February 12, 2026

The headlines we’re seeing scream “late-cycle tension,” but the tape in thematic ETFs is more specific: investors are paying up for scarcity and hedges (metals, miners, broad natural resources) while keeping one eye on a potential pivot back to Growth if inflation cooperates and policy uncertainty stops leaking into margins. The push and pull is visible in your performance/flows sheet: “Natural Resources” has been the standout pocket on a trailing basis, while semiconductors remain the most credible bridge back into Growth once macro volatility settles.

Why Natural Resources themes keep winning the allocation debate

The bull case for Natural Resources right now rests on a rare alignment of structural demand and geopolitics. AI is not just a software story; it is a power-and-wires story. Grid bottlenecks and data-center buildouts raise the call on copper and related inputs, and recent research argues copper demand could rise from roughly 28 million metric tons in 2025 to ~42 million by 2040—a scale problem the mining industry cannot solve quickly given permitting and project lead times.

At the same time, precious metals have regained their “macro utility.” The World Gold Council estimates central banks bought 863 tonnes of gold in 2025, and Reuters highlights that gold investment demand hit a record with large ETF inflows in 2025—evidence that gold is being treated as an insurance asset as tariffs, fiscal questions, and geopolitics remain unresolved.

Your sheet shows investors have been rewarded for leaning into that setup. Over the last three months, silver and miners have surged alongside solid inflows into the “quality beta” expressions of the trade: Gold (GLD) shows +23.1% over three months with about +$1.74B in YTD flows, while gold miners (GDX) show +39.1% with +$1.56B YTD flows. Copper miners (KOPX) stand out as a “grid + electrification” lever with +48.7% over three months and roughly +$1.88B in YTD inflows. The more speculative torque remains alive too: junior silver miners (SILJ) are up +56.5% over three months with about +$0.61B YTD inflows. Interestingly, silver bullion (SLV) is up +64.8% over three months but shows net YTD outflows (~-$0.38B)—a reminder that positioning is still choppy even when price is right. (All performance/flow figures here are from your provided spreadsheet.)

The bigger point: when tariffs and supply-chain uncertainty flare, when central banks keep buying gold, and when electrification collides with underbuilt grids, “Natural Resources” stops being a tactical trade and starts acting like a macro sleeve investors can justify owning through the cycle.

What could pull investors back toward Growth themes

A durable rotation back to Growth needs a cleaner macro backdrop than the market has enjoyed recently. The next catalyst is inflation—and notably the seasonal quirks around January. The BLS has flagged that updated CPI seasonal factors will be introduced with the January CPI release cycle, and the Boston Fed has discussed why “new year” inflation can behave differently due to residual seasonality and pricing patterns. If CPI prints cleaner than feared and real rates drift lower, Growth duration gets its tailwind.

The second catalyst is simply earnings reality: if AI capex remains strong but monetization concerns fade, the market can re-rate the Growth complex without needing multiple expansion fantasies. Your sheet hints that investors are already keeping a foot in the door via semis: Semiconductor ETFs show strong trailing performance and heavy inflows—SMH is up +18.5% over three months with roughly +$3.25B in YTD flows, and SOXX is up +22.2% with about +$1.45B in YTD flows. That’s a classic “barbell tell”: real assets for hedge/scarcity, semis for the eventual return of pro-cyclical Growth leadership.

Are we heading toward recession? A slowdown case is easier than a recession call

The recession question is genuinely two-sided. The latest labor market read was better than expected: January payrolls +130K and unemployment 4.3% (Reuters/FT), which argues against an imminent downturn. But the caution flag is that 2025 job growth was revised sharply lower in some reporting, and the composition of hiring appears narrow (healthcare-heavy), which fits your own headline set about consumer divergence and pressure on value-oriented demand.

If you want a probabilistic framework rather than a binary call, one mainstream house view (RSM) recently put 12-month recession odds around 30%. That feels directionally consistent with the mosaic: not a base-case recession, but not a “green light” expansion either—more like a growth scare regime where defensives and real assets keep receiving incremental capital until inflation and earnings remove doubt.

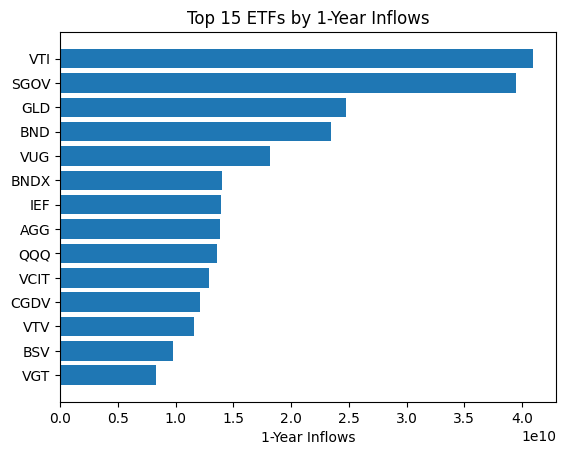

Note: ETF flows ($ billions, source: FactSet), YTD flows show investors favoring EM equities, metals and bonds

The bottom line for thematic ETF positioning

In the near term, present dynamics—tariffs, policy noise, geopolitics, and inflation uncertainty—still favor Natural Resources themes because they hedge both supply-side risk and monetary credibility. For a sustained shift back to Growth, investors likely need some combination of: benign CPI, stabilization in policy/tariff expectations, and earnings proof that AI infrastructure spend is translating into durable cash flows rather than just bigger capex numbers.

Endnotes / Sources

- World Gold Council, Gold Demand Trends: Q4 and Full Year 2025 (central bank purchases, investment demand).

- Reuters, Global gold demand hits record high in 2025, WGC says (ETF inflows, investment demand).

- S&P Global, Copper in the Age of AI (long-run copper demand trajectory; AI/electrification framing).

- Reuters, Global power grid expansion fuels fresh copper demand surge (EV/grid-driven copper demand growth).

- IEA, World Energy Outlook 2025 – Executive Summary (data center buildout and grid strain context).

- BLS, Seasonal Adjustment in the CPI / Updated seasonal factors February 13, 2026 (January CPI seasonal factor update).

- Federal Reserve Bank of Boston, Why has inflation behaved differently in the new year? (residual seasonality discussion).

- Reuters; Financial Times, January 2026 jobs report coverage (130K payrolls, 4.3% unemployment).

- RSM, Economic outlook for 2026 (recession probability framework).

- Your provided performance/flows spreadsheet (02/12/26) for ETF returns and flows cited (GLD, GDX, SLV, SILJ, KOPX, SMH, SOXX).

Data sourced from Factset Research Systems Inc.