December 23, 2025

S&P futures are little changed in early trading after a firm but low-volume Monday that left the S&P 500 just shy of a fresh record. Leadership remained risk-on, with retail-investor favorites, AI enablers, high-beta names, and small caps outperforming. Treasuries were firmer (yields down ~1–3 bp), the dollar fell 0.4% with yen strength reversing some post-BoJ weakness, gold surged to a new record above $4,500/oz, bitcoin eased 0.8%, and WTI added 0.2% after Monday’s 2.6% jump.

Expect another quiet session. The upside narrative is unchanged: AI enthusiasm (including China-related chip updates), Santa-Claus seasonality, cleaner positioning and vol compression (VIX at YTD lows), M&A tailwinds, expectations for double-digit earnings growth, and potential 2026 catalysts (tax refunds, stimulus). Supportive macro and disinflation trends persist, though markets price only ~55 bp of cuts through end-2026, reflecting ongoing Fed path uncertainty.

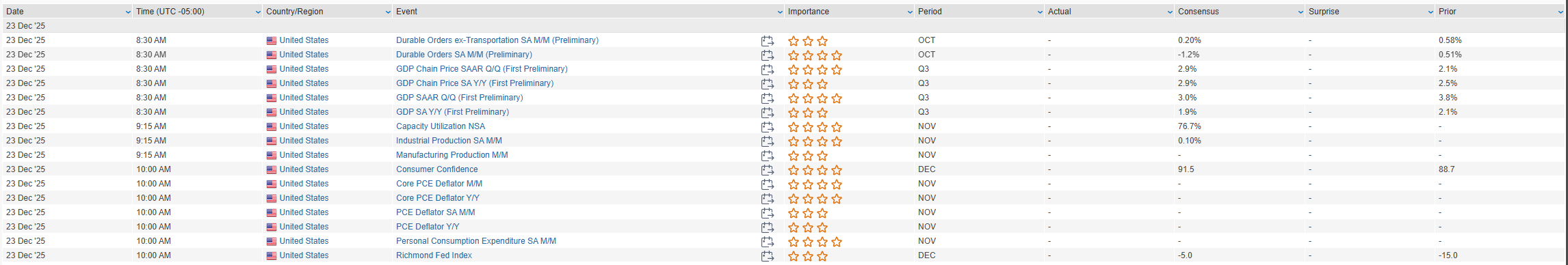

Today’s data include October durable goods, the first estimate of Q3 GDP, December consumer confidence, and the Richmond Fed index. Treasury auctions $70B of 5-year notes, following Monday’s 2-year sale that tailed modestly. Geopolitics remain centered on Venezuela, while global bond markets watch recent yield swings after Japan’s 10-year hit its highest level since 1999 and Germany’s bund reached a 2023 high.

Corporate news is light:

- FDA approval for an oral GLP-1 (Wegovy).

- WBD to review the PSKY bid after a $40B guarantee.

- JNJ hit with a $1.5B punitive damages verdict in a talc-asbestos case.

- ARES signaled readiness for a large PE acquisition.

- HII firmer on details around a proposed “Golden Fleet.”

U.S. equities extended last week’s gains in a broad risk-on session (Dow +0.47% | S&P 500 +0.64% | Nasdaq +0.52% | Russell 2000 +1.16%), with the S&P 500 posting a third straight gain and closing just shy of a fresh all-time high. Trading was relatively quiet from a headline perspective, but positive AI sentiment, renewed M&A activity, and favorable year-end seasonality supported upside. Small caps, high-beta names, and retail-investor favorites led, while defensives lagged.

Treasuries weakened modestly with some curve flattening as yields rose ~1–2 bp. The dollar fell 0.3%, gold surged +1.9% to a record high, and WTI crude jumped +2.6% on continued U.S. actions near Venezuela. Bitcoin finished modestly higher after paring early gains.

