ETF Insights | February 1, 2025 | Comm. Services Sector

S&P 500 Comm. Services Sector Price Action & Performance

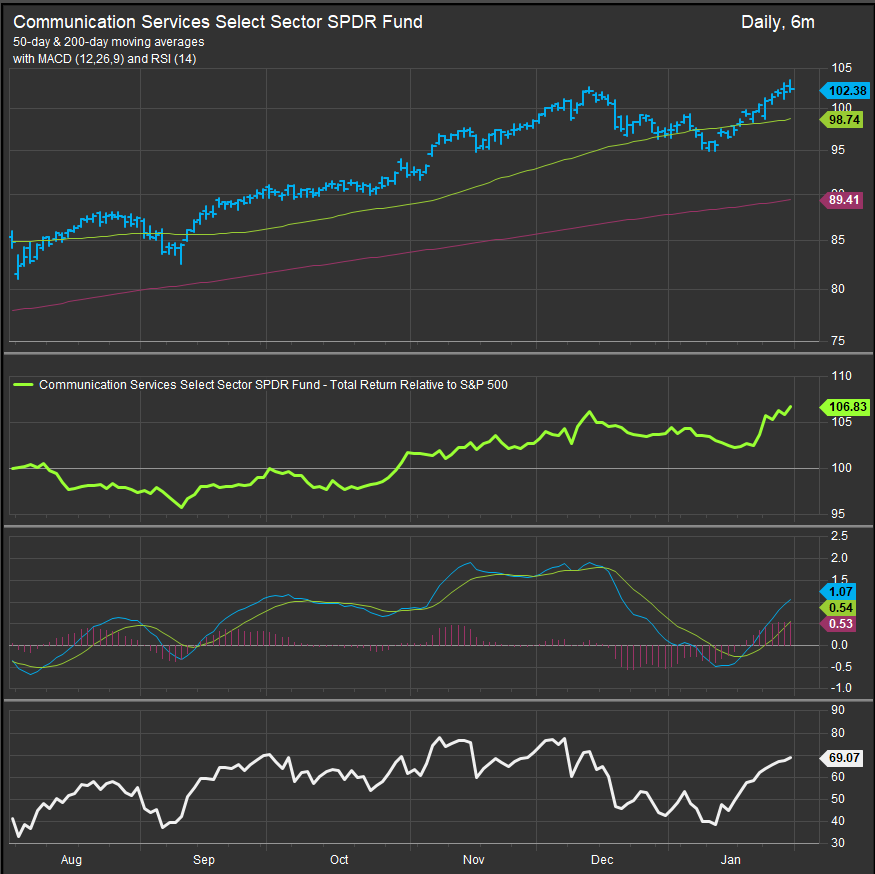

The Comm. Services Sector has been a top performer since mid-September of 2024. The chart of the XLC below shows prices breaking out to new highs. Oscillator work shows the MACD study on a buy signal while RSI is just shy of an overbought reading. The latter would be of some concern, but this is one of the few sectors that is in an uptrend, and oscillators can stay overbought for sustained periods when that is the case.

S&P 500 Comm. Services Sector: Industry Performance Trends

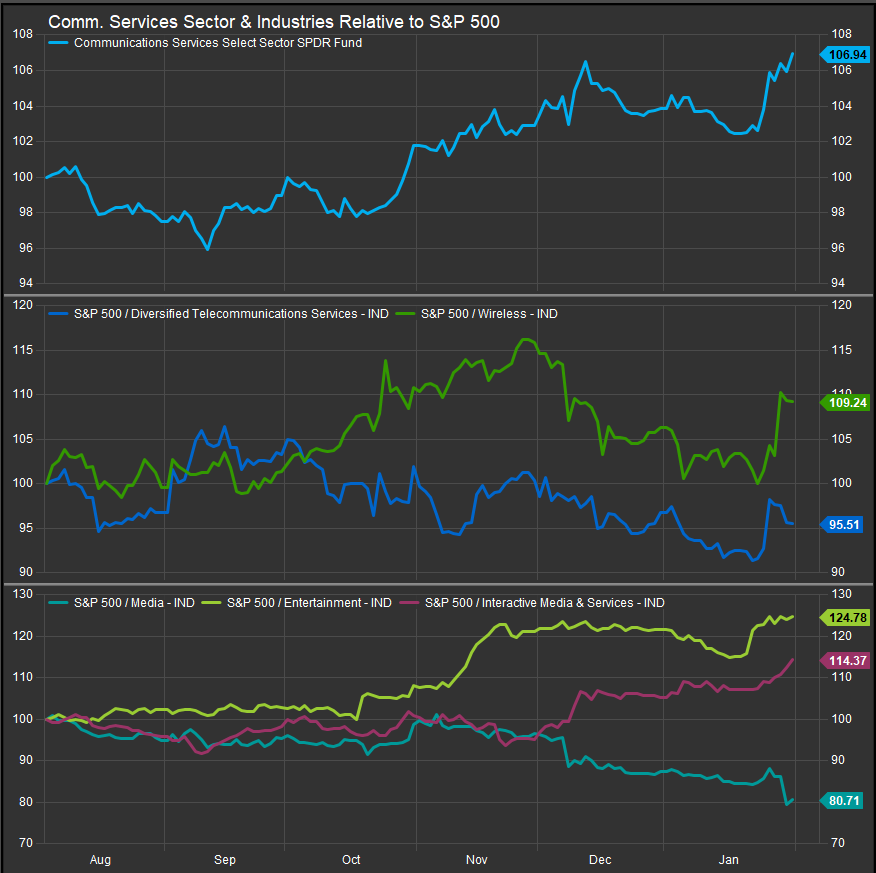

Entertainment, Interactive Media and Wireless industries drove gains in the sector. Wireless is just one stock (TMUS). Diversified Telecom has held up better than expected and contributed positively in January. The Media industry is going through a post-election hangover which part of its long-term seasonal pattern. Interactive Media is where the Cap. is, and those stocks (META, GOOG/L) had a strong earnings season.

