ETF Insights | February 1, 2025 | Consumer Discretionary Sector

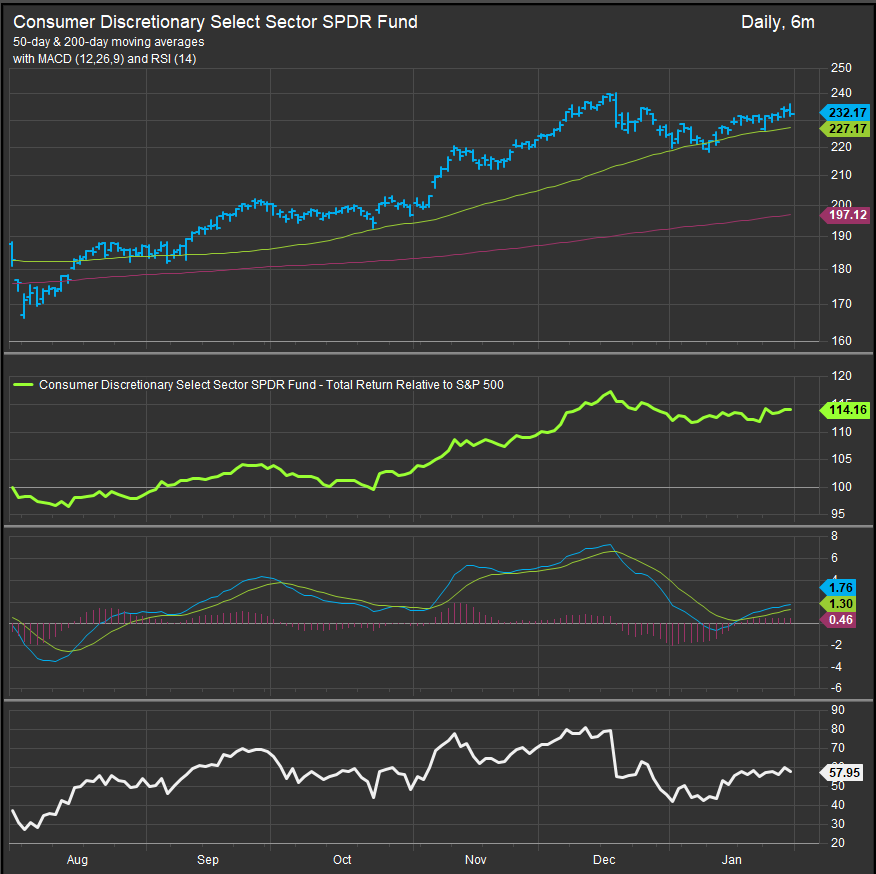

S&P 500 Discretionary Sector Price Action & Performance

Discretionary stocks rebounded from a weak December, posting strong returns for January despite some inflation agita hitting the tape. With pressure coming off interest rates in the near-term, we are back to a bullish stance on the Consumer. The chart below shows price supported at the 50-day moving average. The MACD oscillator has registered a buy signal, and the RSI study is short of overbought conditions. We like this setup as bullish continuation for Discretionary stocks.

S&P 500 Discretionary Sector: Industry & Sub-Industry Performance Trends

Upside participation remains robust across industries within the Discretionary Sector. Automobile stocks have been consolidating November/December gains while Multi-line retail (AMZN, EBAY) drives outperformance in the near-term. Textile and Apparel stocks (ex-NKE) have been a strength along with Cruise lines, and Hotels. Auto Components remain weak along with Household Durables and Leisure Products.

