November 7, 2025

S&P futures -0.3%, near premarket lows, after U.S. equities fell sharply Thursday, with three of four major indexes down over 1%. The Nasdaq 100 logged its third >1% pullback in six sessions, as AI, retail favorites, and most-shorted names led declines. NVDA and TSLA were the weakest of the Mag 7. Other laggards included software, E&Cs, trucking, cruise lines, chemicals, and MCOs, leaving the S&P on track to break a three-week winning streak.

Overseas, Asia was broadly lower (Japan, South Korea lagging), while Europe slipped ~0.6%. Treasuries were narrowly mixed (long end softer); Dollar index flat, gold +0.4%, Bitcoin -0.7% near $100K, and WTI crude +0.9%.

Headlines remain light. AI capex and valuation scrutiny continue to drive risk-off sentiment, while markets persist in punishing earnings beats amid a high-bar setup. Rising concern over labor-market softening and potential cracks in consumer resilience added to caution. Still, the broader bullish narrative—anchored by double-digit earnings growth, prospects for Fed easing, solid macro data, AI investment, fiscal stimulus (OBBBA), seasonality, buybacks, retail flows, and M&A momentum—remains intact despite the week’s pullback.

On the macro front, University of Michigan sentiment (Nov prelim) is today’s focus, expected at 53.0 vs. 53.6, with 5-10-year inflation expectations seen easing to 3.8%. Fed speakers Williams, Jefferson, and Miran are on the docket; Williams recently discussed the neutral rate and possible balance-sheet expansion, while Miran reiterated support for easing. Next week brings continued data delays from the government shutdown—CPI and retail sales remain postponed—alongside NFIB small business optimism (Tue) and heavy Treasury issuance (3-, 10-, 30-year auctions).

Corporate highlights:

- Travel: EXPE and ABNB rallied on strong earnings and upbeat U.S. demand commentary.

- Tech: SNDK beat and guided higher on datacenter and hyperscaler strength; MCHP beat but guided light for Dec-Q; AKAM positive on cloud services; TTWO fell on another GTA VI delay; AFRM up on beat-and-raise; XYZ sank on GPV-GP spread scrutiny.

- Consumer: MNST beat on sales and GM; TXRH comps solid though food-cost inflation pressured margins; DKNG missed and guided down on weaker sportsbook outcomes; SG dropped on soft trends and guidance cut.

- Chemicals: CE higher on strong FCF; CC down on light EBITDA outlook.

- Auto: TSLA shareholders approved Musk’s pay package.

Stocks fell Thursday (Dow -0.84% | S&P 500 -1.12% | Nasdaq -1.90% | Russell 2000 -1.86%) and closed near lows in a broad risk-off move. AI, retail-favorite, most-shorted, quantum computing, nuclear and crypto names led declines; Big Tech was mixed with NVDA and TSLA among the weakest. Treasuries firmed (belly -7–8 bp), DXY −0.5%, gold little changed, Bitcoin −2.9% (near $100K), and WTI −0.3%.

The market refocused on AI capex/ROI scrutiny after OpenAI walked back talk of government debt guarantees; Oracle weakness reinforced the theme. Beats often weren’t rewarded (QCOM another example). Labor concerns re-accelerated on Challenger job cuts >150K in October (YTD >1M). Auto sentiment worsened after a KMX negative pre-announcement.

Fedspeak: Goolsbee cautioned against continuing the cut cycle; Williams discounted a higher neutral (models ~1%); Barr cited AI’s role in a “low-hire, low-fire” dynamic; Hammack sees 2–3 years to 2% inflation and policy “barely restrictive”; Miran reiterated support for a December cut. Friday brings U. Michigan sentiment/inflation expectations plus more Fed speakers.

Sector Highlights

Defensives and energy held up best, while growth/cyclicals tied to AI and consumer risk underperformed. Energy (+0.87%), Health Care (+0.19%), Communication Services (+0.67%), Utilities (+0.43%), Real Estate (+0.43%), Industrials (+0.41%), Materials (+0.40%), Financials (-0.32%), Consumer Staples (-0.26%); laggards were Technology (-2.00%) and Consumer Discretionary (-2.50%). The pattern reflected renewed AI-ROI skepticism, softer retail signals, and a bid for cash-flow stability.

Technology

- QCOM −3.6%: Beat/raised (QCT/QTL), but Apple/Samsung share loss, higher opex kept pressure.

- ARM: Beat/raised on AI royalties/licensing; strong tailwinds cited.

- DDOG +23.1%: Beat on EPS/rev/margins; strong billings/large-customer momentum; guide raised.

- COHR +18.3%: Beat; AI datacenter/communications demand strong; guide midpoints ahead.

- FTNT −6.3%: Third straight Services miss; softer billings.

- HUBS −15.0%: Solid multi-hub uptake; Q4 guide light vs elevated expectations.