S&P 500 Comm. Services Sector Breadth

The Comm. Services Sector breadth measures have recovered nicely since bottoming out in mid-January. Historically the sector is carried by its Mega Cap. constituents, but this year legacy industries made some positive contributions to performance early in the year. Media stocks are being faded in the near-term, but unlike Financials or Industrials, this sector doesn’t need 80-90% upside participation to outperform.

S&P 500 Comm. Services Sector Top 10 Stock Performers

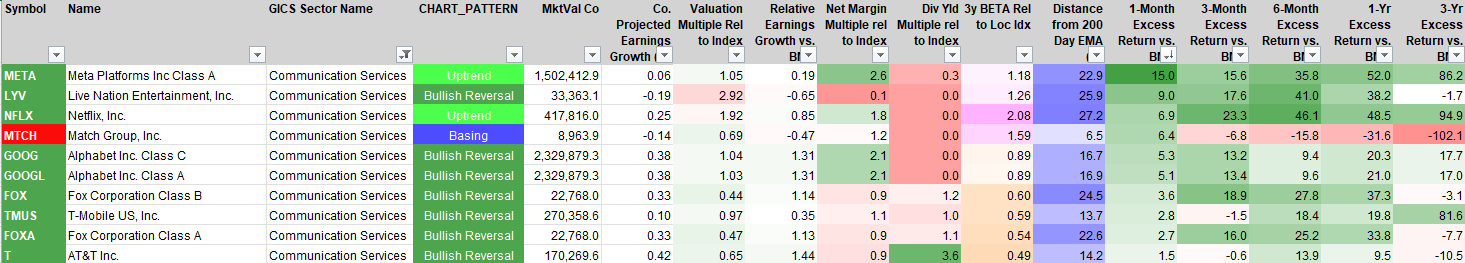

Long-term winners led in January, while T is a positive surprise outperforming the S&P 500 by almost 10% over the past 12 months.

S&P 500 Comm. Services Sector Bottom 10 Stock Performers

Mainly down and out stocks on this list. CMCSA and VZ have been structural laggards, same with legacy advertizers IPG and OMC. TTWO, WBD and DIS are still in bullish reversal price structures despite the month’s pullback.

S&P 500 Comm. Services Sector Fundamentals

The chart below shows S&P 500 Comm. Services Sector Margin, Debt/EBITDA, Valuation and Earnings. Like many other sectors, we are seeing some margin compression. FY1 valuations are getting rich as earnings are projected to dip that year, while FY2 consensus earnings projections remain strong.

Economic and Policy Developments

The S&P 500 Communication Services sector experienced a mixed January as strong digital ad revenue growth clashed with policy uncertainty and macroeconomic headwinds. While AI-powered advertising fueled gains for major platforms, regulatory scrutiny over privacy, content moderation, and spectrum allocation added to investor concerns.

Earnings were a key driver of performance. Meta (META) delivered a standout Q4, reporting a 21% year-over-year increase in ad revenue, benefiting from AI-enhanced ad targeting and a resurgence in ad spending. Charter Communications (CHTR) beat expectations on video net adds, attributing gains to strategic pricing adjustments. Conversely, Comcast (CMCSA) struggled with weaker broadband and wireless net additions, reflecting softer consumer demand and heightened competition from fiber and fixed wireless providers.

Digital ad pricing trends remained favorable, with companies leveraging AI for improved targeting. Meta and Alphabet (GOOGL) reported stable ad demand, with analysts noting resilience in key verticals like e-commerce and travel. However, smaller platforms and ad-supported streaming services faced tougher conditions, with Amazon (AMZN) scaling back investment in original programming for Prime Video in favor of sports content and third-party licensing deals.

Regulatory risks weighed on sentiment, particularly around data privacy and content moderation. In Washington, lawmakers pushed forward potential federal privacy legislation that could restrict data collection practices critical to targeted advertising. Analysts noted that if passed, stricter consumer data protections could impact platforms reliant on behavioral targeting, reducing ad efficiency and revenue per user. Meanwhile, content moderation policies remained contentious, with lawmakers debating platform liability protections ahead of the 2024 election.

The telecom segment faced its own set of challenges. While spectrum auctions are historically crucial for network expansion, delays in new auctions and uncertainty around future allocations created uncertainty for wireless carriers like Verizon (VZ) and AT&T (T). Additionally, the Biden administration’s broadband expansion initiatives faced pushback, as telecom companies raised concerns over pricing regulations and rural deployment costs.

February Outlook

Looking ahead, February will focus on ad spending trends, potential progress on privacy regulations, and the impact of tariffs on communication hardware. Investors will monitor Alphabet’s earnings for further ad demand insights, Disney’s (DIS) performance in streaming and media, and any updates on spectrum policy affecting telecom providers. While AI-driven advertising remains a growth driver, regulatory risks and intensifying competition will continue shaping the sector’s trajectory.

In Conclusion

The Comm. Services continued to exhibit strong technical and fundamental characteristics in January. We start February with the Comm. Services Sector as an overweight position of +5.11% vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.