ETF Insights | February 1, 2025 | Consumer Staples Sector

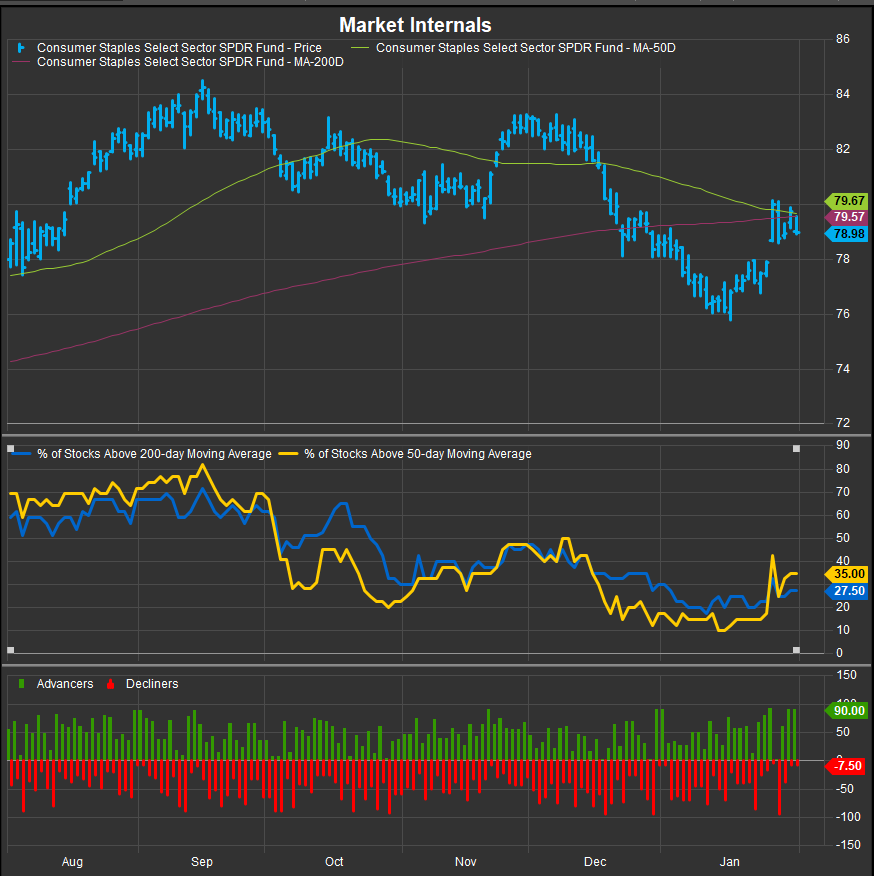

S&P 500 Staples Sector Price Action & Performance

Staples started 2025 deeply oversold but pivoted to the upside mid-month. More work needs to be done to demonstrate a sustainable turnaround. We continue to expect that the path to Staples outperformance involves a top-line equity market correction, and we aren’t expecting that at present. The RSI study is still reading bearish as it is rolling over below overbought levels which indicates weak buying power. The MACD study shows a tactical buy but is still in negative trend territory.

