January 29, 2026

Commodities prices are moving higher. The Bloomberg Commodities Index (chart below) is in long-term bullish reversal after 3 years of sideways price action. Demand for both base and precious metals has re-entered the macro spotlight, driven by a convergence of structural investment cycles, geopolitical fragmentation, and late-cycle monetary dynamics. Unlike prior commodity upswings that were narrowly tied to China or speculative excess, the current environment is broader and more persistent—rooted in energy transition capex, defense and infrastructure spending, and a global re-rating of real assets as financial hedges.

BCOM Index

Base Metals: Electrification, Infrastructure, and Supply Constraints

Base metals sit at the heart of the global electrification push. Copper, aluminum, and nickel are critical inputs for power grids, EVs, renewable energy, and data-center infrastructure. The International Energy Agency has repeatedly highlighted that copper demand from clean energy applications alone could double by the early 2030s, while grid expansion and data-center buildouts add incremental pressure today.

What makes this cycle different is supply discipline. Years of underinvestment—particularly after the 2014–2016 commodity downturn—have left global mining capacity tight. Large projects face long permitting timelines, rising costs, and political risk, limiting the industry’s ability to respond quickly to higher prices. This has created a favorable setup for established producers with scale and operating leverage.

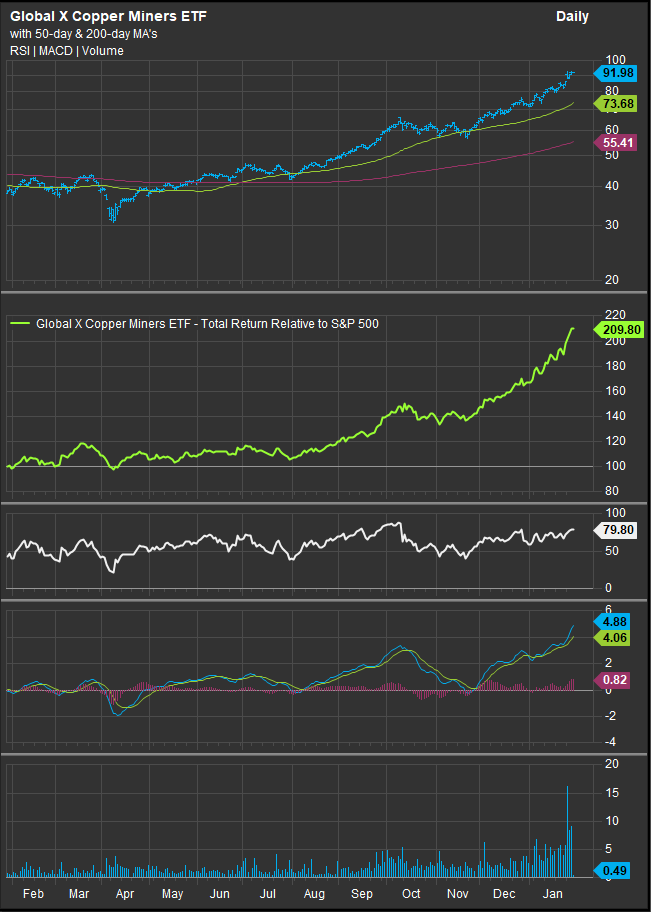

Among equities, diversified miners such as BHP, Rio Tinto, and Freeport-McMoRan have been notable beneficiaries, offering direct exposure to copper and iron ore alongside strong balance sheets. From an ETF perspective, vehicles like the Global X Copper Miners ETF and the SPDR S&P Metals & Mining ETF have tracked the recovery well, reflecting both rising prices and improving cash flows across the mining complex.

COPX ETF

Precious Metals: Monetary Hedging and Geopolitical Demand

Precious metals—particularly gold—are responding to a different but complementary set of forces. Persistent geopolitical risk, rising sovereign debt burdens, and questions around the long-term credibility of fiat currencies have driven renewed demand for gold as a reserve asset. Central banks, especially in emerging markets, have been consistent buyers, seeking diversification away from U.S. dollar reserves.

At the same time, real interest rates remain historically low relative to debt levels, even after recent tightening cycles. That environment is supportive for gold and, to a lesser extent, silver, which also benefits from industrial demand tied to solar panels and electronics.

