November 21, 2025

Tech shares couldn’t get off the mat this week despite a strong beat and raise from NVDA on Wednesday evening. The mismatch between recent results (WMT also posted a strong quarter with better guidance) and pessimistic sentiment is driven by a level of near-term uncertainty around the economy, inflation pressure and Fed policy for December. Cross currents are the name of the game as economic weakness is a concern, but so is the potential that accommodative Fed policy could trigger inflation. Right now the AI/Growth trade is getting dinged for both possible outcomes even though it’s more likely we will only be dealing with one or the other.

In the near-term, when considering the technical position of the AI trades foundation, Mag7 and Semiconductors, the charts show potential for an additional 8% near-term downside from current levels. We’ve highlighted horizontal resistance on the SOX Index and MAGS ETF charts below.

MAGS

SOX Index

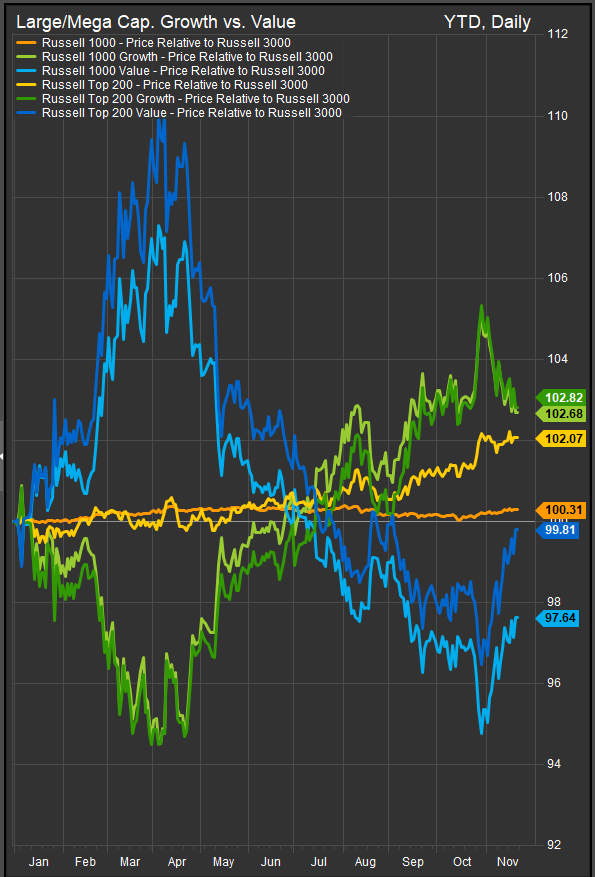

From a factor perspective the current rotation is clear. Investors are moving from Growth to Value and towards low vol. exposures. Risk appetite has deteriorated as fixed income investors are rotating into government credit from higher yielding corporate-linked exposures. Spreads are widening, albeit from very tight levels.

Large Cap. Growth vs. Value

We think ultimately this will set up opportunity to accumulate AI exposures at a discount. Growth vs. Value (below) is retracing as investors de-risk on near-term concerns. Notably, Large Cap. stocks continue to outperform despite rotation. We think that will eventually redound to the benefit of Large Cap. Growth players which, despite current pessimism are near record earnings. If interest rates remain low, they will have the ability to continue positioning for growth at lower costs.

Market Breadth Nearing “Wash Out” Levels

Selling from overbought conditions is “profit taking”. What we’re seeing from our S&P 500 internal trend measures (chart below) that breadth levels are near points where reversal occurs, and we haven’t seen significant damage to the bull trend. While admitting there is plenty of uncertainty in future outcomes, we nonetheless see recent selling against a backdrop of an economy near full employment and falling interest rates as a setup that should favor bullish accumulation.

Conclusion

We remain constructive on the Growth trade over longer timeframes. We continue to think the current cycle will persist as a Growth led bull market provided interest rates remain contained and inflationary pressures remain on the sidelines. In the near-term portfolios should positioned in a tactically conservative manner, but a breadth wash out where <20% of stocks within the S&P 500 are above their 50-day moving average while the economy remains in expansion is typically a time to accumulate favored exposures.

Other Data sourced from FactSet Research Systems Inc.