Monday opens as a slow day on the economic and earnings calendar. Investors in both the stock and bond market are likely looking ahead to Wednesday’s CPI print for the latest data point on inflation with wall street strategists starting to back off calls for rate cuts in the 2nd half of the year on predictions of sticky inflation. Asian stocks are also signaling a sluggish start to the weak as demand figures came in light and some signs of a slowing economy state side.

Eco Data Releases | Monday May13th, 2024

| Date Time | Event | Survey | Prior |

| 05/13/2024 11:00 | NY Fed 1-yr Inflation Expectations | — | 3% |

S&P 500 Constituent Earnings Announcements by GICS Sector | Monday May13th, 2024

No Earnings Releases Today

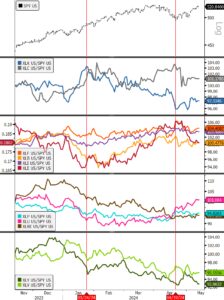

We wanted to start off the week looking at US Large Cap Sector Performance over the trailing 6-month period. Notable has been the bearish correction in Tech Sector (XLK/SPX, Chart 2nd panel) performance and the corresponding surge in the Energy Sector (XLE/SPX, Chart 3rd panel) between January 24 and April 19. As the benchmark has attempted a bullish reversal the XLK remains short of re-establishing an outperformance trend while Utilities have continued to lead off the late April low. Leadership over the last 6 months has flipped to Financials and Industrials. This has been subtle, but given the continued presence of inflation, the way equities typically trade in an election year (consolidation into the election) and a loss of momentum in the bull markets initial leadership cohort, it should be expected to continue absent another roar from mighty NVDA which reports on 5/22. Read more on this dynamic in the momentum section below and in our weekly newsletter!

- Notable has been the bearish correction in Tech Sector (XLK/SPX, Chart 2nd panel) performance and the corresponding surge in the Energy Sector (XLE/SPX, Chart 3rd panel) between January 24 and April 19

Momentum Monday

Each Monday we will touch on momentum investing either at the stock or sector level. We use a technical analysis tool kit to navigate high momentum stocks. The advantage of technical analysis is it doesn’t require a definition of momentum that a machine can understand. Similar to the oldest of art-forms and its adjacencies, a technician “knows it when he/she see’s it.” One way I like to describe technical analysis is as the analogue study of momentum because many of the price patterns that technicians are keen on describe the confirmation or dissipation of momentum in a stock. For example, we touched on NVDA earlier in this note. Here’s the chart and what it says to do about identifying momentum. A sector investor has an easy way to manage their NVDA exposure using a tool like SPDR’s. A tactical underweight in the XLK when a bellwether like NVDA is in consolidation below resistance and a move to overweight on a break-out is a strategy that would capture upside momentum while conserving alpha in a draw-down environment.

- NVDA 2yr, weekly price w/ RSI, Relative to SPX

- It took 6 months for NVDA to build a base in 2H23 after its pause in July, a similar scenario seems likely based on the price action and momentum signature here

- In the near-term support is at $750 while resistance is at $974…those are the buy and sell signal levels for the stock given the current set up.

- The Relative trend is consolidating, and the underlying uptrend support line shows the stock is potentially ahead of itself and could correct to trend