July 24, 2025

S&P futures up 0.1% in Thursday morning trading, following another record close for the S&P and Nasdaq on Wednesday. Strength came from AI power, med-tech, credit cards, chemicals, airlines, building products, and apparel. Asian markets were higher with Japan up 1.5%, and Europe is rallying ~0.7%. Treasuries are steady despite a backup in European yields. Dollar index +0.1%, gold -0.9%, Bitcoin futures +0.6%, and WTI crude +1.3%.

Earnings remain the key focus, especially after mixed early results from the Mag 7. GOOGL rose on AI-driven strength and higher capex, while TSLA struggled with weak EV demand despite Musk’s pivot to AI/robotics. Broader sentiment is bullish, underpinned by U.S. macro resilience, expected near-term Fed easing, low volatility, solid corporate margins, and reduced trade uncertainty.

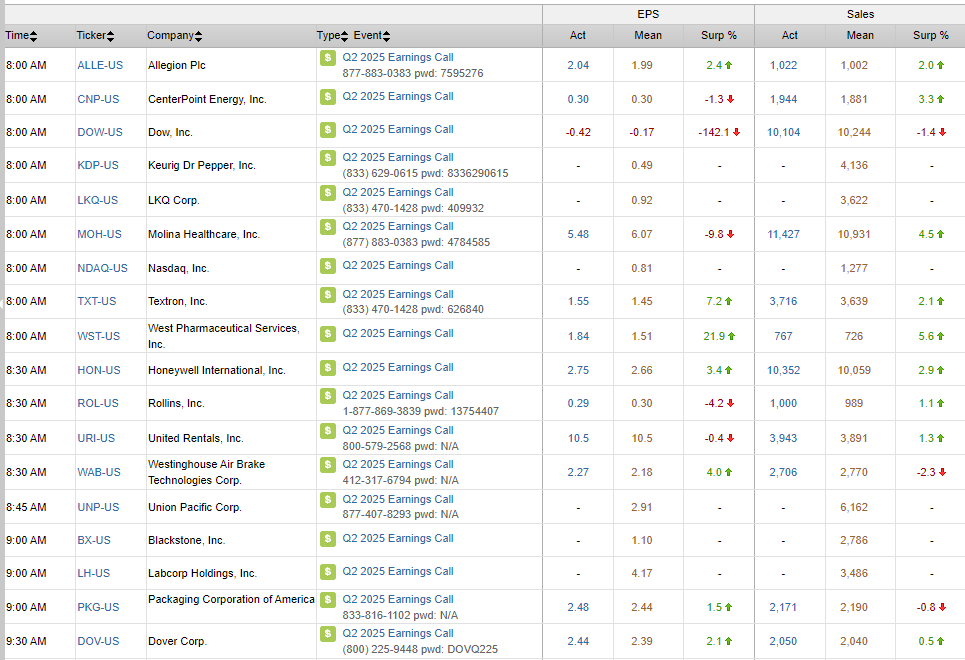

Earnings highlights:

- GOOGL: Strong AI narrative, capex up.

- TSLA: Weighed down by soft EV sales and credit environment.

- TMUS, NOW, URI: Beat and raised guidance.

- IBM, CMG, LUV, MAT, MOH: Missed or lowered guidance.

- ORLY, CSX, LVS, ICLR: Mixed takeaways, operational strengths in focus.

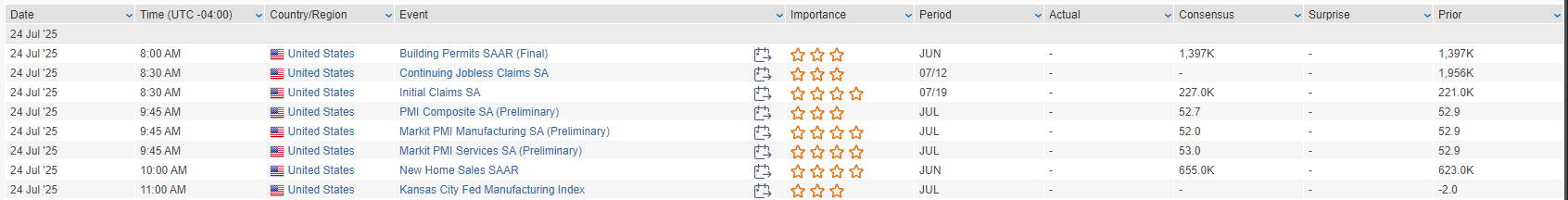

Macro calendar today includes initial jobless claims (expected +230K), July flash PMIs (manufacturing seen dipping, services improving), and June new home sales (seen +4.3% m/m). Friday features June durable goods (expected -10.8%) and core capital goods (+0.2%). Markets looking ahead to next week’s FOMC decision and the 1-Aug reciprocal tariff deadline.