- SNAP +9.7%: Beat; DAUs/MAUs up; $400M Perplexity AI partnership; $500M buyback.

- MRVL: Helped by reports SoftBank’s acquisition attempt failed.

- Google Finance: To add Gemini AI tools for traders (The Verge).

Consumer Discretionary

- DASH −17.5%: Strong Q3 metrics, but sizable 2026 investments cap margin outlook.

- PZZA +3.8%: Mixed Q3; lowered NA comps but reaffirmed international openings.

- ELF −35.0%: EPS beat, revenue miss; FY guide below; FY26 growth worries.

- WRBY −11.1%: Sales light; EBITDA beat; FY sales guide cut.

- GOOS −13.7%: Misses despite upbeat tone; big YTD run into print.

- KMX −24.3%: CEO exit; weak prelims across retail units/wholesale depreciation.

- LYFT +5.8%: Better GB/EBITDA/FCF; sees 2026 acceleration via partnerships/Waymo.

- PLNT +12.5%: Beat; raised FY25; members 20.7M at high end.

Communication Services

- WBD (≈) / TKO −: Weaker post-prints.

- SNAP +9.7%: (details above).

- Meta: Reportedly saw ~10% of 2024 sales from scam/fraud ads (CNBC).

- NFLX: Ads reached 190M viewers in October (new metric rollout).

Energy

- Group resilient vs tape; APD +8.9% better-than-feared with FY26 EPS midpoint above Street; productivity and Europe cited.

- VST −2.5%: EBITDA beat; FY25 range narrowed; +$1B buyback, but shares up >70% in six months.

Health Care

- LLY / NVO: To cut GLP-1 prices; three-year tariff reprieve in White House deal.

- MTSR +14.3%: FT said PFE matched NVO bid (~$86.20).

- AMGN: Strength continued following beat/raise (Repatha/Imdelltra/Evenity).

Financials

- BHF +26.8%: To be acquired by Aquarian Capital for $70/sh (2026 close expected).

- FRGE +68.7%: To be acquired by SCHW for $45/sh cash.

- BAC +1.6%: Clarified 16–18% ROTCE and 12%+ EPS growth as base case.

- Moneycenters held up better than beta plays; no signs of broad de-grossing but shorting elevated (sell-side flow notes).

Industrials

- PH +7.8%: Beat; raised FY revenue/margins/EPS; aero strong; margin expansion continues.

- CMI +5.4%: Rev beat; one-time EPS charges; data-center backup power a tailwind.

- ROK +2.7%: Beat; FY26 EPS midpoint above Street.

- E&Cs/trucking lagged; parcels/logistics held up better.

Materials

- APD +8.9% (above) and aluminum/automation pockets steadier; chemicals mixed.

Real Estate & Utilities

- Both outperformed the tape as yields fell; defensives benefited from duration support.

Other Headlines / Policy

- Trump–LLY/NVO weight-loss drug price deals announced; DOJ drops Boeing criminal case; Peloton recalls 833K bikes; White House considering flight reductions during shutdown; Pelosi to retire in 2026.

Eco Data Releases | Friday November 7th, 2025

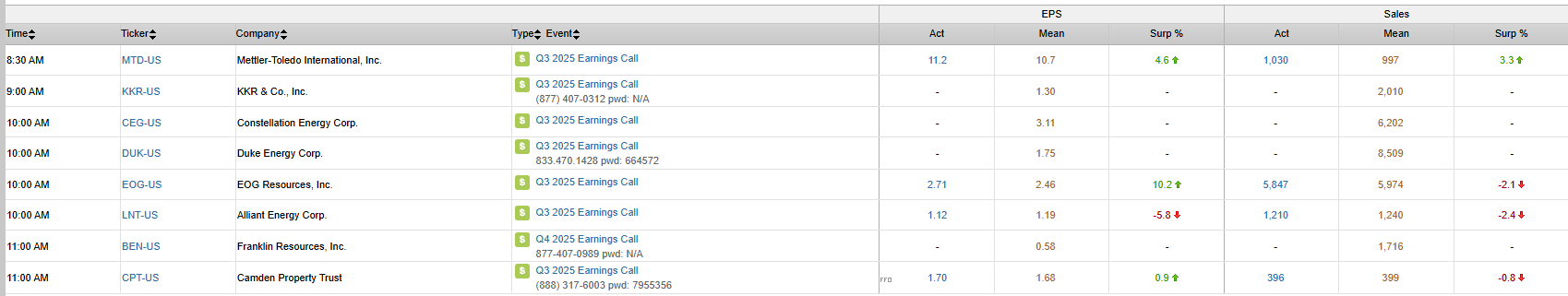

S&P 500 Constituent Earnings Announcements | Friday November 7th, 2025

Data sourced from FactSet Research Systems Inc.