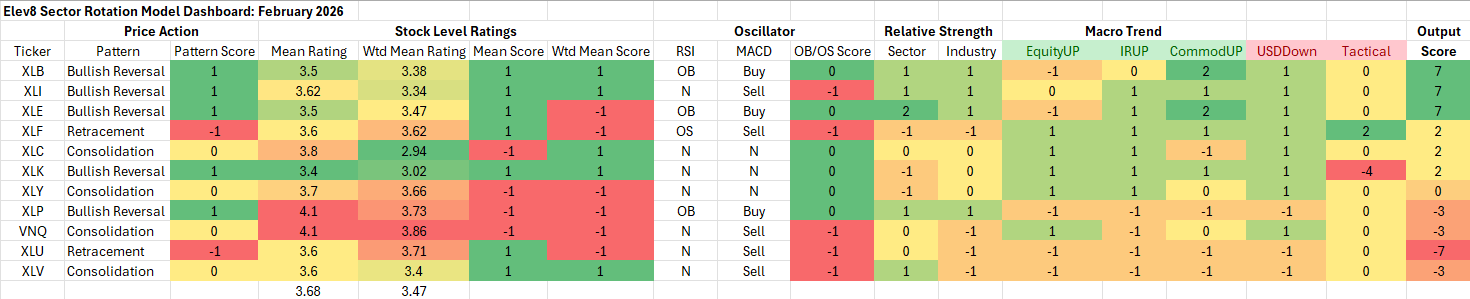

Elev8 Model Input Scores: February 2026

The table below shows the Elev8 model’s scores for February. January’s big developments included deposing Venezuela’s Maduro, renewed saber-rattling on Iran and earnings that confirmed strong present trends but didn’t completely assuage concerns over valuation and monetization in the AI space. These developments were interpreted as a catalyst to rotate towards real assets and Commodities exposures. As a result, we saw scores for Materials, Energy and Industrials sectors rise to the top of our rankings. Historically low vol. sectors are derated in our model due to upwards pressure on interest rates and commodities prices, but also because much of the agita around the equity market is being expressed through rotation rather than a change in the top-line trend.

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buy-sell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Model Input Commentary

We’ve added a tactical overlay based on our continued concerns over inflation and clear rotation from Growth towards Value exposures that has gained steam with investors over the last 3 months. We think the near-term momentum associate with rotation into Energy and Materials is likely to carry forward in the near-term even though both sectors are currently overbought. Alpha is usually generated asymmetrically by the commodities complex and typically its lumpy and front-loaded. We’ve also boosted the Financial sector score through our tactical overlay because our research tells us that Banks and Insurance stocks have historically been good inflation hedges and generally work well when rates are moving higher.

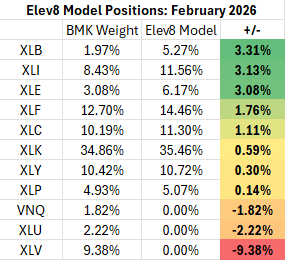

Elev8 Sector Rotation Model Portfolio: February Positioning vs. Benchmark Simulated S&P 500 (data as of 12/30/25)

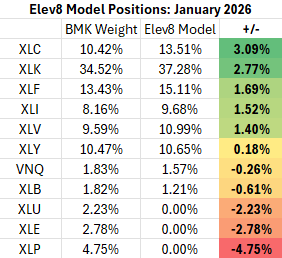

Previous Positioning as of last Rebalance: December 26, 2025

Simply put, our trend following process has been vulnerable to being whip-sawed during periods of structural trend change. We put defensive and commodities exposures into the Elev8 portfolio in December with lackluster results and we interpreted the miss as a false signal with the Fed. shifting towards a dovish stance. Two days into January the Venezuela situation broke and the Energy sector became a free-for-all bull trade. The price action in Energy and Materials has been strong, and we are assuming tailwinds will remain in place for longer than one- month. Hard assets have potential to be a durable trend given the backdrop of increased global competition, tariffs, and US/China friction. The AI trade is still a powerful cash-flow generator, but a move towards commodities and cyclicality is clearly underway in early 2026.

Conclusion

Given that we are in late cycle, the time for big sector bets is likely past absent a clear dislocation in market pricing. We’re gaining conviction in the shift over to natural resources from technology as the dominant trend motivating equities at present. We do think if the cycle persists in longer-term expansion that there may be some give and take between these two big themes, but at present the Cyclical/Value trade is in the driver’s seat over Growth and as a trend following process, we are adapting to that reality.

About Elev8

We introduced the Elev8 Sector Rotation Model in February of 2024. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for April and our resulting positions. The model includes up to 14 indicators that range from:

- Stock Level Technical Characteristics

- Macro-overlays:

- equity trend (S&P 500)

- interest rate trend (10yr US Treasury Yield)

- commodities trend (Bloomberg Commodities Index)

- USD trend (vs. EUR & Broad Currency Indices)

- Relative performance vs. the benchmark S&P 500

- Overbought/Oversold oscillator studies

We use the largest passive sector-based ETF by AUM ($) for each sector as our proxy for Elev8 sector positions. We select 8 out of 11 Sectors each month and have no exposure to the 3 with the lowest scores in our model.

Data from Factset Research Systems Inc.