February 10, 2026

S&P futures are up 0.1% in Tuesday morning trading following a mostly higher start to the week for U.S. equities. Monday’s advance was led by Technology, with software and the broader OpenAI ecosystem standing out, alongside strength in precious metals and global miners. Insurance brokers were notable laggards as investors weighed the longer-term competitive impact of AI on pricing and underwriting. Overseas, Asian markets traded mostly higher overnight, led by Japan (+2%+), while European equities are modestly firmer (~+0.2%). Treasuries are bid with yields down roughly 2 bp further out the curve. The dollar is little changed, gold (-0.2%) and silver (-0.4%) are slightly softer, bitcoin futures are down 1.7%, and WTI crude is off 0.2%.

There are no major directional catalysts this morning ahead of a heavier macro calendar over the coming sessions. Market discussion continues to center on the extreme rotations seen last week, set against a still-constructive earnings backdrop (+13% y/y), resilient macro surprise momentum despite softer labor data, and ongoing hyperscaler capex and debt-raising activity. AI-driven competitive threats remain top of mind, particularly for insurance and other information-intensive industries. Washington headlines are also in focus, with reports pointing to a significant regulatory rollback tied to climate policy and parallel efforts to secure data-center energy supply, while momentum appears limited behind proposals to restrict institutional investors from buying single-family homes.

On today’s calendar, January NFIB small-business optimism, December retail sales, and import/export prices are due this morning. Headline retail sales are expected to rise 0.4% m/m, with the core control group seen up 0.5%. Fed speakers Hammack and Logan are scheduled, and Treasury auctions $58B of 3-year notes. January employment data is the key release Wednesday, followed by January CPI on Friday (core CPI expected +0.3% m/m, +2.5% y/y).

Company News

Technology

- Taiwan Semiconductor Manufacturing (TSM) moved higher after reporting a 37% y/y jump in January revenue.

- Credo Technology (CRDO) surged after raising guidance for its January quarter.

- ON Semiconductor (ON) was pressured by a slightly softer outlook for the March quarter.

- Upwork (UPWK) beat earnings and guided 2026 above expectations but fell on a weaker Q1 outlook.

- GitLab (GTLB) declined as results highlighted solid upmarket momentum offset by softer downmarket demand.

Industrials

- AECOM (ACM) saw positive takeaways around bookings strength and its decision to retain its Construction Management business.

- AMETEK (AME) was hit by a free-cash-flow miss despite otherwise solid execution.

- Goodyear Tire & Rubber (GT) fell sharply after an EPS miss, though management commentary was more constructive.

Health Care

- AstraZeneca (AZN) traded higher after issuing improved guidance.

- Medpace (MEDP) reported a sales beat, but shares were pressured by weaker-than-expected bookings.

Financials

- Cincinnati Financial (CINF) posted results highlighting improved underwriting, no prior-year reserve charges, and lower net premiums written.

- Principal Financial Group (PFG) saw focus on near-term outflows, offset by a more constructive outlook for 2026.

Energy

- BP (BP) was pressured after announcing a pause in share buybacks.

U.S. equities extended Friday’s sharp rally (Dow +0.04% | S&P 500 +0.47% | Nasdaq +0.90% | Russell 2000 +0.70%), though indices faded from intraday highs. Leadership remained concentrated in large-cap technology and AI-linked software, helping the Nasdaq outperform. The equal-weight S&P 500 again lagged the cap-weighted index but closed at another record, signaling continued—but selective—broadening.

Treasuries finished little changed after reversing earlier weakness. Policymaker commentary downplaying near-term labor softness helped temper rate pressure tied to reports that China is encouraging banks to curb Treasury exposure and optimism following Japan’s decisive LDP election result. Markets continue to interpret incremental labor cooling as consistent with late-cycle normalization rather than a hard growth break.

The U.S. dollar weakened sharply, falling 0.8% and fully retracing last week’s gains. Dollar weakness supported precious metals, with gold rising 2.0% to move back above $5,000 and silver surging nearly 7% to reclaim $80. WTI crude settled up 1.3%, while bitcoin futures ended modestly higher after early pressure.

