November 19, 2025

S&P futures are up 0.4% Wednesday morning after U.S. equities finished mostly lower on Tuesday, marking the S&P’s fourth straight decline and leaving the index nearly 4% below its recent peak. Big tech remained a drag, though six of eleven sectors advanced and equal-weight S&P outperformed by ~90 bp. Treasuries were little changed, the dollar rose 0.2%, gold gained 1.2%, Bitcoin fell 1%, and WTI crude slipped 1.5%.

The market is attempting another stabilization ahead of NVDA earnings after the close, a focal point given the recent AI-skepticism-driven momentum unwind. Expectations remain high—supported by hyperscaler capex trends and Nvidia’s late-October disclosure of ~$500B in data center revenue through 2026—even as the stock has fallen more than 12% in recent weeks. Walmart earnings on Thursday and the September NFP report (also Thursday) are the next major catalysts amid growing concerns around consumer caution and softening labor data. Broader narrative remains largely unchanged: stretched systematic long positioning, an uptick in put-buying (a potential contrarian signal), and steady corporate buyback activity continue to shape sentiment.

The October FOMC minutes are due at 14:00, which may shed more light on the Fed’s internal divide over a December rate cut. Additional Fedspeak comes from Miran, Barkin, and Williams. Later in the week, September NFP (Street at ~50K) and Friday’s flash PMIs will round out the macro slate.

Corporate updates were mixed:

- LOW gained on a Q3 EPS beat and encouraging early-Q4 trends.

- TGT missed Q3 comps and cut full-year EPS.

- xAI is reportedly seeking to raise $15B at a $230B valuation.

- CEG rallied after receiving a $1B federal loan to restart Three Mile Island.

- ORLY lifted its buyback by $2B; ON announced a $6B repurchase plan.

- WBD is reportedly seeking a bid closer to $30/share.

- DLB beat Q4 but guided light.

- IPAR fell on softer 2026 guidance tied to macro and inventory pressures.

- LZB beat Q2 estimates and will exit non-core businesses.

U.S. equities finished mostly lower Tuesday (Dow −1.07%, S&P 500 −0.83%, Nasdaq −1.21%, Russell 2000 +0.31%), though stocks recovered modestly from intraday lows in a choppy session. The S&P 500 fell for a fourth straight day, while equal-weight outperformed cap-weight by nearly a full percentage point, underscoring ongoing rotation as technical conditions deteriorate—both the SPX and NDX now trade below their 50-day moving averages. Market tone remains fragile, shaped by systematic-strategy unwind triggers, lingering AI skepticism (circularity, debt financing, slowing ROI), softening labor-market signals, and a more balanced Fed outlook that has tempered December cut expectations.

Economic data offered mixed signals. The ADP weekly employment gauge showed average job loss of 2.5K over the four weeks ended 2-Nov (better than the prior −11K pace). The NAHB homebuilder sentiment index unexpectedly rose, though a record 41% of builders cut prices. August core durable goods orders came in a bit light. Fedspeak leaned cautious, with Barkin highlighting persistent inflation risks and a labor market that may be weaker than reported. Key macro catalysts ahead include Wednesday’s FOMC minutes, Thursday’s delayed September NFP, and Friday’s November flash PMIs, along with a heavy slate of retail and tech earnings led by NVDA.

Sector Highlights

Sector moves reflected defensive rotation and pressure on growth pockets. Communication Services (+1.13%), Utilities (+0.84%), Healthcare (+0.54%), Real Estate (+0.36%), Consumer Staples (+0.15%), and Consumer Discretionary (+0.80%) were relative outperformers, supported by steadier earnings outlooks and selective corporate catalysts. Materials (+0.01%), Financials (−0.19%), Industrials (−0.48%), and Energy (+0.61%) saw mixed to modest performance. The weakest groups were Technology (−1.68%) and Consumer Discretionary (−2.50%), which remained under pressure from big-tech softness, AI skepticism, and continued weakness in housing-linked retail.