U.S. equities closed higher Wednesday (Dow +1.14%, S&P 500 +0.78%, Nasdaq +0.61% , Russell 2000 +1.53%) with the S&P 500 and Nasdaq notching fresh all-time highs. Gains were driven by value rotation, strength in industrials and healthcare, and optimism around trade policy. A low-volatility backdrop and continued retail participation (including meme names) supported flows. Treasuries weakened slightly with front-end yields up 5–6 bp and the curve flattening. The 20-year bond auction was strong. Dollar index slipped 0.2%. Gold fell 1.3%. Copper rose 1.7%. WTI crude dipped 0.1%, and Bitcoin futures lost 0.7%.

On the policy front, the U.S. announced a trade deal with Japan lowering auto tariffs to 15% from the threatened 25%. Reports also suggest a similar U.S.-EU deal is near, averting steeper tariffs on goods like autos, spirits, and aircraft. The U.S.-China 12-Aug deadline may be extended as both sides prepare to meet in Stockholm. Canadian PM Carney warned he won’t accept a bad deal, adding complexity.

June existing home sales came in at 3.93M SAAR vs. consensus 4.005M, citing tight supply and high mortgage rates. Remaining week data includes initial claims, flash PMIs, new home sales (Thursday), and durable goods (Friday). Fed is in blackout before the July FOMC meeting, where no change is expected; however, dissent risk (Waller, Bowman) remains. Markets are pricing in ~45 bp of easing for 2025.

Sector Performance:

- Outperformers: Healthcare +2.03%, Industrials +1.75%, Energy +1.54%

- Underperformers: Utilities -0.79%, Consumer Staples +0.07%, Materials +0.10%, Real Estate +0.18%, Communication Services +0.28%, Consumer Discretionary +0.41%, Financials +0.72%, Technology +0.74%

Information Technology (XLK):

- TXN -13.3%: Q2 beat but mixed Q3 guide. Tariff-related pull-ins, soft auto, and cautious tone weighed.

- SAP -5.1%: Cloud strength noted, but FY25 guide unchanged; macro and deal-cycle elongation flagged.

- PEGA +13.9%: Q2 beat on ACV and FCF; strong SaaS momentum.

- MANH +7.4%: Cloud and services growth drove beat; FY guide raised.

- U -2.4%: Downgraded on valuation; AI advertising benefit seen overstated.

- SHOP -1.2%: Downgraded; valuation cited, alongside competitive threats.

Health Care (XLV):

- TMO +9.1%, BSX +4.5%: Broad-based beats; organic growth strong. BSX highlighted electrophysiology momentum.

- ENPH -14.2%: Q3 guidance missed; TAM expected to shrink 20% by 2026.

- FI -13.8%: Raised low-end FY EPS, but cut organic growth view; Canadian acquisition noted.

Industrials (XLI):

- GD +6.5%: Beat with strength in Marine and Tech; backlog hit $104B.

- LII +6.6%: Q2 beat; record margins in HVAC segment.

- CNI -4.1%: Lowered FY guide citing tariff/macro pressure; downgraded.

- OTIS -12.4%: Revenue miss and organic growth concerns.

- OKLO +9.2%: Announced partnership to expand power solutions for data centers.

Energy (XLE):

- BKR +11.6%: Q2 beat; margin strength in IET segment. Raised FY guide.

- EQT -4.4%: Production and capex strong; FCF missed.

- TLN +8.2%: PJM auction seen as positive for nuclear producers; beat Street expectations.

- CEG also noted as a beneficiary from nuclear market dynamics.

Consumer Staples (XLP):

- HSY: Raised prices to offset rising cocoa costs.

- CALM +13.8%: Beat on avian flu-related egg supply shortages.

- LW +16.3%: Strong Q4 beat; targeted $250M cost savings by 2028.

Consumer Discretionary (XLY):

- HLT -2.6%: Beat, but RevPAR and guidance underwhelmed.

- MCD, KO, PEP: Previously noted on pricing shifts tied to ingredient costs and trade changes.

Financials (XLF):

- COF +7.9%: Positive commentary despite acquisition-related integration costs.

- FI -13.8%: Organic growth pressured despite EPS beat and M&A update.

- CB -3.1%: Beat but flagged softening P&C pricing trends.

- NTRS -1.8%: Rumored deal interest cooled after reaffirmed strategic independence.

Utilities (XLU):

- CEG, TLN: Boosted by stronger-than-expected PJM nuclear auction results.

- Sector overall was the weakest performer at -0.79%.

Eco Data Releases | Thursday July 24th, 2025

S&P 500 Constituent Earnings Announcements | Thursday July 24th, 2025

Data sourced from FactSet Research Systems Inc.