January 22, 2026

S&P futures +0.5% after Wednesday’s rally (off best levels). Small caps led again, with strength in Mag 7, semis/memory, regional banks, transports, autos, and international plays. Asia mostly higher overnight (Japan, South Korea led on tech/semi strength). Europe rallying ~+1.5%. Treasuries firmer with curve flattening (long-end yields −2 bp). DXY flat. Gold −0.3%, Silver +1.1%, Bitcoin −0.4%, WTI −0.9%.

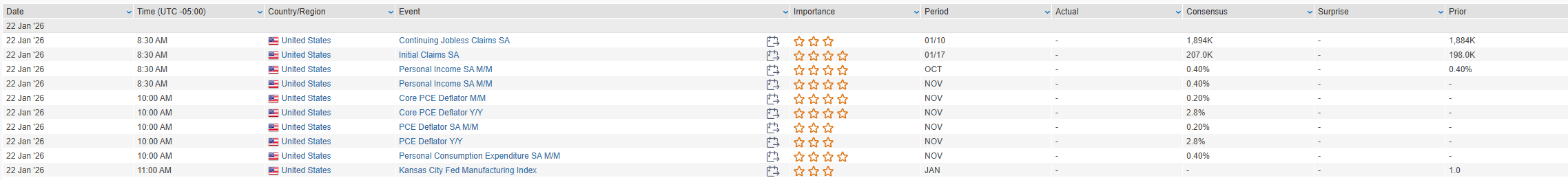

Markets appear to be moving past geopolitical risk after the Greenland framework and scrapped tariff threat, reinforcing the BTD narrative, particularly for small-cap and cyclical/value exposures aligned with the White House’s “run-it-hot” growth stance. While sentiment and select positioning indicators look stretched, rotation beneficiaries continue to see supportive flows. Focus now shifts to Big Tech earnings next week, especially AI capex and monetization/productivity signals. Today’s data includes Q3 GDP (3rd), personal income/spending incl. PCE (Oct/Nov) and weekly jobless claims; Fed remains in the quiet period.

Company News

- OpenAI (Private) – Reportedly in talks to raise $50B+ at a $750–830B valuation; AI funding momentum remains a focal point.

- ADTN – Issued a positive Q4 preannouncement, citing strong demand and execution.

- CACI – Bookings missed (government shutdown impact), but EBITDA and FCF beat; FY26 guidance raised.

- IPAR – Q4 sales preannouncement ahead, led by Europe; flagged lingering macro headwinds and destocking in select markets.

- KMI – Q4 results ahead; FY26 guidance largely in line; highlighted leverage to data-center growth.

- KNX – Missed, with commentary pointing to a still-soft freight backdrop, though noted early signs of rate improvement.

- LSTR – Preliminary Q4 EPS ahead; benefited from reduced industry capacity.

U.S. equities rebounded sharply on Wednesday (Dow +1.21% | S&P 500 +1.16% | Nasdaq +1.18% | Russell 2000 +2.00%), reversing much of Tuesday’s selloff as risk sentiment improved on signs of de-escalation around Greenland. President Trump outlined a late-day “framework” for a future agreement involving Greenland and the broader Arctic region, explicitly ruling out tariffs slated for Feb. 1 and signaling immediate negotiations with Denmark and NATO. This removed a key overhang, likely sidelining Europe’s previously discussed €93B in counter-tariffs and anti-coercion measures.

Rates were supportive, with Treasuries firmer and the curve flattening as long-end yields fell ~4–5 bp, while JGB stabilization overnight helped calm global rate volatility. The SCOTUS hearing on Fed Governor Cook unfolded largely as expected, with several justices voicing skepticism toward the administration’s case and reiterating concerns around Fed independence. On the data front, December pending home sales fell 9.3% m/m (largest decline since Apr-2020), while October construction spending beat expectations. A $13B auction of 20-year notes stopped through by 1 bp. Markets continue to price a flatter rate-cut path (~44 bp through year-end) and remain in wait-and-see mode ahead of Big Tech earnings next week.

Sector Highlights

Cyclical leadership was pronounced. Energy (+2.38%), Materials (+1.87%), Healthcare (+1.80%), and Industrials (+1.71%) led the market as investors rotated back into value- and activity-sensitive groups following the Greenland de-escalation. Consumer Discretionary (+1.60%) and Communication Services (+1.44%) also participated, supported by airlines and select media names. More defensive areas lagged, with Utilities (+0.20%), Consumer Staples (+0.25%), Real Estate (+0.38%), and Financials (+0.42%) underperforming on a relative basis, while Technology (+0.99%) advanced but trailed the broader tape amid ongoing dispersion within the AI trade.

