December 12, 2025

Growth vs. Value: The Setup Is Shifting From “Duration Dominance” to a More Cyclical, Cash-Flow–Disciplined Market

The current equity backdrop is best described as a regime transition rather than a clean “risk-on” or “risk-off” phase. Earnings are still trending in the right direction, the Fed is cutting—but doing so with visible internal division—and labor data are sending mixed signals that keep recession fears contained while keeping investors wary of overpaying for long-duration stories. In that kind of tape, style leadership tends to rotate toward whichever side offers the clearest combination of near-term earnings visibility and valuation support. Right now, that advantage is gradually shifting toward Value, even as Growth retains structural support from AI and easing financial conditions.

The most important new development for the Growth–Value debate is the market’s renewed obsession with cash flow quality and capex discipline—a lens that almost always tightens the market’s tolerance for expensive Growth. Oracle’s latest quarter is a perfect example. The headline backlog picture remains very strong (RPO surging), but the market focused on the uncomfortable truth: AI infrastructure is becoming a capital-intensity story, not just a revenue growth story. Oracle missed key operating metrics, posted sharply negative free cash flow, and raised capex guidance materially. That combination—big commitments, heavy spending, delayed monetization—re-energizes the core critique of the AI trade: even if demand is real, returns on capital may not arrive fast enough to justify the valuation premium embedded across much of Growth.

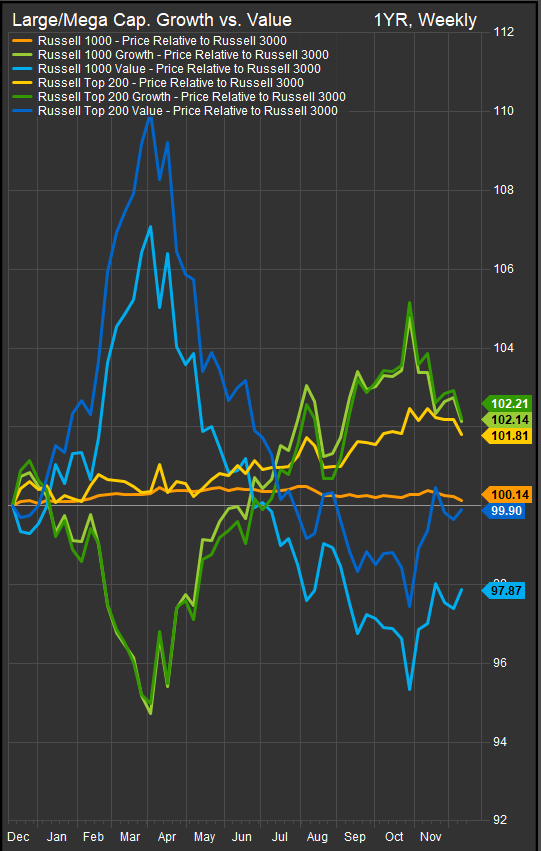

That doesn’t mean Growth is “broken.” It means the market is repricing the type of Growth it wants to own. When capex-heavy AI beneficiaries stumble, investors tend to rotate away from “infrastructure Growth” and toward either (a) higher-quality software/platform Growth with clearer monetization, or (b) cyclical Value sectors that benefit from easing and improving breadth. This is why the same day that the AI complex struggled, the market narrative simultaneously carried talk of cyclical outperformance and broadening participation (chart below)—an environment where Value can quietly take the baton even if the index remains supported by large-cap tech.

Risk Appetite Barometers

The decidedly risk-off tone in November flipped with firming consensus of the Fed’s rate cut this week. Now that the cut has come to pass and the FOMC has articulated its view that the current accommodation should be enough support, we will see if this one last cut is enough to put the economy back on the right track.

High Beta Preferred over Low Vol.

The Fed backdrop also argues for a more balanced style mix—but it’s not unambiguously Growth-friendly. The December meeting delivered another 25 bp cut, but with multiple dissents and a dot-plot that highlights disagreement about the path forward. That kind of internal division often increases rate volatility and makes investors less willing to pay peak multiples for long-duration Growth. At the same time, Powell’s comments suggesting official jobs data may be overstating job creation adds a softening-labor undertone. A cooling labor market usually supports the case for additional easing, which can help Growth—but only if inflation doesn’t reassert itself and force the long end higher. In other words, Fed easing is a tailwind for Growth in principle, but the market is currently treating it as a tailwind for cyclicals and breadth just as much as it is for duration.

The economic prints reinforce the same ambiguity. Weekly claims bounced higher, but continuing claims improved, and several strategists have emphasized that holiday-seasonality makes near-term claims data noisy. The trade deficit narrowed sharply, offering a near-term GDP arithmetic tailwind. Surveys like JOLTS and NY Fed consumer expectations show labor perceptions stabilizing modestly and inflation expectations not surging. But small business surveys highlight persistent price pressures and elevated uncertainty. Put simply: the economy looks “fine,” but not clean—and that’s the kind of environment where the market starts caring more about what you pay than what you can imagine.

Earnings, however, remain the stabilizer—and they complicate any call for a full Value takeover. FactSet data show that Q4 bottom-up EPS estimates have edged higher at a time when they usually fall, and the market is still looking at solid growth into 2026. That matters because Growth rarely loses leadership decisively when earnings revisions are broadening. The difference today is that the market is asking for a higher standard: earnings strength is not enough if free cash flow is deteriorating. That’s the key bridge between the Oracle shock and the broader Growth-vs-Value setup. Growth can still outperform, but it will be quality Growth—cash generative, monetizing, and less dependent on relentless financing.

So what does this mean for style positioning over the near term?

The setup tilts toward Value because the market’s marginal buyer is rewarding (1) improving breadth, (2) cyclicals responding to easing, (3) sectors with near-term cash flow, and (4) reasonable multiples that don’t require perfect execution. This aligns with the ongoing outperformance of cyclicals versus defensives that strategists have been flagging and the broader “early-cycle-like” narrative some banks are pushing into 2026. Value leadership, in this regime, doesn’t require a booming economy—it simply requires that growth not collapse and that the cost of capital remain a meaningful constraint on long-duration valuations.

Growth is no longer being rewarded for ambition; it’s being rewarded for conversion—turning demand into durable free cash flow. Value, meanwhile, is being rewarded for doing what it always does best late-cycle: delivering earnings without requiring investors to pay high prices for delayed gratification on cash flows and dividends. Investors must balance how they value the continued potential dominance of AI technology and infrastructure against legacy operating co.’s that have cheaper earnings streams. An Easing Fed offers support to both, but our view holds that while Value and High Beta are on a relief rally driven by a more supportive than expected interest rate policy to close 2025, pitfalls to cyclical recovery are still present. The current wave is boosting Value stocks but also key AI components like Semiconductors. Overweighting Value exposures in the near-term is appropriate given investor reaction to the Fed.

Sources

- The Guardian (Oracle results / AI capex concerns) The Guardian

- Yahoo Finance (Oracle capex raised to $50B; negative free cash flow) Yahoo Finance

- FactSet Earnings Insight (Q4 earnings growth and estimate revisions) FactSet+1

- AAII Investor Sentiment Survey / Bull-Bear spread context AAII+1

Other Data sourced from FactSet Research Systems Inc.