Focus now turns to a heavy data week, highlighted by January employment on Wednesday and January CPI on Friday, alongside $125B in Treasury auctions across the 3-, 10-, and 30-year tenors.

Sector Highlights

Performance skewed decisively toward growth and cyclicality. Technology (+1.59%) led the market, driven by a rebound in software and renewed confidence in the AI infrastructure and enablement complex. Materials (+1.44%) followed closely, supported by sharp gains in precious-metals miners and agricultural chemicals as dollar weakness boosted commodity-linked equities. Energy (+0.84%) advanced alongside higher crude prices, while Communication Services (+0.80%) benefited from AI capex headlines and merger-related optimism in media. Real Estate (+0.59%) posted moderate gains as Treasury yields stabilized after early volatility.

Defensive and rate-sensitive areas lagged. Healthcare (-0.86%) underperformed amid GLP-1 regulatory uncertainty and weakness in managed care and medtech. Consumer Staples (-0.86%) also trailed despite isolated strength in grocers, reflecting waning demand for defensives in a risk-on tape. Financials (-0.61%) lagged as payments and insurance offset relative strength in capital-markets-linked names. Consumer Discretionary (+0.34%), Industrials (+0.33%), and Utilities (+0.31%) finished modestly higher but failed to keep pace with the broader market, underscoring the day’s concentration in large-cap growth leadership.

Company-Specific Developments by GICS Sector

Information Technology

- Oracle (ORCL) surged after DA Davidson upgraded the stock to Buy, citing improved visibility around OpenAI funding, capital raises, and data-center demand.

- Micron Technology (MU) declined after reports its HBM4 product did not qualify for NVIDIA’s next-generation Vera Rubin platform.

- STMicroelectronics (STM) rallied after announcing an expanded strategic collaboration with AWS across cloud and semiconductor technologies.

- Dynatrace (DT) jumped following strong earnings, billings and ARR beats, raised guidance, and announcement of a new $1B buyback.

- monday.com (MNDY) sold off after guidance disappointed, citing near-term margin pressure from FX despite headline beats.

- Workday (WDAY) slipped after announcing a CEO transition, with co-founder Aneel Bhusri returning to lead the company.

Communication Services

- Alphabet (GOOGL) is seeking to raise roughly $15B via a multi-tranche bond offering following guidance for up to $185B in 2026 AI-related capex.

- Tegna (TGNA) and Nexstar Media Group (NXST) rallied after President Trump expressed support for their proposed merger.

Health Care

- Novo Nordisk (NVO) gained after the FDA moved to restrict compounded GLP-1 APIs, reinforcing Novo’s competitive position.

- Hims & Hers Health (HIMS) sold off sharply after scrapping plans for a compounded semaglutide pill and disclosing legal action from Novo Nordisk.

- Waters (WAT) declined after issuing weaker-than-expected near-term revenue guidance tied to academic and government demand softness.

- Eli Lilly (LLY) announced a drug-development collaboration with China-based Innovent Biologics.

Consumer Staples

- Kroger (KR) advanced after naming former Walmart executive Greg Foran as its next CEO and reaffirming full-year guidance.

Consumer Discretionary

- AppLovin (APP) rallied sharply after a research firm corrected prior allegations, removing a major overhang.

- Apparel retail, hotels, and cruise operators broadly lagged amid mixed consumer spending signals.

Financials

- Robinhood Markets (HOOD) rose after Wolfe Research upgraded the stock, citing improved risk-reward following recent underperformance.

- Payments, P&C insurance, and exchanges underperformed despite continued strength in investment-banking-linked names.

Industrials

- Transocean (RIG) announced a $5.8B all-stock acquisition of Valaris (VAL), expanding its rig fleet ahead of a multi-year offshore recovery.

- Cleveland-Cliffs (CLF) fell after reporting weaker-than-expected EBITDA, though management struck a more constructive tone on trade conditions.