Information Technology

- Apple – Planning to revamp Siri later this year, effectively turning it into its first AI chatbot.

- Arm Holdings (+6.3%) – Upgraded to Positive at Susquehanna; cited stronger long-term EPS power, datacenter CPU/XPU diversification, v9 migration, and AWS Gravitron tailwinds.

- Progress Software (+10.8%) – Q4 EPS beat; FY26 EPS and revenue midpoints guided above consensus; management pushed back on AI disruption fears.

- Netflix (−2.2%) – Q4 beat but FY outlook mixed; operating margin guidance light with heavier 2H investment weighting; M&A overhang persists.

Communication Services

- GameStop (+2.8%) – Shares lifted after Chairman/CEO Ryan Cohen disclosed purchase of 500K shares, taking his stake to ~9.2%.

- Meta Platforms – Threads rolled out ads globally, expanding monetization.

Consumer Discretionary

- United Airlines (+2.2%) – Q4 beat with upbeat early-Q1 demand commentary; FY guidance in line but framed as conservative.

- Kraft Heinz (−5.7%) – Weighed down after Berkshire Hathaway registered its full 27.5% stake for potential sale; also downgraded at BNP Paribas Exane.

- Nathan’s Famous (+8.7%) – Agreed to be acquired by Smithfield Foods for $102/share in cash.

Energy

- Halliburton (+4.1%) – Q4 beat across Completion & Production and Drilling & Evaluation; free cash flow highlighted as a strength.

- Crude prices modestly higher (+0.4%) despite recent volatility tied to geopolitics.

Industrials

- Teledyne Technologies (+9.8%) – Q4 beat driven by FLIR and Marine segments; FY guidance in line.

- Gibraltar Industries (−11.7%) – Guided Q4 EPS well below prior outlook due to end-market volume declines.

Financials

- Truist Financial (+1.8%) – Q4 EPS/revenue missed, but NIM ahead; analysts cautious on expenses despite stable credit.

- Charles Schwab – Revenue light with higher expenses flagged.

- Travelers – Results aided by lower catastrophe losses.

- Ally Financial – Beat expectations, though scrutiny remains on auto-finance pressures.

Healthcare

- Johnson & Johnson – Broad-based beat with in-line guidance; bar seen as high and talc-litigation headlines linger.

Eco Data Releases | Thursday January 22nd, 2026

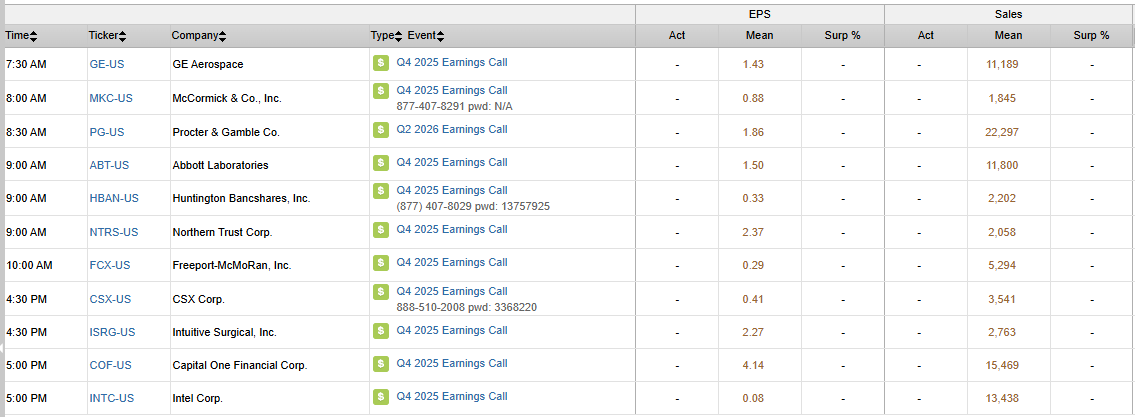

S&P 500 Constituent Earnings Announcements | Thursday January 22nd, 2026

Data sourced from FactSet Research Systems Inc.