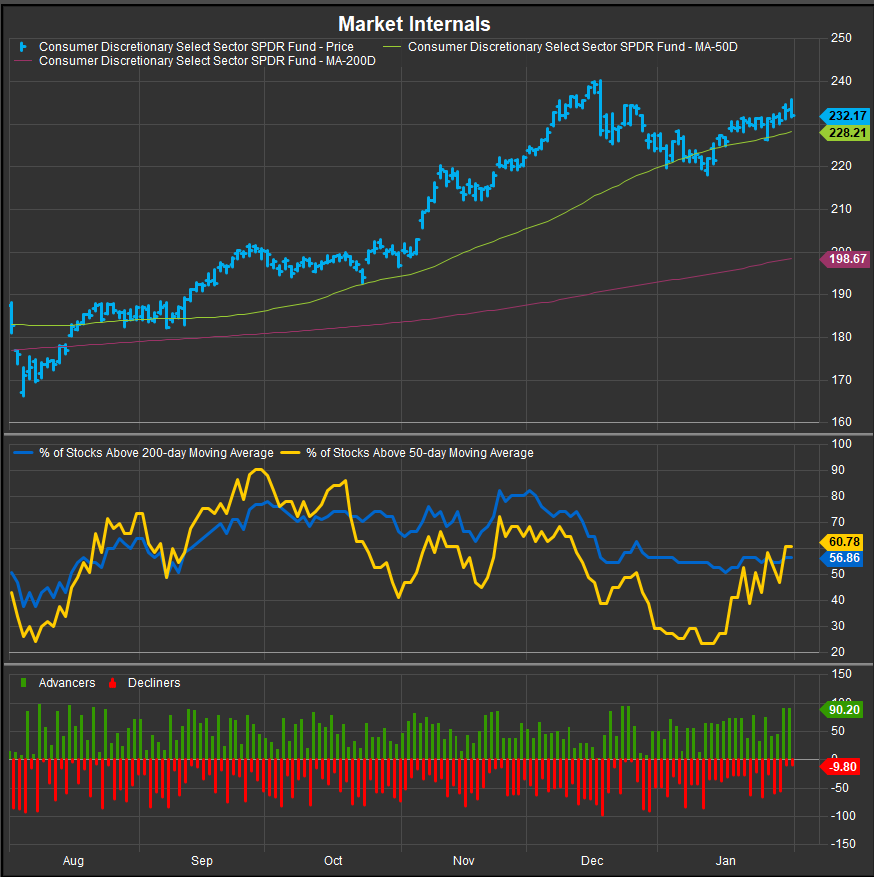

S&P 500 Discretionary Sector Breadth

Internal strength is on the upswing for the sector. Only a slight majority of stocks are above their 200-day moving averages, but AMZN and TSLA, as mega cap. anchor stocks for the sector have been drivers of outperformance despite a number of stocks (auto components, home retail, durables) struggling for upside in over the past several months.

January finished with two consecutive 90% “up” days for the sector. This is typically bullish internal behavior.

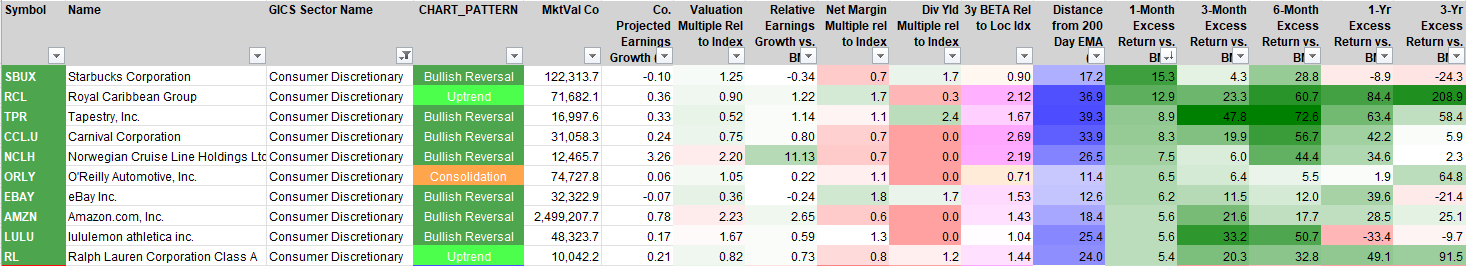

S&P 500 Discretionary Sector Top 10 Stock Performers

We upgraded SBUX as it is now in a bullish reversal pattern after a 15% January gain. AMZN, RL, LULU and Cruise lines were other top performers. NCLH projects to grow earnings 11X faster than the S&P 500 over the next 12 months based on consensus estimates. That surprised us.

