Equities are out to all-time highs spurred by a lighter than expected CPI print that has investors betting against an inflation overhang. The Nasdaq paced the major US indices up 1.44% while the S&P 500 added 1.17% and the Dow lagged gaining 0.88%.

Yields moved lower across the curve in accordance with the weaker CPI triggering ETFsector.com’s short covering signal for the XLK. With an upside break-out to all-time highs for the S&P 500 and a break-down in the uptrend channel for the US 10yr Yield the table is set for Growth oriented sectors to outperform.

Eco Data Releases | Thursday May 16th, 2024

| Date Time | Event | Period | Survey | Actual | Prior | Revised |

| 05/16/2024 08:30 | Revisions: Housing Starts, Permits | |||||

| 05/16/2024 08:30 | Initial Jobless Claims | 11-May | 220k | — | 231k | — |

| 05/16/2024 08:30 | Continuing Claims | 4-May | 1780k | — | 1785k | — |

| 05/16/2024 08:30 | Housing Starts | Apr | 1420k | — | 1321k | — |

| 05/16/2024 08:30 | Housing Starts MoM | Apr | 7.50% | — | -14.70% | — |

| 05/16/2024 08:30 | Building Permits MoM | Apr | 0.90% | — | -4.30% | -3.70% |

| 05/16/2024 08:30 | Building Permits | Apr | 1480k | — | 1458k | 1467k |

| 05/16/2024 08:30 | New York Fed Services Business Activity | May | — | — | -0.6 | — |

| 05/16/2024 08:30 | Philadelphia Fed Business Outlook | May | 8 | — | 15.5 | — |

| 05/16/2024 08:30 | Import Price Index MoM | Apr | 0.30% | — | 0.40% | — |

| 05/16/2024 08:30 | Import Price Index ex Petroleum MoM | Apr | 0.10% | — | 0.00% | — |

| 05/16/2024 08:30 | Import Price Index YoY | Apr | 0.40% | — | 0.40% | — |

| 05/16/2024 08:30 | Export Price Index MoM | Apr | 0.20% | — | 0.30% | — |

| 05/16/2024 08:30 | Export Price Index YoY | Apr | -1.10% | — | -1.40% | — |

| 05/16/2024 09:15 | Industrial Production MoM | Apr | 0.10% | — | 0.40% | — |

| 05/16/2024 09:15 | Capacity Utilization | Apr | 78.40% | — | 78.40% | — |

| 05/16/2024 09:15 | Manufacturing (SIC) Production | Apr | 0.10% | — | 0.50% | — |

Given the softer than expected CPI print yesterday, it would take some strong releases to change the near-term narrative. We would advise looking across the sectors to gauge upside participation. The typical playbook for falling rates and a rising equity market is to be exposed to Growth over Value and to stay in longer-term leadership areas of the equity market which would point to XLK and XLC. However there is a chance the gains will be shared more broadly as the bull trend in equities will be reaffirmed.

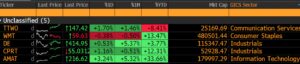

S&P 500 Constituent Earnings Announcements by GICS Sector | Thursday May 16th, 2024

A bit busier on the earnings calendar for Thursday. AMAT is likely a potential “tell” for NVDA next week as the Semi industry is typically highly correlated. DE and WMT are important for the other side of the Growth trade. Things are looking very bullish for equities overall, but it will be important to see if we want to favor the reflation of “everything else”, or if the pro-momentum trade will reassert itself.

- AMAT (200-day m.a. | Relative to S&P 500 )

- The stock looks poised for an upside break-out with an intermediate-term pattern objective +10% above previous highs on the recent upside break-out above resistance

BUY Signal Alert!: Cover shorts in XLK, recommend accumulation on any near-term weakness

ETFSector.com buy/sell signals for XLK are based on direction of the equity trend, direction of interest rate trend and the price action of the ETF itself. Lower rates, higher equities and an upside breakout in the ETF have us covering our short and looking to opportunistically move to a long position in the near-term.

- XLK (200-day m.a. | Relative to S&P 500 )

- XLK projects an intermediate-term pattern objective +10% above recent resistance at the $212 level for a price target above $230

- The Relative curve is confirming with a break-out above downtrend channel resistance

- US 10yr Generic Treasury Yield (weekly chart)

- Yields have broken a multi month uptrend channel support level. This puts the relevant macro level trends (Equities UP, Rates DOWN) in place to where investors should be rewarded for being in upside and pro-Growth exposures like XLK and XLC and should also offer relief to XLY