Policy commentary was mixed but not market-moving. Governor Miran warned that failing to ease policy could raise inflation risks, while Cleveland Fed’s Hammack reiterated a steady-policy base case pending clearer inflation and labor data. The week’s $183B Treasury issuance began with a $69B 2-year auction that tailed by 0.3 bp. Markets largely ignored geopolitics and focused on positioning, AI optimism, and seasonals. A heavy data slate arrives Tuesday (Q3 GDP, durable goods, industrial production, consumer confidence, Richmond Fed), followed by jobless claims in Wednesday’s shortened session.

Sector Highlights

Cyclicals led the tape. Materials (+1.35%), Financials (+1.25%), Industrials (+1.11%), and Energy (+1.08%) outperformed as investors leaned into growth, M&A, and year-end seasonality. Real Estate (+0.71%) and Healthcare (+0.66%) also finished higher. Relative laggards were Consumer Staples (-0.41%), Utilities (-0.43%), and Communication Services (+0.57%), while Technology (+0.40%) advanced but trailed the broader cyclicals despite strong AI leadership.

Information Technology

-

NVIDIA (NVDA) rose on reports it is preparing to ship H200 AI chips to China starting mid-February, with additional capacity and order windows opening in 2026.

-

Clearwater Analytics (CWAN) surged after agreeing to be acquired for ~$8.4B by a Warburg Pincus / Permira-led consortium.

-

Fastenal (FAST) slipped after announcing CEO Dan Florness will step down in July 2026; President and CSO Dan Watts was named successor.

Communication Services

-

Warner Bros. Discovery (WBD) gained after reports that Larry Ellison will personally back Paramount Skydance’s $30/share all-cash bid, increasing financing certainty and raising the reverse termination fee.

-

Netflix (NFLX) reportedly refinanced part of a $59B bridge loan tied to its own bid for WBD.

-

Alphabet (GOOGL) agreed to acquire clean-energy partner Intersect Power for $4.75B plus debt, lifting renewables-linked names.

Financials

-

UniFirst (UNF) jumped on reports Cintas (CTAS) made a renewed $275/share takeover offer (~62% premium).

-

Janus Henderson (JHG) is set to be acquired by Trian Fund Management and General Catalyst for ~$7.4B.

-

Exchanges, investment banks, asset managers, and credit-card issuers broadly outperformed amid the risk-on tape.

Industrials

-

Stanley Black & Decker (SWK) advanced after selling its aerospace manufacturing unit to Howmet Aerospace (HWM) for $1.8B, with proceeds earmarked for debt reduction.

-

CACI International (CACI) announced the $2.6B cash acquisition of ARKA Group, expanding its defense and space portfolio.

-

Honeywell (HON) edged lower after trimming guidance to reflect discontinued operations and a one-time aerospace charge.

-

Cummins (CMI) rose on an upgrade citing a potential 2H-2026 freight recovery despite near-term caution.

Energy

-

Energy stocks broadly outperformed alongside the +2.6% jump in crude oil, driven by heightened U.S. tanker actions near Venezuela.

-

Dominion Energy (D) fell after the Interior Department suspended several offshore wind projects on national-security grounds.

Consumer Discretionary

-

Tesla (TSLA) climbed after a Delaware court restored Elon Musk’s 2018 pay package (~$139B).

-

Ollie’s Bargain Outlet (OLLI) was upgraded on continued upside tied to Big Lots liquidation dynamics.

-

Instacart (CART) slipped after announcing it will halt AI-driven pricing tests amid FTC scrutiny.

Consumer Staples

-

Coty (COTY) declined on leadership changes, with both the Executive Chair and CEO stepping down.

Materials

-

Solar names rallied; First Solar (FSLR) benefited from Alphabet’s Intersect Power deal, reinforcing data-center-linked renewable demand.

Real Estate

-

REITs finished modestly higher in the risk-on environment but continued to lag cyclicals.

Eco Data Releases | Tuesday December 23rd, 2025

S&P 500 Constituent Earnings Announcements | Tuesday December 23rd, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.