ETF Insights | January 1, 2025 | Comm. Services Sector

S&P 500 Comm. Services Sector Price Action & Performance

The Comm. Services Sector enters 2025 setup for accumulation after a year-end correction alleviated near term overbought conditions. The typical caveats around continued rising rates and other exogenous bearish developments do apply, but US equities have seen broad selling during the final weeks of 2024, and we expect institutional market participants to come back from their vacations in a mood to accumulate the year-end selling. The steady upward move in rates cracked in the last trading days of 2024 and we expect the bull trend to continue.

The price chart below for the XLC SPDR shows oscillator studies (panel 3 & 4) at uptrend oversold levels as price has retraced to the 50-day moving average. Relative performance stabilized vs. the index into the last days of the year as selling broadened out across sectors. At present, we view this as an accumulation opportunity.

S&P 500 Comm. Services Sector: Industry Performance Trends

Entertainment, Interactive Media and Wireless industries drove gains in the sector. Wireless is just one stock (TMUS). Diversified Telecom held up surprisingly well in 2024.

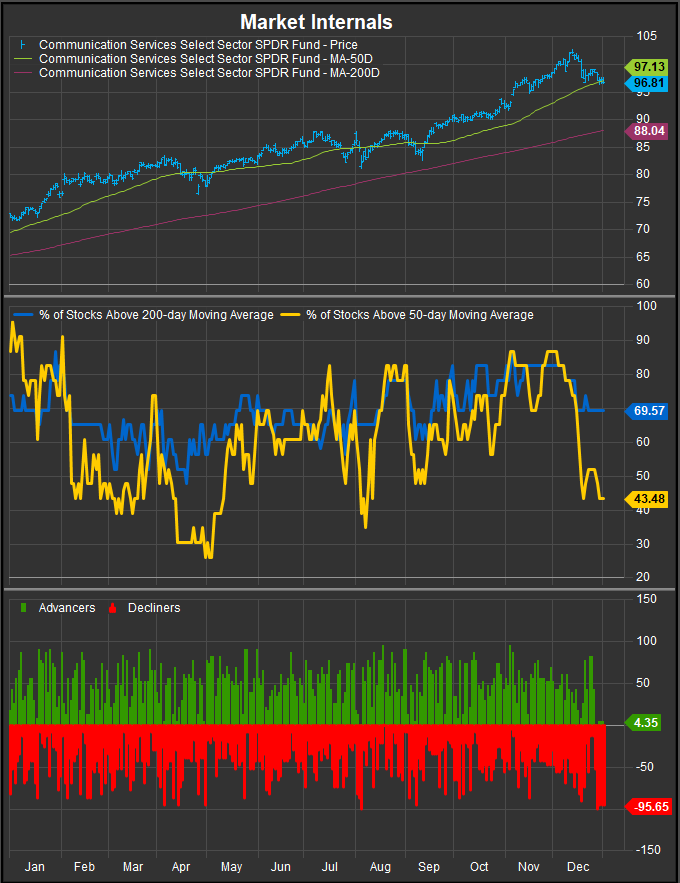

S&P 500 Comm. Services Sector Breadth

The Comm. Services Sector breadth has shown a less extreme dislocation in stocks trading below their 50-day moving average, but it is still a notable spread. As we’ve mentioned, we expect this near-term weakness to be accumulated, but it will be a somewhat bearish signal if it is not.

