November 13, 2025

S&P futures −0.1% in Thursday morning trading after U.S. equities ended mixed Wednesday, with equal-weight S&P (SPW) outperforming the cap-weighted index by over 50 bp. Healthcare, retail, big banks, and materials led gains, while large-cap tech lagged. Asia mostly higher overnight (Shanghai Composite strong), and Europe +0.2%. Treasuries slightly weaker (yields +1 bp), DXY −0.2%, gold +0.7%, Bitcoin +1.3%, WTI crude +0.4%.

Market tone remains rotation-driven, with cyclicals and healthcare leading recent gains while AI momentum moderates. CSCO was the bright spot, helping temper renewed AI skepticism following an FT report on “phantom data centers.” Fedspeak continues to lean hawkish, with Collins noting a high bar for more cuts. Market-implied odds of a December rate cut have fallen below 60%, the lowest since the easing cycle began in September.

Focus remains on the extended data gap: the September NFP report could be released next week, but key macro updates—November NFP (Dec 5) and CPI (Dec 10)—aren’t expected until early December.

Corporate highlights:

- CSCO + after a strong beat and FY guidance raise, citing 13% product order growth and record $1.3B AI infrastructure orders.

- BABA reportedly overhauling its mobile AI app to add agentic-AI features.

- PFE may sell its remaining $500M stake in BNTX.

- FLUT − after EBITDA guidance cut tied to unfavorable sports results; announced entry into prediction markets.

- SEE + on reports it’s in take-private talks.

Macro calendar:

Fed speakers Musalem and Hammack due today. Both have urged caution on further easing, with Hammack noting policy is “barely restrictive.” Treasury auctions $30B of 30-year bonds following Wednesday’s weak 10-year sale. Bostic and Schmid round out Fedspeak on Friday.

U.S. equities ended mixed Wednesday (Dow +0.68% | S&P 500 +0.06% | Nasdaq −0.26% | Russell 2000 −0.30%) as rotation and breadth continued to define trading. The equal-weight S&P (RSP) outperformed for the sixth time in seven sessions, highlighting sustained movement into cyclicals and value after weeks of narrow leadership. Treasuries were firmer (yields −2–4 bp) as investors digested soft labor data and the shutdown-driven data vacuum. The Dollar Index edged up 0.1%, gold rose 2.4%, Bitcoin slipped 1.1%, and WTI crude fell 4.2%—its sharpest daily drop in over two months—after OPEC projected a more balanced oil market in 2026 versus prior deficit expectations.

Breadth improved across the tape even as AI and mega-cap tech consolidated. Energy and growth tech lagged, while healthcare and financials led gains. Positive AI sentiment carried over from AMD’s analyst day and Foxconn earnings, but enthusiasm was tempered by renewed softness in ORCL and other large-cap growth names. The market’s focus stayed on the Fed’s divided tone, with speakers split between patience and preemptive easing. Traders continue to price roughly 65% odds of a December 25 bp cut and 80+ bp of easing through 2026, supported by weaker job indicators and slowing momentum in consumer credit and hiring.

Macro visibility remains limited: the White House confirmed October CPI and jobs data likely won’t be released due to the government shutdown. Incoming data after reopening are unlikely to resolve FOMC divisions, according to several Fed watchers.

Sector Highlights

Sector moves reflected broad rotation and value leadership:

- Outperformers: Healthcare (+1.36%), Financials (+0.90%), Materials (+0.76%), Tech (+0.25%), Utilities (+0.24%), Industrials (+0.09%)

- Underperformers: Energy (−1.42%), Communication Services (−1.18%), Consumer Discretionary (−1.05%), Real Estate (−0.77%), Consumer Staples (−0.22%)

Healthcare led on valuation support and earnings revision stabilization. Financials benefited from easing capital rules for big banks and strength in payments and asset managers. Energy underperformed sharply as crude prices retreated, while defensives such as staples and real estate lagged amid rotation into cyclicals.