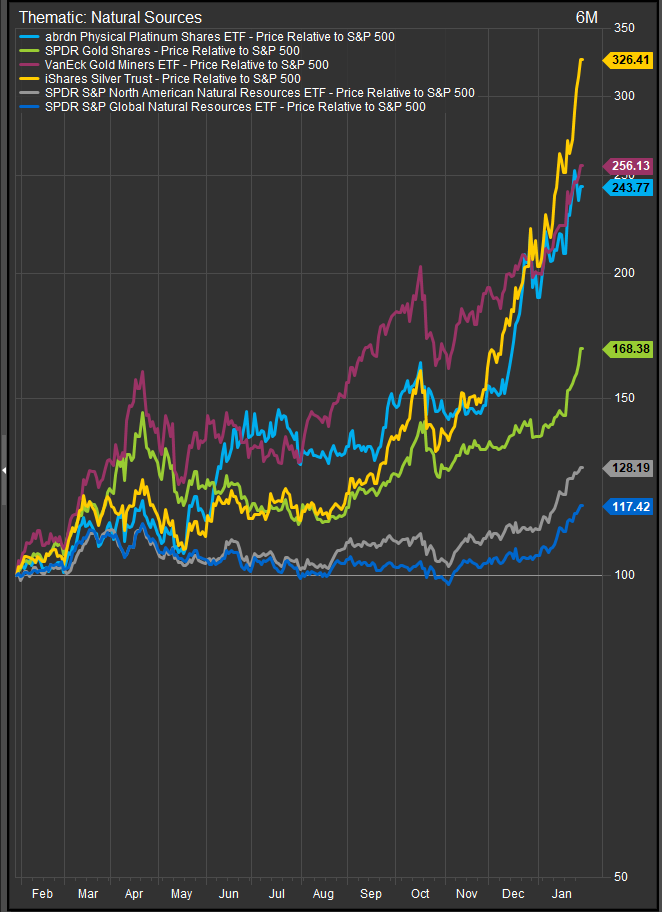

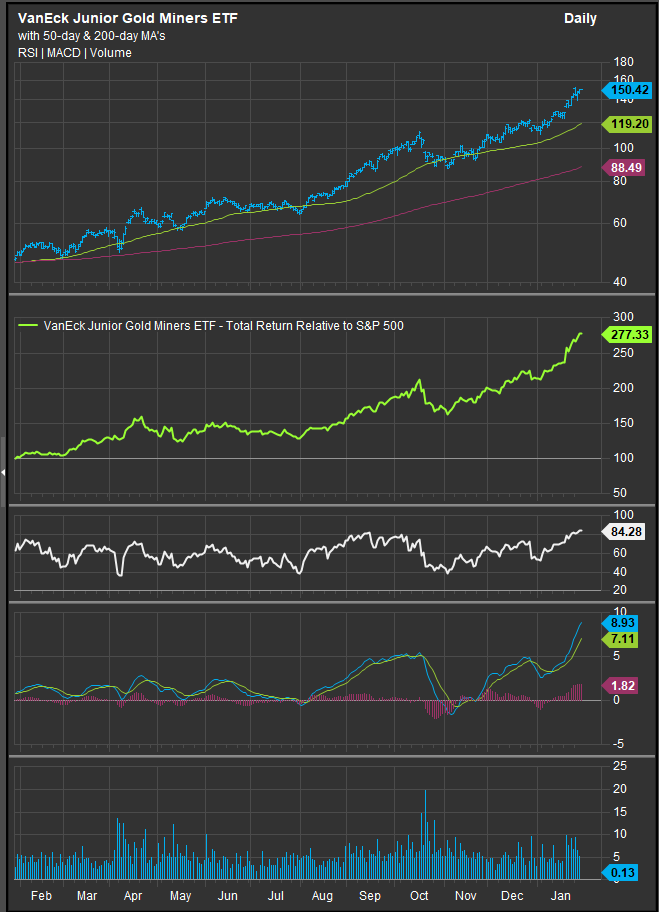

Leading miners such as Newmont and Agnico Eagle Mines have outperformed as margins expanded alongside higher bullion prices. On the ETF side, the VanEck Gold Miners ETF and VanEck Junior Gold Miners ETF have offered leveraged exposure to rising gold prices, while physical-backed products such as SPDR Gold Shares continue to serve as portfolio hedges against macro instability.