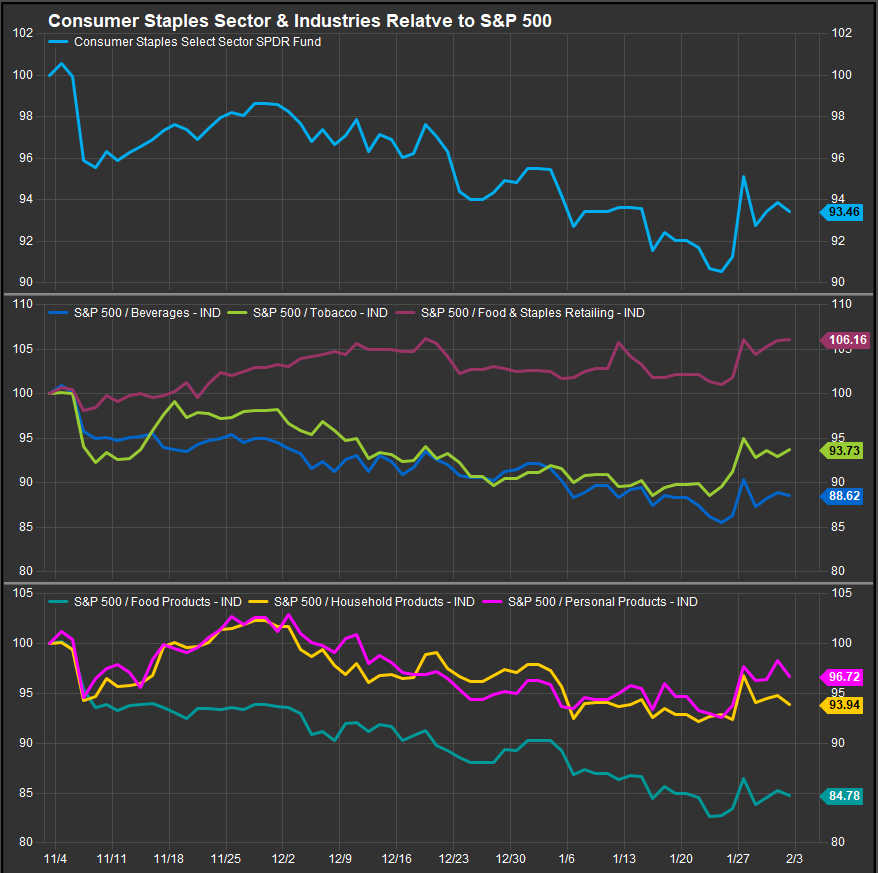

S&P 500 Staples Sector: Industry Performance Trends

Outperformance remains concentrated in just two stocks, COST and WMT. Near-term improvements from the Tobacco and Personal Products industries are improving. We need to see more to get excited.

S&P 500 Staples Sector Breadth

Breadth for the sector improved with price in January. Still just 35% of stocks above their 50-day moving average and a woeful 27% above their 200-day moving average. Strength in heavyweight’s WMT and COST ameliorate this somewhat, but many of the established brands within the sector don’t retain enough goodwill to keep these stocks competitive.

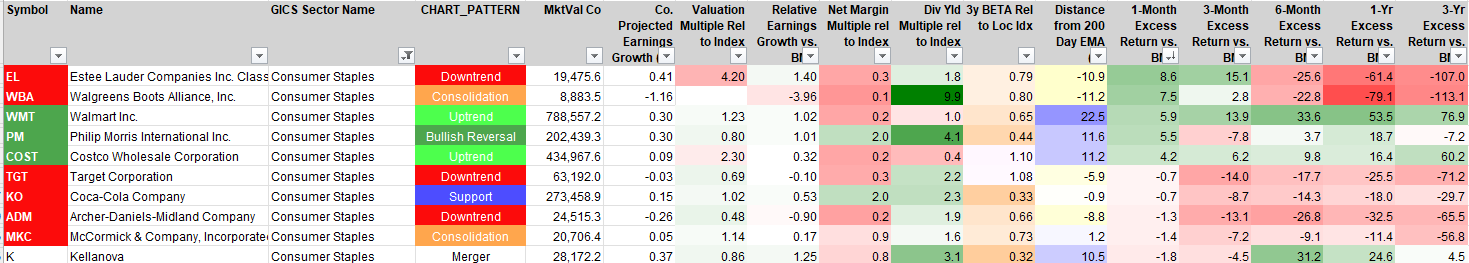

S&P 500 Staples Sector Top 10 Stock Performers

Down and out stocks were the best performers in December with EL and WBA posting the largest monthly gains. WMT and COST continue to be stalwart.

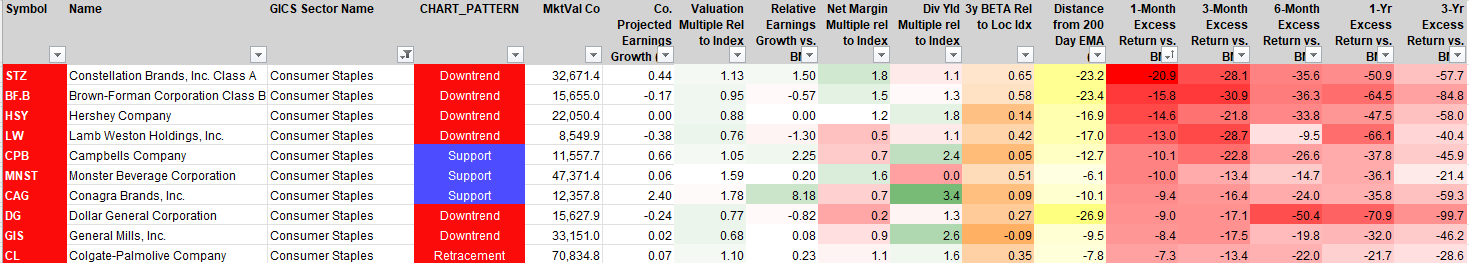

S&P 500 Staples Sector Bottom 10 Stock Performers

Food and Beverage stocks were hit particularly hard for a 2nd month in a row.

