ETF Insights| December 1, 2024 | Communications Services Sector

Price Action & Performance

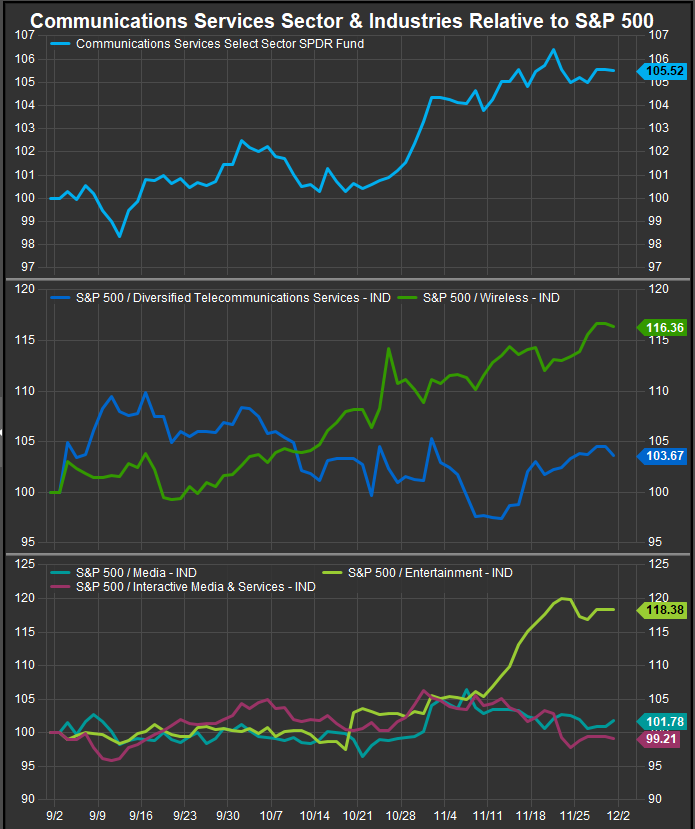

The Communications Services Sector maintained its strong outperformance trend through November despite regulatory challenges to Alphabet Corp. Legacy industries like Media and Entertainment posted strong gains and Diversified and Wireless Telecom industries also added to positive performance.

In aggregate the Comm. Services Sector starts off December in a strong position with broad upside participation across industries and at the stock level. Concerns include developing overbought conditions and potential for increased regulatory scrutiny, but Comm. Services stocks have been a persistent part of the bull market leadership cohort and we don’t see that changing for December based on our inputs.

At the industry level, legacy telecom outperformance has faded, while Wireless, Entertainment and Interactive Media Industries outperformed in October. On the downside, Media has continued to be a laggard but has improved slightly over the past 3-months on performance.

At the stocks level, META, GOOG/L and NFLX continue to be favored exposures, but they have been joined by T, TMUS, FOX.A, and NEWS.A which has helped push the sector to new relative highs. GOOG/L is now under pressure from US anti-trust actions, but post-election enthusiasm as buoyed other areas of the sector.

Economic and Policy Drivers

Positive macroeconomic factors, such as resilient consumer spending and a solid labor market, also contributed to the sector’s strength, as demand for digital communication platforms and media services remained robust. The sector additionally gained from corporate investments in artificial intelligence (AI) and cloud computing, particularly in areas such as content personalization, advertising efficiency, and infrastructure optimization. Key players in the sector, including Alphabet and Meta, experienced gains amid rising optimism about their AI-driven ad platforms and cloud services, while Netflix benefited from strong content releases driving subscriber growth.

Looking ahead to December, the outlook for the Communication Services sector remains constructive but includes nuanced challenges. Continued adoption of AI is expected to drive demand for data-intensive communication services, supporting further expansion in cloud computing and digital advertising. Strategic initiatives, such as potential acquisitions and partnerships, could further enhance competitive positioning among leading firms. However, the sector faces headwinds from an evolving regulatory landscape, including increased antitrust scrutiny on large tech firms such as Alphabet and Meta, as well as global concerns over data privacy and content moderation. Supply chain constraints in hardware infrastructure, driven by geopolitical tensions and semiconductor shortages, also pose risks to service deployment timelines. Despite these challenges, the sector’s growth prospects are bolstered by sustained innovation and rising consumer engagement with digital platforms, positioning it for continued gains into the new year.

In Conclusion

We like the technical setup for XLC heading into December though we have pared our long exposure slightly due to the presence of overbought conditions. The Elev8 Sector Rotation Model recommends an OVERWEIGHT position in XLC of +2.76% vs. the benchmark S&P 500 for December 2024.

Chart | XLC Technicals

- XLC 12-month, daily price (200-day m.a. | Relative to SPX | MACD | RSI )

- Trend structure is strong with our only concern being near-term overbought conditions after 3 strong months of outperformance

XLC Relative Performance | XLC Industry Relative Performance | 3-Months

Data sourced from FactSet Research Systems Inc.