January 28, 2026

S&P futures are up ~0.3% after U.S. equities finished mostly higher Tuesday, with momentum and big tech leading and the S&P 500 closing at a new record high. Healthcare lagged on the Medicare Advantage rate update. Asia traded mostly higher overnight (Hong Kong, South Korea strongest), while Europe is modestly lower (~0.1%). Treasuries are slightly weaker with yields down 1–2 bp. The dollar is stabilizing after sliding to a near four-year low Tuesday. Gold (+3.7%) and silver (+6.6%) are ripping; WTI −0.2%; Bitcoin +0.5%.

What’s driving the tape: Tech sentiment remains the key tailwind amid a momentum breakout and ahead of megacap earnings. Focus is on results from ASML, SK Hynix, TXN, and STX, updates on NVDA H200 chips in China, and reports SoftBank may invest $30B more into OpenAI (which is reportedly targeting up to $100B total funding); Anthropic lifted its 2026 revenue target by 20%. The dollar’s recent weakness is drawing comment from ECB officials, while precious metals have resumed their surge. Shutdown odds remain elevated but markets appear largely unfazed. Geopolitically, the U.S. and South Korea signaled room to resolve tariff tensions; oil is consolidating after a ~3% rally tied to Iran headlines.

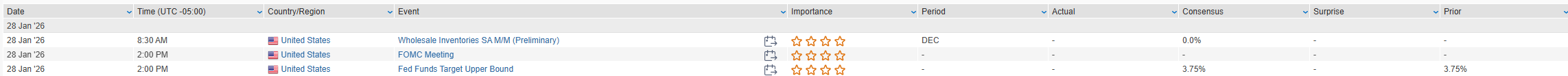

Macro calendar: Quiet this morning. The FOMC decision and Powell presser are the main event today (policy hold expected; watch dissents). Thursday brings unit labor costs, claims, trade, and factory orders; PPI on Friday.

Company highlights

- ASML: Record bookings nearly 2× consensus.

- TXN: Q1 guide above, improving linearity/backlog; signs of a broad industrial rebound.

- STX: Beat & raise; strong hyperscaler demand and capacity constraints.

- FFIV: Beat & raise; limited demand impact post-breach.

- QRVO: Q3 beat on iPhone strength; weaker guide tied to Android exits.

- MANH: RPO growth +300 bp vs expectations.

- LRN: Shares up on resolution of IT issues.

- PPG: Missed and guided lower; takeaways closer to buyside expectations.

- AMZN: Reportedly cutting ~16K corporate roles.

U.S. equities finished mostly higher Tuesday (Dow (0.83%), S&P 500 +0.41%, Nasdaq +0.91%, Russell 2000 +0.26%), though off best levels, with growth, momentum, and large-cap tech extending leadership while small caps lagged for a third straight session after last week’s sharp run. The S&P 500 closed at a fresh all-time high, and the Nasdaq moved within roughly 0.5% of its October 2025 record. Macro attention centered on a sharp downside surprise in January consumer confidence—the weakest reading in more than a decade—which contributed to curve steepening and a modest pickup in Fed easing expectations (roughly 45 bp of cuts priced for 2026, +4 bp vs. last Friday).

Rates were mixed: the 30Y yield rose ~4 bp, while the $70B 5Y Treasury auction tailed by 0.3 bp, contrasting with Monday’s strong 2Y sale. The U.S. dollar fell 1.4%, its worst day since April 2025 and weakest level since early 2022, aided by supportive yen commentary from Japanese officials. Commodities were volatile: WTI crude +2.9%, gold modestly higher, while silver fell 8.3%, giving back part of Monday’s surge. Tariff rhetoric toward South Korea and elevated government shutdown odds were largely ignored by markets.

Key data included January Consumer Confidence (lowest since 2014; labor-market differential narrowed to the weakest since 2021), a soft January Richmond Fed reading, and slowing ADP weekly private payroll averages. The calendar remains busy with the FOMC decision and Powell press conference Wednesday, followed by labor-costs, claims, trade, factory orders, and PPI later in the week.

Sector Highlights

Sector action reflected the growth-led tone of the session. Technology (+1.42%) led decisively, followed by Utilities (+1.25%), Energy (+0.99%), Consumer Discretionary (+0.67%), and Industrials (+0.42%). On the downside, Health Care (−1.66%) was the clear laggard amid managed-care pressure, while Financials (−0.74%) also underperformed. Communication Services (+0.02%), Materials (+0.04%), Real Estate (+0.14%), and Consumer Staples (+0.33%) finished little changed.

Information Technology

- GLW +15.6%: Benefited from a $6B fiber-optics deal with META tied to AI data-center buildouts.

- MU +5.4%: Announced a $24B advanced wafer fab in Singapore, with production expected to begin in 2H’28.

- NET +8.8%: Extended gains on enthusiasm around its AI assistant and broader AI-agent adoption.

- CRM: Secured a $5.6B U.S. Army contract.

- CVLT −31.1%: Sold off despite a beat as ARR guidance was cut.

- SANM −21.6%: Fell on lighter next-quarter revenue guidance despite strong AI-infrastructure commentary.

Communication Services

- META: Signed the $6B Corning fiber deal to support AI data centers.

- PINS: Announced a ~15% workforce reduction to reallocate resources toward AI initiatives.

- ROP −9.6%: Weighed on the group after light organic growth and FY26 guidance.