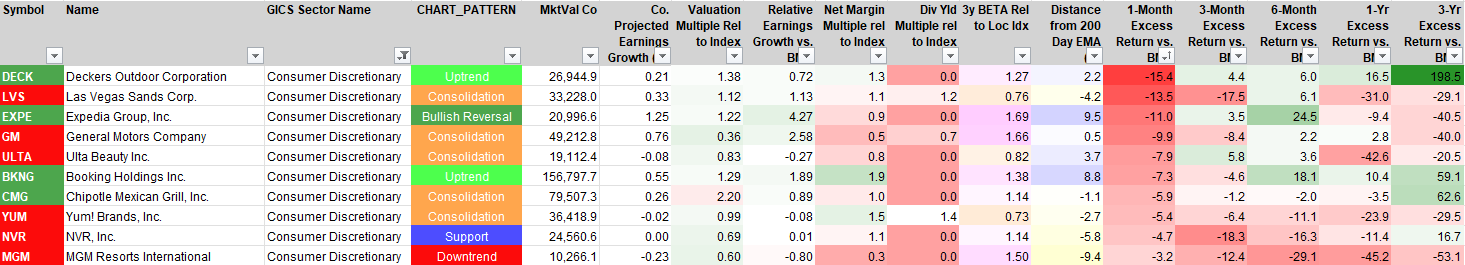

S&P 500 Discretionary Sector Bottom 10 Stock Performers

DECK was the biggest decliner in January, though it remains a strong chart over the longer-term. BKNG had a setback, but we like the potential for accumulation there. Casinos have been very weak.

S&P 500 Discretionary Sector Fundamentals

The chart below shows S&P 500 Discretionary Sector with Margins, Debt/EBITDA, Valuation and Earnings. Forward EPS projections have risen steadily throughout the year along with valuation. A slight regression in margins is something to keep an eye on.

Economic and Policy Developments

The consumer discretionary sector navigated a mix of strong consumer spending, policy uncertainty, and inflationary pressures in January. Q4 GDP grew 2.3%, driven by a robust 4.2% annualized increase in consumer spending, while core PCE inflation remained at 2.8%, suggesting potential delays in Fed rate cuts. The labor market remained solid, with jobless claims falling to 207K, though housing market weakness emerged as December pending home sales dropped 5.5%.

Trump’s renewed tariff threats on Canada, Mexico, and China raised concerns for automakers and retailers, particularly regarding cost inflation for steel, aluminum, and auto components. Discussions about potential e-commerce taxes also signaled regulatory shifts that could impact online retailers.

Earnings were mixed. Tesla (TSLA) rose 2.8% despite an EPS miss, as investors focused on cost-cutting and new model launches. Visa (V) gained 5.3% after noting an acceleration in U.S. spending trends, while Starbucks (SBUX) jumped 8.1% on better-than-expected revenue and customer engagement initiatives. Deckers (DECK) dropped 20.5% on weaker Q1 guidance, while Boot Barn (BOOT) fell 7.8% amid signs of softening discretionary demand. Charter (CHTR) rose 2.6% as video subscriber losses were less severe than feared.

Consumer balance sheets showed mixed signals. Credit card delinquencies inched higher but remained below pre-pandemic levels, while auto loan delinquencies ticked up, raising concerns about big-ticket discretionary spending. Increased promotional activity suggested growing consumer price sensitivity.

2025 Outlook

Looking ahead, February will bring more clarity on trade policy, inflation, and consumer sentiment. Tariff implementation could weigh on retailers and automakers, while the February 12 CPI report will be key for Fed expectations. Major earnings from Home Depot (HD), and Lowe’s (LOW) will provide further insight into Q1 consumer trends. Despite strong spending, the sector faces heightened volatility amid inflation and trade uncertainty

In Conclusion

January demonstrated Consumer resiliency, and a strong earnings season has the Sector in a constructive position for February. We start 2025 with an overweight position of + 3.48% for the Discretionary sector in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.