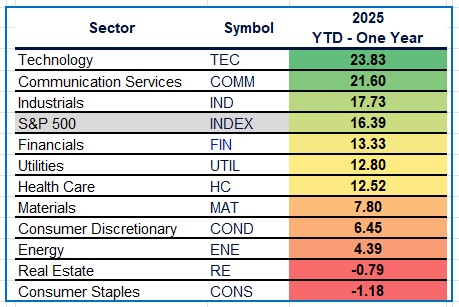

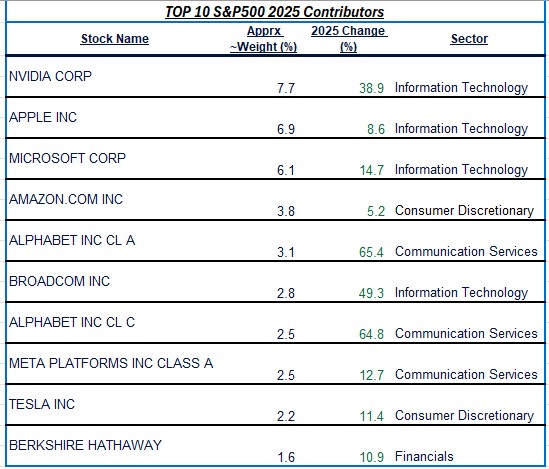

The S&P 500 posted a robust 16.4% gain in 2025, supported by a soft‑landing narrative, moderating inflation, and small Fed rate cuts that helped sustain earnings growth across most sectors. Equity leadership remained narrow, with growth and capex‑levered industries tied to artificial intelligence, data infrastructure, and industrial reshoring again doing the heavy lifting.

High‑performing sectors

- Technology

Technology led as AI adoption, cloud migration, and semiconductor demand drove double‑digit earnings growth and kept investors comfortable paying premium multiples despite “higher‑for‑longer” real yields. Corporate capex into automation and data centers, alongside hopes that rate cuts will eventually ease financing costs, further buoyed this sector. - Communication Services

Digital advertising and streaming returned to steady growth as consumer spending normalized, while mega‑cap platforms monetized AI tools and cloud services. Market leadership remained concentrated in a handful of communication‑platform giants, amplifying index‑level returns. - Industrials

Industrials benefited from onshoring, infrastructure spending, and defense outlays, which sustained order books even as broader growth cooled. Efficiency gains from automation and pricing power in select niches supported margins in a still‑decent nominal GDP environment.

Middle‑of‑the‑road sectors

- Financials

Banks and insurers gained as credit quality remained benign in a soft‑landing scenario and the yield curve slowly normalized with gradual Fed cuts. Higher structural rates supported net interest income, even as fee businesses stayed sensitive to deal and market volumes. - Utilities

Utilities delivered solid returns as rate volatility eased and investors rewarded stable dividends in a world where long‑term yields stayed elevated but off their peaks. Growing investment in grid modernization and renewables added a secular growth angle to this traditionally defensive group. - Health Care

Health care participated in the rally as procedure volumes normalized and innovation in drugs and medical technology continued. However, ongoing policy and pricing overhangs, plus competition from higher‑beta growth sectors, kept returns closer to the index.deloitte+1 - Materials (7.80%)

Materials lagged the market’s leaders but still posted gains as industrial activity and infrastructure spending offset softer global manufacturing and China‑related demand. Producer‑price disinflation limited pricing power, restraining earnings leverage to volumes. - Consumer Discretionary

Discretionary stocks rose modestly as a still‑healthy labor market supported spending, but high rates and fading excess savings pressured big‑ticket and lower‑income‑focused segments. Leadership remained concentrated in a few dominant brands with strong balance sheets and pricing power.

Laggard sectors

- Energy

Energy underperformed as oil prices traded in a range amid adequate supply and only moderate global growth. Capital‑discipline and shareholder‑return policies supported cash flow, but absent a stronger commodity tailwind, multiples compressed from prior years’ highs. - Real Estate

Real estate struggled with elevated long‑term yields and tighter financing conditions that pressured valuations, particularly in office and weaker retail segments. Pockets of strength in data centers and logistics were not enough to offset broad headwinds from refinancing risk and slower rent growth. - Consumer Staples

Staples lagged as investors rotated toward cyclicals and growth after several years of defensive outperformance. Slowing volume growth, waning pricing power as inflation cooled, and rich starting valuations weighed on this typically resilient group.

Outlook

Looking ahead, a constructive backdrop of moderate growth, easing but positive real yields, and broadening earnings contributions suggests that diversified exposure across growth leaders, cyclicals, and select defensives can still reward patient investors. While leadership may gradually rotate away from the narrow AI complex, the combination of resilient fundamentals and a disciplined Fed continues to support a favorable long‑term case for U.S. equities.