Consumer Discretionary

- GM +8.8%: Q4 EPS and EBIT beat; FY26 guidance raised, dividend increased, and $6B buyback authorized.

- AAL: Advanced on a better FY26 EPS outlook.

- PII −4.2%: Guided FY26 EPS below expectations, citing tariff and promotional pressures.

- PCAR −1.1%: Slipped after an in-line Q4 and largely unchanged industry outlook.

Health Care

- HCA +7.1%: Strong reaction to Q4 EBITDA beat and FY26 guidance above consensus; announced $10B buyback.

- UNH −19.6%: Led sector weakness after in-line Q4 results, lighter FY26 revenue guidance, and pressure from lower-than-expected Medicare Advantage rate increases for 2027.

Industrials

- UPS: Helped by a Q4 beat and stronger FY26 revenue outlook, despite announcing 30K additional job cuts tied to its Amazon unwind.

- RTX +3.7%: Q4 beat with FY26 guidance in line.

- BA: Beat on Commercial strength but flagged 777 engine durability issues.

- NOC: Weighed down by a disappointing 2026 guide.

Financials

- SYF −5.8%: Fell on weaker loan growth and higher expenses despite an EPS beat.

- Insurance and diversified financials broadly lagged amid rate and confidence concerns.

Energy

- WTI +2.9% supported the group; energy equities outperformed on crude strength and improving sentiment around global demand.

Materials

- NUE −2.3%: Declined on a Q4 EBITDA miss and cautious near-term outlook despite expectations for modest 2026 demand growth.

Eco Data Releases | Wednesday January 28th, 2026

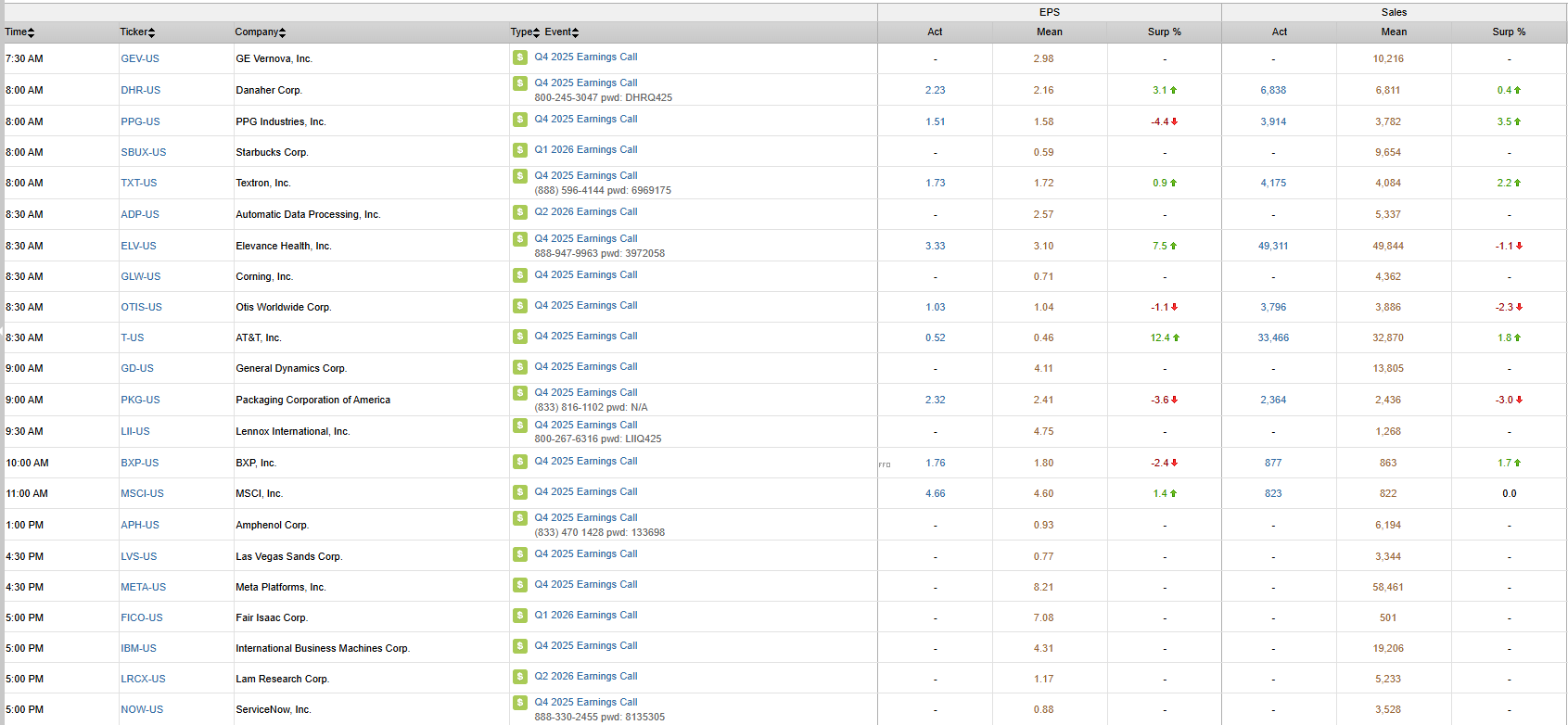

S&P 500 Constituent Earnings Announcements | Wednesday January 28th, 2026

Data sourced from FactSet Research Systems Inc.