December 16, 2025

S&P futures are down 0.3% following Monday’s pullback, which saw AI infrastructure, crypto, retail favorites, most-shorted names, and small caps lead the downside. Big Tech was mixed with TSLA and NVDA standing out, while healthcare, HPCs, and travel & leisure outperformed. Asia traded sharply lower (South Korea −2%+, Japan/Hong Kong −1.5%+), Europe is down ~0.4%, Treasury yields are ~1 bp lower, the dollar is modestly weaker, gold flat, bitcoin slightly higher, and WTI −1.9% on Ukraine peace-talk optimism.

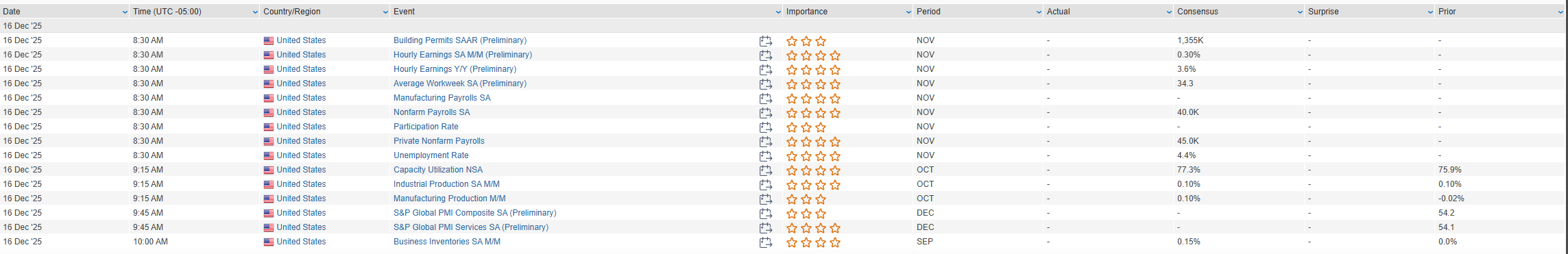

Focus turns to a heavy data slate, led by November NFP, amid heightened uncertainty around data quality and the Fed’s reaction function. Consensus looks for ~50K payrolls and unemployment ticking up to 4.5%. Macro optimism tied to a solid backdrop and 2026 double-digit earnings growth remains a bullish pillar, though AI infrastructure bubble concerns, crypto volatility, and a hawkish global central-bank tilt (with a BoJ hike expected) continue to temper risk.

On the calendar: November employment report, October retail sales, and December flash PMIs today; Fed speakers Wednesday; initial claims, November CPI, and Philly Fed Thursday; existing home sales and final U. Michigan Friday.

Corporate highlights:

- Ford (F): Raised 2025 operating profit outlook to $7B (from $6–6.5B) alongside a $19.5B EV writedown; FCF tracking toward the high end of prior guidance.

- PayPal (PYPL): Applied to become a U.S. bank, aimed at expanding small-business lending.

- Waste Management (WM): Announced a $3B buyback and 14.5% dividend increase.

- Elanco (ELAN): Shares up on insider buying.

Earnings to watch: Micron (MU) Wednesday after the close; also LEN, GIS, JBL, FDX, KMX, NKE, CAG, PAYX throughout the week.

U.S. equities finished modestly lower (Dow −0.09%, S&P 500 −0.16%, Nasdaq −0.59%, Russell 2000 −0.81%), extending part of Friday’s selloff, as markets remained in wait-and-see mode ahead of key catalysts later this week (November payrolls, CPI, Micron earnings). Risk appetite stayed soft, with renewed pressure on AI infrastructure, speculative pockets, crypto-linked names, and small caps. Treasuries provided a mild offset as yields fell ~1–2 bp with a steeper curve, while the dollar eased slightly; yen strength was the FX focal point ahead of expected BoJ tightening. Commodities were mixed, with WTI down 1.1% on geopolitical headlines and oversupply chatter.

Macro data was mixed but not decisive. The Empire State Manufacturing Index surprised to the downside (−3.9), though forward expectations improved and price pressures eased further. NAHB homebuilder sentiment ticked higher and modestly beat expectations. Fed speak leaned incrementally dovish at the margin, with officials highlighting easing inflation risks and rising labor-market risks—helping rates but not enough to re-ignite risk.

Sector Highlights

Outperformers: Healthcare (+1.27%), Utilities (+0.88%), Consumer Discretionary (+0.48%), Real Estate (+0.28%), Consumer Staples (+0.26%).

Underperformers: Technology (−1.04%), Energy (−0.76%), Communication Services (−0.19%).

Overall, the session reinforced a defensive tilt and ongoing rotation away from crowded AI and speculative trades, with markets awaiting clearer direction from labor data, inflation prints, and high-profile earnings later this week.

Information Technology

- Tesla (TSLA): Shares outperformed after reports the company has begun robotaxi testing in Austin without a driver or safety monitor.

- ServiceNow (NOW): Lower on reports it is in advanced talks to acquire Armis in a deal potentially valued up to ~$7B.

- Intel (INTC): Reportedly in advanced talks to acquire SambaNova Systems for roughly $1.6B, including debt.

- Zillow (Z): Shares fell after reports Google is testing real-estate listings directly in search results.

- iRobot (IRBT): Collapsed after announcing it will go private via a court-supervised Chapter 11 process; equity holders expected to be wiped out.

Communication Services

- Media names held up better than the broader market amid continued focus on strategic optionality and M&A narratives.

- Imax (IMAX): Upgraded to overweight at JPMorgan on removal of overhangs and a stronger upcoming film slate.

Consumer Discretionary

- Marriott (MAR): Upgraded to buy at Goldman Sachs on strength in luxury, international travel, and group demand.

- Viking Holdings (VIK): Upgraded to buy at Jefferies, citing pricing power and margin expansion tied to higher-income consumers.

- Las Vegas Sands (LVS): Upgraded to buy at Goldman Sachs on sustained Macau gaming momentum and buybacks.

- Caesars (CZR): Downgraded to neutral at Goldman Sachs on softer industry spending trends.

Consumer Staples

- Hershey (HSY): Upgraded to overweight at Morgan Stanley as cost pressures ease and sales momentum improves.

- Coca-Cola (KO): Reportedly in talks with TDR Capital to salvage the Costa Coffee deal.

Health Care

- Immunome (IMNM): Jumped after its Phase 3 desmoid tumor trial met its primary endpoint; NDA filing planned for Q2’26.

- Bristol Myers Squibb (BMY): Upgraded to buy at BofA on pipeline visibility.

- Charles River Labs (CRL): Upgraded to buy at BofA on improving demand outlook.

- HCA Healthcare (HCA): Downgraded to underweight at Morgan Stanley on valuation and easing ACA tailwinds.

Industrials

- XPO Logistics (XPO): Executive Chairman Brad Jacobs to step down at year-end.

- Westlake (WLK): Announced facility closures and job cuts as part of restructuring efforts.

Financials

- Franklin Resources (BEN): Shares supported by a favorable Justice Department decision.

- Asset managers and insurers broadly outperformed as defensiveness and yield sensitivity drew interest.

Energy

- Crude complex: Energy equities lagged as oil prices fell on geopolitics and early signals of oversupply; Venezuela cyberattack headlines added noise.

Eco Data Releases | Tuesday December 16th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday December 16th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.