Natural Resources as a Portfolio Allocation

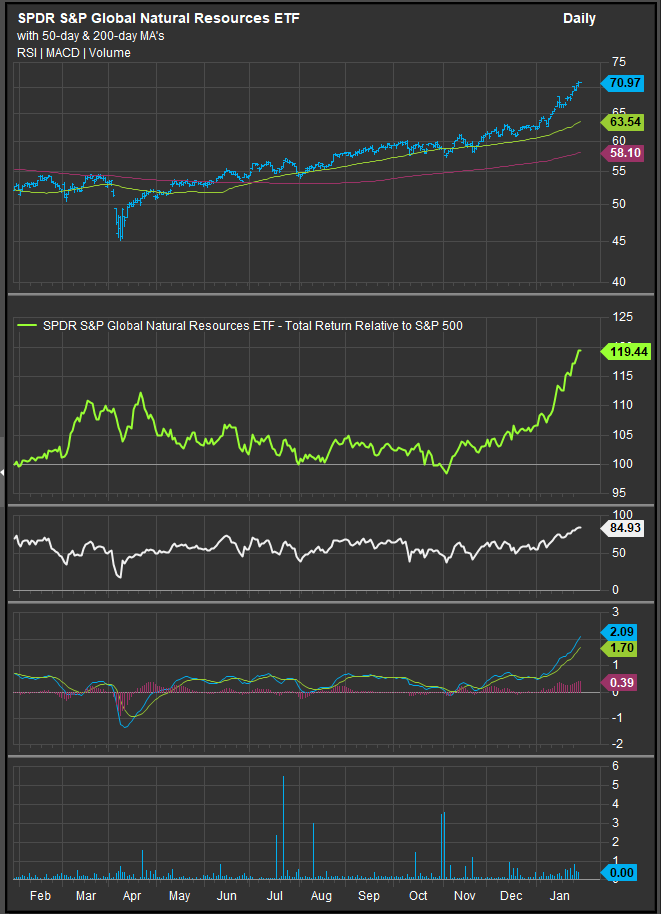

Beyond individual metals, the broader natural resources complex is benefiting from its role as both a growth input and a financial hedge. Energy transition policies, reshoring of supply chains, and higher defense spending all point to sustained demand for raw materials. At the same time, commodities and resource equities tend to perform well during periods of fiscal expansion and late-cycle inflation uncertainty.

Diversified ETFs such as the iShares Global Materials ETF and the SPDR S&P Global Natural Resources ETF have captured this theme by blending exposure to mining, energy, and materials producers across geographies.

What Keeps the Thesis Intact

For the metals trade to remain durable, three conditions matter most: continued infrastructure and energy capex, restrained supply growth, and a macro backdrop that keeps real assets relevant. Even modest economic growth can sustain demand if supply remains tight and inventories stay lean. One of the key drivers has been global trade tensions. From the biggest picture perspective, bifurcation of US and China spheres of influence creates disintegration in the global supply chain. The upshot for the metals trade is that this structural inefficiency at the global level creates more input demand.

The other current tailwind is political. The Trump Administrations policies generally run against decades of establishment consensus around such things as the USD’s reserve currency status, NATO and central bank independence. These dynamics put downwards pressure on the dollar and decrease ex-US demand for US paper. This contributes to real asset demand.

In that context, base and precious metals are less about short-term speculation and more about strategic scarcity. With limited substitutes, long lead times for new production, and growing geopolitical and technological demand, metals have reasserted themselves as a core pillar of the real-asset investment universe—one reflected clearly in the performance of leading miners and natural resource ETFs.

Sources

- International Energy Agency (IEA)

The Role of Critical Minerals in Clean Energy Transitions

Analysis on copper, nickel, and aluminum demand tied to electrification, renewables, and grid expansion. - World Bank

Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition

Estimates of multi-decade growth in base metal demand driven by energy transition capex. - U.S. Geological Survey (USGS)

Mineral Commodity Summaries

Supply, production, and reserve data for copper, gold, silver, and industrial metals. - Bloomberg Intelligence

Global Mining & Metals Outlook

Commentary on supply discipline, capex constraints, and cash-flow dynamics across miners. - Financial Times

Coverage of central bank gold purchases, geopolitics, and reserve diversification trends. - World Gold Council

Gold Demand Trends

Data on central bank buying, investment demand, and real-rate sensitivity. - Company Filings & Investor Presentations

BHP, Rio Tinto, Freeport-McMoRan, Newmont, Agnico Eagle Mines

Production outlooks, capex plans, and margin sensitivity to metal prices. - ETF Issuers (Fact Sheets & Methodology)

Global X (COPX), SPDR (XME, GNR), VanEck (GDX, GDXJ), iShares (MXI)

Holdings, sector exposure, and performance attribution. - S&P Global Commodity Insights

Research on mining investment cycles, permitting timelines, and geopolitical supply risks.

Additional charts and data sourced from FactSet Research Systems Inc.