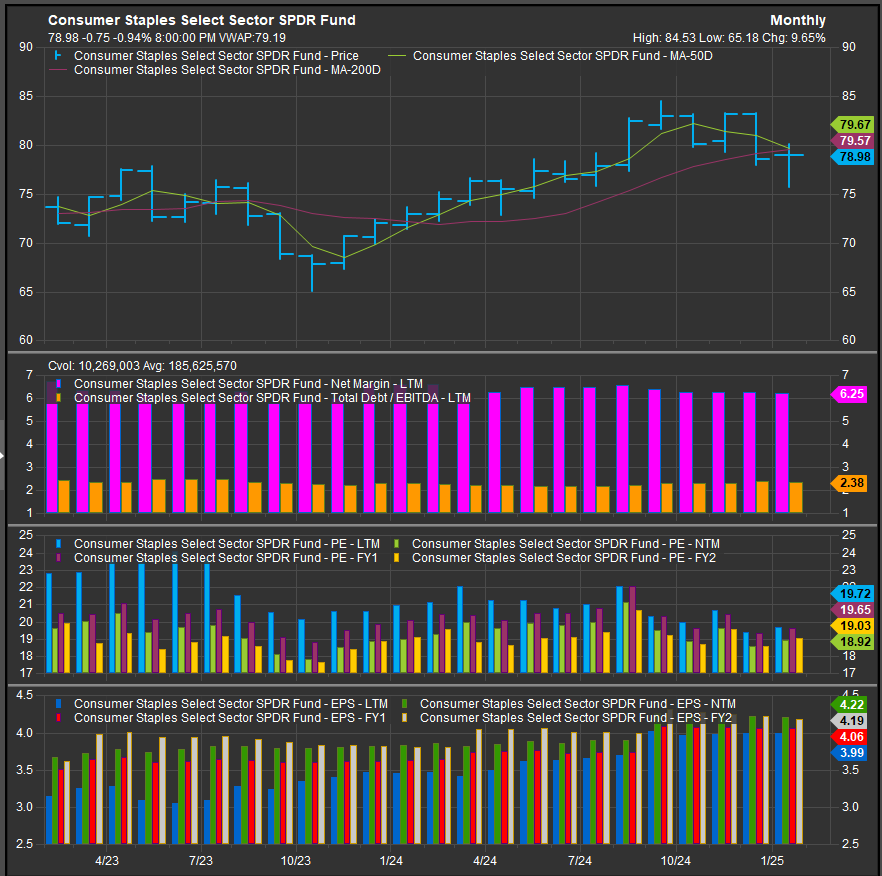

S&P 500 Staples Sector Fundamentals

The chart below shows S&P 500 Staples Sector with Margins, Debt/EBITDA, Valuation and Earnings. Margins ticked lower and debt higher in Q4. However what’s notable here is multiple compression over the past 6-months despite improving forward earnings expectations.

Economic and Policy Developments

The sector benefited from steady consumer demand, even as core PCE inflation held at 2.8% and Q4 GDP showed 4.2% annualized consumer spending growth.

The Federal Reserve left rates unchanged, with Chair Powell signaling that rate cuts would be data-dependent, potentially delayed beyond June. This stance helped staples stocks maintain appeal as investors braced for prolonged tight monetary policy. Trump’s renewed tariff threats on Canada, Mexico, and China raised concerns over supply chain disruptions and cost pressures on food, household products, and beverages. Retailers and packaged goods companies prepared for potential cost inflation in commodities like aluminum, grains, and packaging materials.

Earnings results in the sector were mixed. Colgate-Palmolive (CL) fell 4.6% as Q4 revenue missed estimates due to weaker pet food sales and softness in Europe. However, stronger-than-expected margins helped offset some of the decline. Altria (MO) provided slightly weaker EPS guidance, while Procter & Gamble (PG) and Kimberly-Clark (KMB) reported resilient consumer demand despite rising promotional activity. Costco (COST) and Kroger (KR) saw continued strength in grocery sales, reflecting stable demand for essentials.

The consumer balance sheet remained solid, with jobless claims falling to 207K, though there were signs of increased price sensitivity as discount retailers saw stronger foot traffic. Higher credit card balances and a slight uptick in delinquencies suggested a cautious consumer mindset, leading to increased promotional activity in household and personal care products.

February Outlook

Looking ahead, February will test the sector’s ability to navigate cost pressures and shifting consumer preferences. Upcoming CPI data (Feb. 12) and additional Fed commentary will provide more insight into the inflation trajectory and potential policy shifts. Earnings from Walmart (WMT) and Target (TGT) will be key barometers for Consumer spending trends, while tariff developments could impact cost structures across the supply chain.

Defensive demand should continue to support consumer staples, though margin pressures remain a risk. If inflation proves sticky, staples could see continued relative strength as investors seek stability. However, cost inflation from tariffs and commodities could pressure earnings, making pricing power and cost control critical themes for the sector in Q1.

In Conclusion

Improvement in January wasn’t enough to keep us in the sector for February. Bright spots COST and WMT aren’t enough to overlook a deluge of weakness elsewhere in the sector. We are short low volatility in aggregate, and we start 2025 with an underweight position of -1.02% vs. the S&P 500 for the Staples Sector in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.