Information Technology

- Microsoft (MSFT) and Amazon (AMZN) both downgraded at Redburn, citing weakening economics of the AI buildout; AMZN −4.4%, MSFT −2.7%.

- NVIDIA (NVDA) and MSFT to invest in Anthropic, which will purchase $30B in Azure compute; market reaction muted given concerns about circularity.

- Google (GOOGL) rose after releasing Gemini 3.0 and unveiling broader agentic-AI tools.

- Cloudflare (NET) declined following widespread outages.

- Intuit (INTU) popped on news of an OpenAI partnership.

- Databricks reportedly seeking funding at $130B+ valuation.

Consumer Discretionary

- Home Depot (HD) fell on a Q3 miss and tempered FY guidance, citing weak demand and fewer storms.

- Topgolf Callaway (MODG) declined after agreeing to sell a 60% stake in Topgolf at a ~$1.1B valuation.

Healthcare

- Medtronic (MDT) beat expectations, raised FY26 outlook, and highlighted strong procedure volumes.

- Merck (MRK) advanced after positive Phase 2 data for WINREVAIR.

- Avantor (AVTR) rose on insider share purchases.

Financials

- Banks and P&C insurers outperformed as rotation favored defensives.

- Activist Elliott disclosed a large stake in Barrick (B), supporting the stock.

- Broader financials saw mixed trading as rate-sensitive pockets lagged.

Industrials

- AECOM (ACM) beat expectations, raised long-term targets, and began exploring a sale of its Construction Management business.

- Helmerich & Payne (HP) fell after an EPS miss and cautious margin commentary.

Communication Services

- Baidu (BIDU) beat on Q3 earnings as cloud strength offset weaker search and marketing.

- A federal judge ruled the FTC failed to prove antitrust claims against Meta (META).

- Warner Bros. Discovery (WBD) slightly higher after fresh speculation around a potential PSKY/Mideast sovereign wealth fund bid.

Materials

- Freeport-McMoRan (FCX) announced restoration of Grasberg production, expecting 2026 output similar to 2025.

- AkzoNobel (AKZA) and Axalta (AXTA) agreed to merge in an all-stock transaction, forming a ~$17B coatings leader.

Consumer Staples

- Energizer (ENR) fell sharply after a Q4 miss, weak organic growth, and soft guidance driven by tariff-related cost pressures.

Eco Data Releases | Wednesday November 19th, 2025

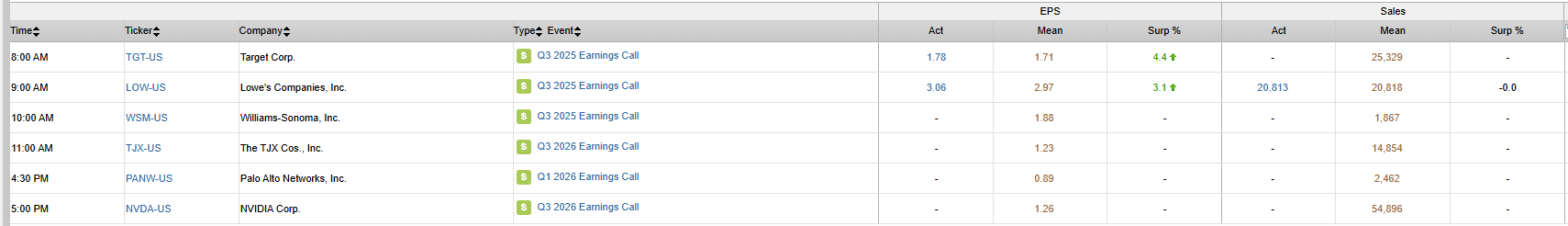

S&P 500 Constituent Earnings Announcements | Wednesday November 19th, 2025

Data sourced from FactSet Research Systems Inc.