S&P 500 Comm. Services Sector Top 10 Stock Performers

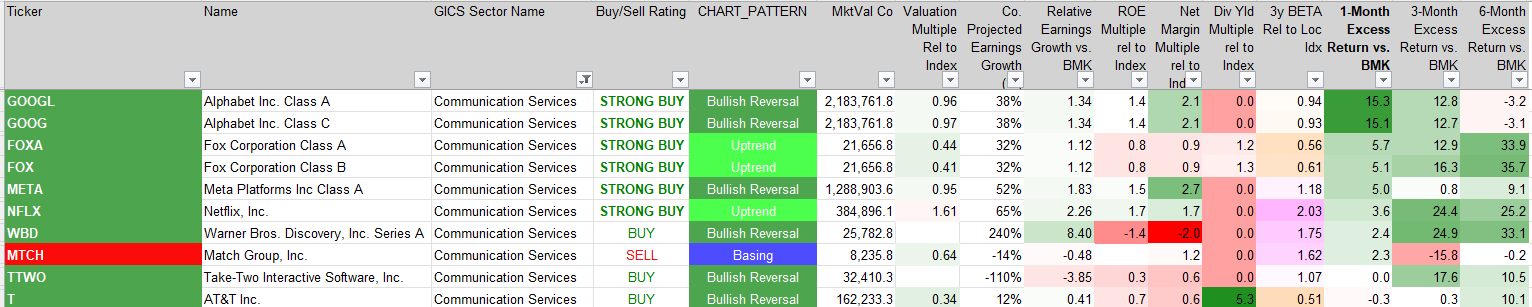

Mega Cap. stalwarts Alphabet, Meta and Netflix continued their strong performances while legacy media and telecom names also made the list. Stock level technicals remain strong for the sector.

S&P 500 Comm. Services Sector Bottom 10 Stock Performers

Legacy advertising and media companies make up the bottom of the list for Comm services. Disney’s bullish reversal is under pressure. TMUS is a potential accumulation opportunity after a >8% pull back.

S&P 500 Comm. Services Sector Fundamentals

The chart below shows S&P 500 Comm. Services Sector FCF yield, and Dividend Yield as well as projected earnings over the next 3 years, valuation and trailing margins. Steadily contracting margins over the past 3 years may eventually become a concern, but consensus eps projections remain favorable for the sector while valuation persists as a premium

Economic and Policy Developments

Regulatory developments around FCC oversight, privacy protections, and spectrum allocation played a significant role in shaping the outlook for the Communication Services sector. The FCC continues to focus on expanding broadband access, with reports of new initiatives targeting underserved rural areas. This aligns with government infrastructure priorities and could benefit telecom providers like AT&T, Verizon, and T-Mobile (TMUS), which are well-positioned to secure federal funding for broadband expansion.

Privacy regulations remain a pressing issue for digital advertising and internet platform companies. The Biden administration, and potentially a Trump 2.0 administration, have floated proposals for stricter consumer data protection laws, which could impact the ad-driven revenue models of companies like Alphabet and Meta. Any changes in privacy frameworks, particularly around third-party data usage, would require these companies to adapt their advertising strategies, potentially increasing compliance costs.

Spectrum auctions and 5G deployment continued to attract attention. The FCC is expected to finalize additional auctions for mid-band spectrum in 2025, which could enhance network capacity for telecom operators. However, competition for spectrum licenses may raise costs for providers already grappling with elevated capital expenditure requirements. The rollout of 5G infrastructure remains a critical focus, with companies racing to capture market share in next-generation wireless services.

2025 Outlook

The Communication Services has potential growth opportunities in broadband expansion, 5G deployment, and digital advertising. Telecom providers stand to benefit from federal initiatives to bridge the digital divide, though rising costs for spectrum and infrastructure investments may weigh on margins. Cybersecurity remains a critical area of focus, particularly for network operators, as the increasing frequency of attacks like the Salt Typhoon incident highlights vulnerabilities.

For media and digital platforms, consumer spending trends and regulatory developments will be pivotal. While Alphabet and Meta are well-positioned to leverage AI advancements for targeted advertising, evolving privacy laws could disrupt traditional ad models. Streaming platforms like Netflix and Disney+ must navigate slowing subscriber growth and intensifying competition by focusing on content differentiation and international expansion.

Spectrum auctions and the continued rollout of 5G will dominate telecom headlines in 2025, offering growth potential but also introducing risks tied to high auction costs and deployment challenges. Companies that effectively balance these investments with cost control and revenue diversification stand to outperform.

Overall, while uncertainties remain, particularly around regulation and macroeconomic conditions, the sector’s underlying growth drivers—connectivity, digital engagement, and advertising innovation—are likely to sustain positive momentum in the medium to long term.

In Conclusion

The Comm. Services sector ended 2024 in a strong technical position. Fundamental upside remains when considering consensus forward earnings, and rising rates have potentially hit an inflection point. We start 2025 with the Comm. Services Sector as an overweight position of +2.77% vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.