Materials

- Precious-metals miners outperformed as gold and silver surged on dollar weakness.

- Agricultural chemicals also advanced, while steel stocks lagged on mixed earnings and margin pressure.

Energy

- Offshore drillers led gains following sector consolidation headlines, while broader E&P stocks tracked higher crude prices.

Real Estate

- REITs posted modest gains as Treasury yields stabilized, though performance remained selective amid elevated financing costs.

Utilities

- Utilities finished slightly higher but continued to lag amid renewed investor appetite for growth and cyclicality.

Eco Data Releases | Tuesday February 10th, 2026

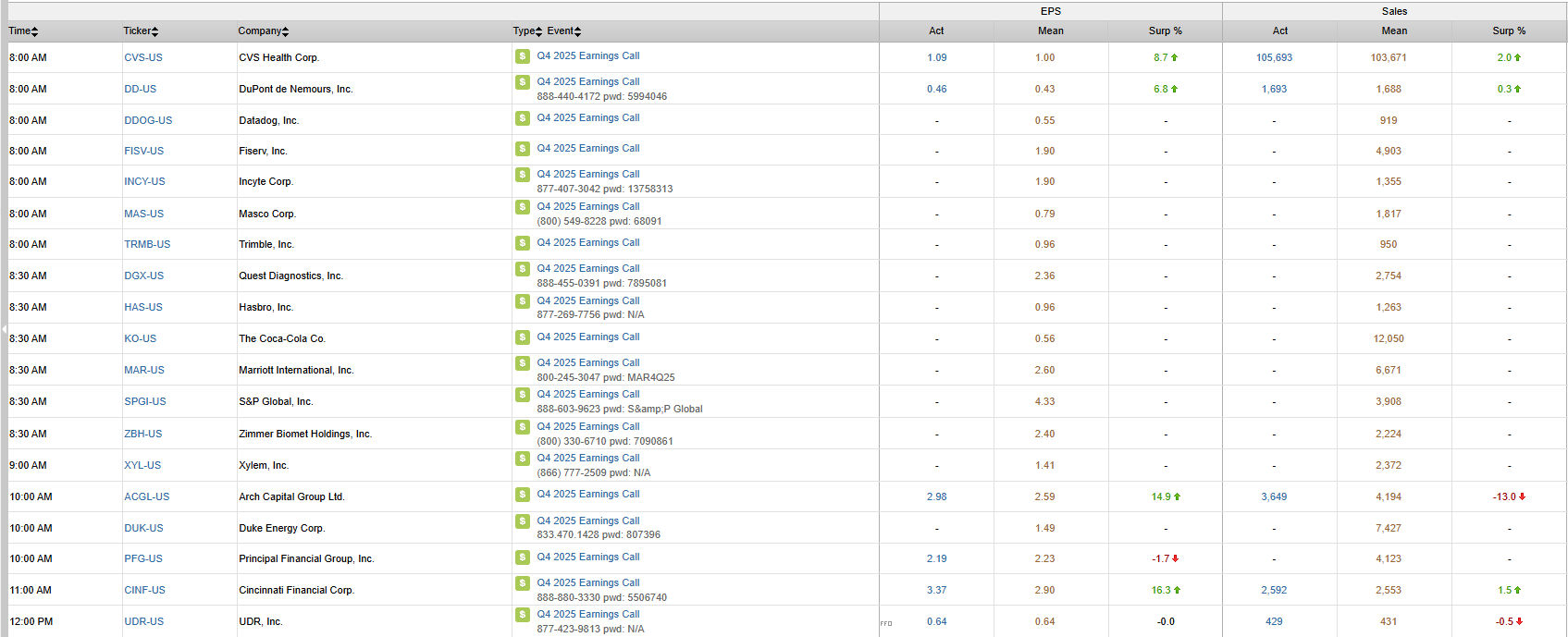

S&P 500 Constituent Earnings Announcements | Tuesday February 10th, 2026

Data sourced from FactSet Research Systems Inc.