Information Technology

- AMD (+9.0%) rallied on upbeat analyst day takeaways, highlighting surging AI demand, a $1T AI silicon TAM by 2030, and a path to double-digit market share.

- ORCL remained weak amid ongoing scrutiny of cloud margin trends.

- TIC (−4.2%) reported solid revenue but softer margins tied to LNG project timing; reaffirmed full-year guidance.

Communication Services

- Meta pledged $1B+ for a new Wisconsin data center, while Anthropic announced $50B in AI infrastructure spending and Microsoft unveiled plans for a multi-gigawatt “super factory” in Atlanta.

- PSKY (−15.4%) missed Q3 results; lower gross margins and impairments weighed on sentiment.

Consumer Discretionary

- ONON (+18.0%) surged on a big Q3 beat and raised guidance, citing strong DTC and wholesale momentum.

- FND (+3.9%) upgraded to Overweight at Piper Sandler on comp growth optimism.

- DKNG (+3.3%) rose after insider share purchases.

- SG (+2.7%) added on expectations of stronger post-shutdown demand.

- PSNY (−15.4%) plunged after Q3 miss and gross margin compression tied to Polestar 3 impairment.

Consumer Staples

- Defensive names were mixed; food and beverage, grocers, and HPCs held steady amid rotation.

Healthcare

- Sector strength led by pharma and managed care, supported by hedge fund inflows and insider buying.

- GRAL (+1.7%) upgraded at Guggenheim on stronger conviction in its cancer-detection pipeline.

- ALKS (−7.1%) fell despite positive phase 2 data for alixorexton, with investors focused on variable efficacy and trial design.

Financials

- BILL (+11.5%) jumped after reports the company is exploring a sale under activist pressure from Starboard.

- Big banks and asset managers rallied on expectations of looser capital requirements.

- Credit card and payments names benefited from upbeat BofA spending data, which showed y/y gains in October, led by higher-income consumers.

Industrials

- FDX (+3.9%) reiterated stronger profit guidance at industry events.

- Delta said Q4 demand remains strong despite shutdown-related flight disruptions.

- GM told suppliers to pivot away from China sourcing, underscoring re-shoring trends.

Energy & Materials

- WTI crude −4.2% after OPEC projected a balanced 2026 market; diesel and aluminum prices rose instead.

- OKLO (+6.7%) gained after breaking ground on its Aurora nuclear facility and securing DOE safety approval.

- CENX (−13.7%) extended declines on block-trade pressure; industrial metals otherwise firm on tariff headlines.

Real Estate & Utilities

- Both sectors posted modest gains; rate sensitivity offset by lower yields. Utilities drew selective buying interest as volatility eased.

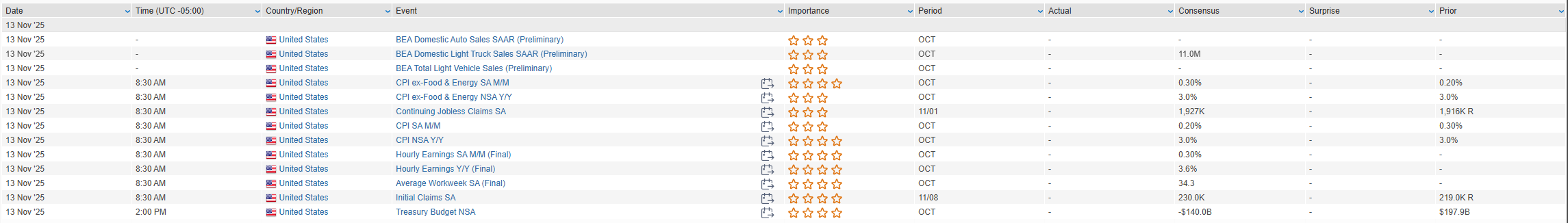

Eco Data Releases | Thursday November 13th, 2025

S&P 500 Constituent Earnings Announcements | Thursday November 13th, 2025

Data sourced from FactSet Research Systems Inc.