

- REITs/Utilities: Little changed; higher yields offset by improved risk tone.

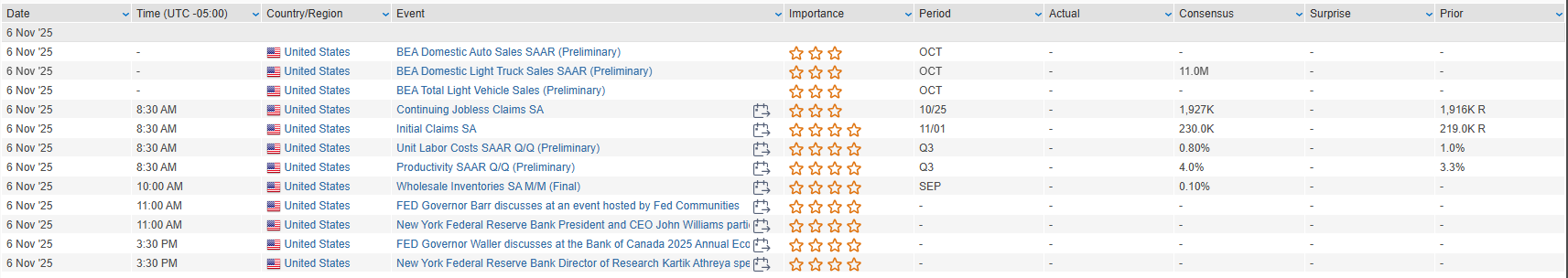

Eco Data Releases | Thursday November 6th, 2025

S&P 500 Constituent Earnings Announcements | Thursday November 6th, 2025

Data sourced from FactSet Research Systems Inc.