January 2, 2026

S&P futures +0.6% in premarket trading, following Wednesday’s decline that left the S&P 500 and Nasdaq down for a fourth straight session, though both still finished 2025 with double-digit annual gains. Recent pressure has been concentrated in most-shorted names, retail-investor favorites, and Big Tech.

Overnight, Asian markets traded higher (Japan and mainland China closed), while European equities were mostly firmer. Treasuries were little changed to slightly stronger, with front-end yields down ~1 bp. The dollar index rose 0.1%. Gold gained 1.6% but remained down more than 3% on the week. Bitcoin futures climbed 2.8%, back above $90K, while WTI crude was little changed.

Stocks are attempting to snap the late-December losing streak, though fresh catalysts remain limited. The broader narrative continues to center on the failed Santa Claus rally, with attention shifting toward early-2026 tailwinds including the pending IEEPA decision, expected OBBBA fiscal support, and new AI model releases from OpenAI and Meta Platforms. Trade headlines were mildly supportive after President Trump delayed January 1 tariff hikes on furniture and cabinets, and the U.S. granted TSMC’s U.S. unit an annual license to import U.S. chipmaking equipment into its Nanjing facility. Fed chair speculation remains unresolved, though prediction markets continue to price Kevin Hassett as the frontrunner at ~45%.

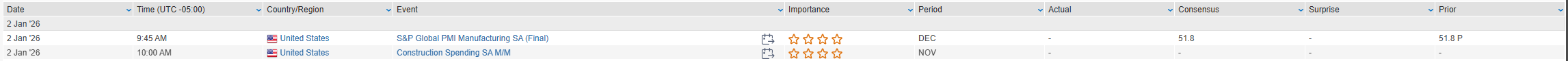

Friday’s data calendar is light, featuring only final December S&P Global Manufacturing PMI. Looking ahead, next week brings a heavy macro slate including ISM manufacturing, ADP, ISM services, JOLTS, factory orders, jobless claims, productivity data, and the January employment report, along with housing data and UoM sentiment. Markets are currently pricing ~56 bp of Fed cuts through year-end 2026, up from ~49 bp into Christmas Eve.

Corporate Headlines

- TSMC — U.S. government granted the company’s U.S. unit an annual license to import U.S. chipmaking equipment into its Nanjing, China facility.

- Apple (AAPL) — Reportedly cutting Vision Pro headset production following weaker-than-expected demand.

- Berkshire Hathaway (BRK.B) — Named Greg Abel as CEO, set to succeed Warren Buffett.

- Baidu (BIDU) — Announced plans to spin off its AI chip unit, Kunlunxin.

U.S. equities closed lower on the final trading day of 2025, Dow (-0.63%) | S&P 500 (-0.74%) | Nasdaq (-0.76%) | Russell 2000 (-0.75%), finishing not far from session lows and extending the late-December pullback. The S&P 500 and Nasdaq declined for a fourth consecutive session, offering little evidence of the much-discussed seasonal tailwind. Still, major indices wrapped up the year with double-digit gains for a third straight year, reflecting strong earnings growth, AI-driven capex, tariff mitigation efforts, supportive fiscal expectations, and 75 bp of Fed easing over the course of 2025.

There were no material macro catalysts during the session. Labor data continued to signal resilience, with initial claims at 199K, below both consensus and the prior week, and continuing claims at 1.866M, also below expectations. The data reinforced confidence in a still-tight labor market heading into 2026.

Cross-asset moves leaned risk-off. Treasuries weakened with yields up ~3–5 bp, while the dollar finished little changed. Gold fell 1.0% and silver dropped 9.4%, though both still posted their strongest annual performance since 1979. WTI crude declined 1.1%, and Bitcoin futures slipped 0.8%.

Markets are closed Thursday for the New Year’s holiday. Friday’s calendar includes only final December manufacturing PMI, with a heavy macro slate next week highlighted by ISM manufacturing and services, ADP, JOLTS, factory orders, jobless claims, productivity data, and the January employment report.

Sector Highlights

Sector leadership skewed defensive during the risk-off session. Utilities, Health Care, Consumer Staples, Energy, and Communication Services outperformed on a relative basis, reflecting late-year de-risking and positioning for macro uncertainty heading into 2026. Cyclically sensitive and rate-exposed groups lagged, with Real Estate, Materials, Industrials, Information Technology, Consumer Discretionary, and Financials under pressure. Weakness in tech and real estate tracked higher yields, while materials and industrials were weighed down by declines in precious and industrial metals and fading year-end momentum.

Information Technology

- NVIDIA (NVDA) — Reuters reported the company has asked TSMC to boost H200 production after Chinese orders for 2026 reportedly exceeded 2M units.

- GlobalFoundries (GFS) — Downgraded to neutral at Wedbush; analysts cited higher costs and weaker near-term demand, with the next refresh cycle seen 12+ months out.

- Tower Semiconductor (TSEM) — Downgraded to neutral at Wedbush on valuation concerns following a 125% YTD rally.

Communication Services

- Trump Media & Technology Group (DJT) — Announced plans to distribute digital tokens to shareholders in partnership with Crypto.com, driving notable outperformance.

Consumer Discretionary

- Nike (NKE) — Shares rose after CEO Elliot Hill disclosed the purchase of 16,388 shares at an average price of $61.10.

- Hyatt Hotels (H) — Guided 2025 EBITDA to the low end of its prior outlook due to cancellations and damage related to Hurricane Melissa in Jamaica.

- Uber Technologies (UBER) — Reportedly considering an acquisition of parking-reservation platform SpotHero.

Health Care

- Axsome Therapeutics (AXSM) — Shares surged after the FDA accepted and granted priority review of a supplemental NDA for AXS-05 in Alzheimer’s disease agitation; PDUFA date set for April 30, 2026.

- Corcept Therapeutics (CORT) — Stock collapsed after receiving an FDA complete response letter for Relacorilant, citing insufficient evidence of effectiveness.

Industrials

- Ondas Holdings (ONDS) — Jumped after securing $10M in new autonomous systems orders.

- Ekso Bionics Holdings (EKSO) — Fell sharply following a downgrade to neutral at HC Wainwright amid strategic uncertainty tied to its announced merger and potential asset sale.

Energy

- TeraWulf (WULF) — Upgraded to outperform at KBW; analysts argued AI and high-performance computing leasing will eclipse bitcoin mining as the primary earnings driver.

Eco Data Releases | Friday January 2nd, 2026

S&P 500 Constituent Earnings Announcements | Friday January 2nd, 2026

No constituents report today

Data sourced from FactSet Research Systems Inc.