ETF Insights| December 1, 2024

Price Action & Performance

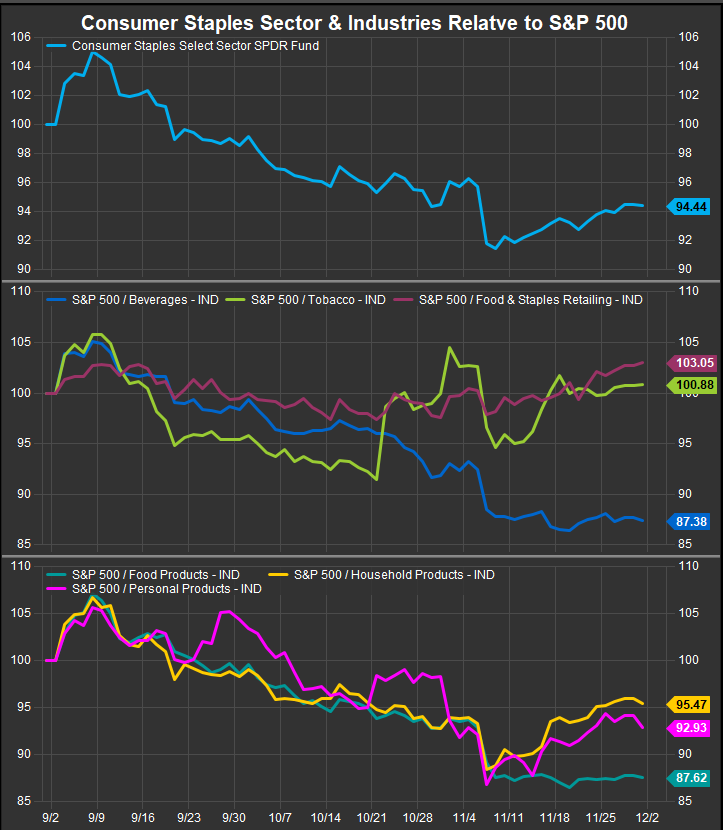

The Consumer Staples sector, like other historically lower vol. sectors, has lagged over the past 3-months relative to broader markets, reflecting its defensive nature and limited upside amid a rally driven by cyclicals and growth names. Until recently, interest rates had been rising too which was a headwind for the Sector. With equities approaching overbought conditions in the near-term, we think there is an increasing likelihood for investors to move into lower vol. stocks.

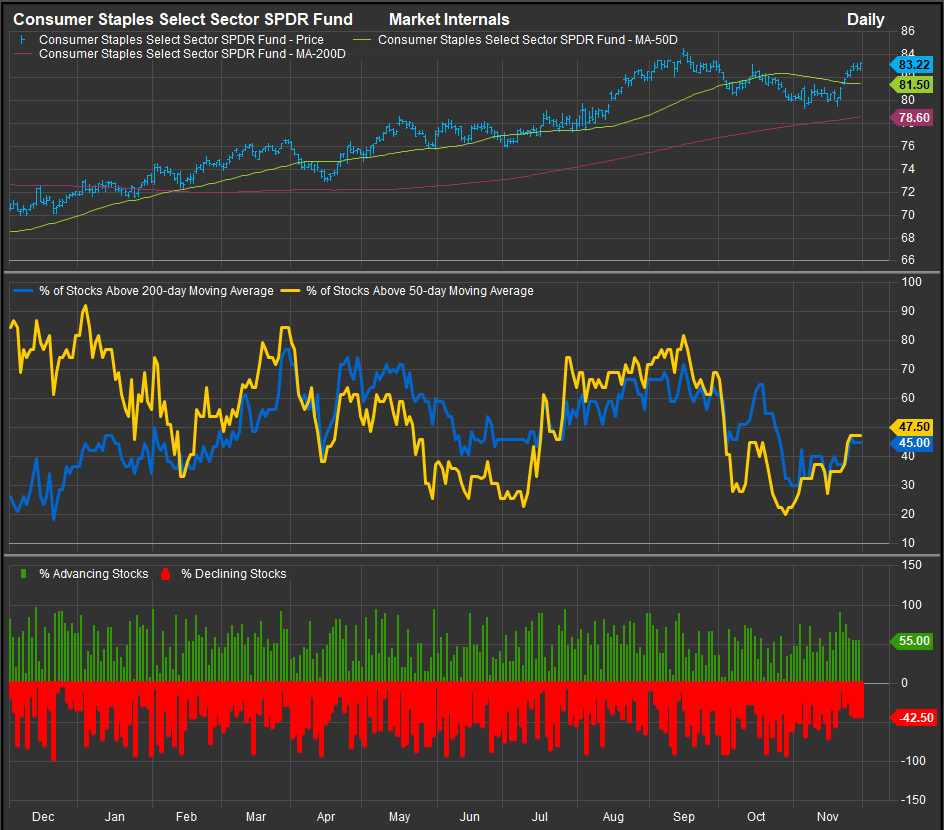

The best thing we can say about the sector’s performance is that it reached washout levels in late October, and we have seen a strong oversold bounce in absolute terms that has taken the price chart of XLP to a marginal new near-term high. Forward potential for outperformance comes from depressed expectations in Beverage, Household and Food Products categories where the stocks have been deeply discounted against the present environment. The percentage of stocks in the XLP below their 50-day moving averages has reached below 20%, which we consider extreme.

At the stock level we aren’t finding many stocks that look like buys in our process. WMT and COST remain the best charts in the sector by a wide margin. KR has etched out a bullish reversal as well. However, Beverage, Household and Food Products stocks are a wasteland of bad charts. We give the benefit of the doubt to PM, MO and KVUE as buy-rated in our work, but most stocks continue to languish in consolidation or outright downtrend even as the S&P 500 bull market continues.

Economic and Policy Drivers

While consumer spending remained stable, benefiting from rising incomes and easing inflation, the Staples Sector faced headwinds from muted pricing power and ongoing promotional activity, particularly during the holiday season. Lower gasoline prices bolstered consumer purchasing power, but much of this gain appeared to flow into discretionary spending rather than staples. Retailers in the space grappled with shrinking margins as consumers increasingly favored private labels and value-driven purchases, a trend exacerbated by the competitive landscape and cautious inventory strategies.

Policy developments added to the mixed outlook for the sector. While the Trump administration’s proposed tax cuts and deregulation were viewed positively for their potential to support disposable incomes and ease compliance costs, the looming threat of tariffs on imports from key trade partners weighed heavily. Companies with exposure to imported raw materials or reliant on global supply chains faced uncertainty, which could translate into higher input costs or supply disruptions. Meanwhile, new sustainability and labeling initiatives signaled potential future regulatory challenges, adding complexity for manufacturers and retailers alike. As a result, the Consumer Staples sector ended the month with a cautious tone, caught between resilient consumer fundamentals and mounting policy and market-driven pressures

While WMT and COST are benefitting from a continued “value seeking” dynamics in the consumer space, most Staples Co.’s are in the business of selling established brands at a price premium. Those companies, whether Clorox, Proctor & Gamble or Coca Cola are seeing consumers trade out for cheaper substitute products. Many of these large brand families are under pressure and it’s hitting the Staples Sector hard in 2024. We are playing for a counter trend move in the near term on technical indications that the bad news is potentially priced in here.

In Conclusion

Weaker inflation and a bullish earnings season have put the XLP in the back seat on performance. However, we’ve reached oversold conditions and we’ve seen a strong bid come in for the sector at the end of November. Our Elev8 Sector Portfolio starts December with an OVERWEIGHT position in XLP of +1.46% vs. the benchmark S&P 500 Index

Chart | XLP Technicals

- XLP 12-month, daily price (200-day m.a. | Relative to S&P 500)

- A strong bounce from a wash-out move in late-October has us playing for a continued bounce in Stales shares

XLP Relative Performance | Industry Level Relative Performance | Trailing 3-months

XLP Internals: % of stocks above their 50-day moving average dipped below 20% in October, our threshold for a contrarian buy signal

Data sourced from FactSet Research Systems Inc.