Votes have been counted and the US Election has been called for Donald Trump and the Republican ticket. As has been prognosticated, equities show a positive near-term reaction to the results. While it is too early to tell whether this is a symptom of relief that election night passed in an orderly progression with a winner called before most awoke on Wednesday, or whether Donald Trump’s agenda is a boon to equities intrinsically, we want to note the fast movers up and down from a sector perspective now that the results are in.

Small & Mid Cap. Stocks Surge Higher

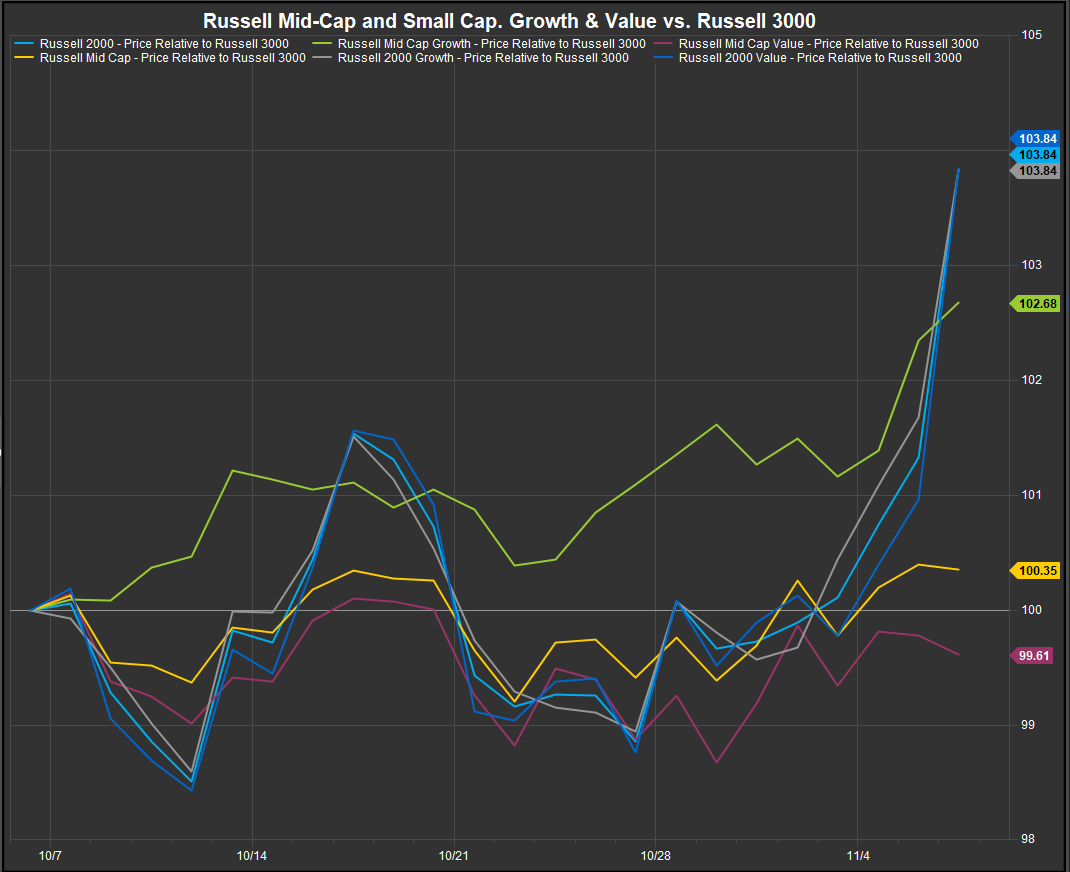

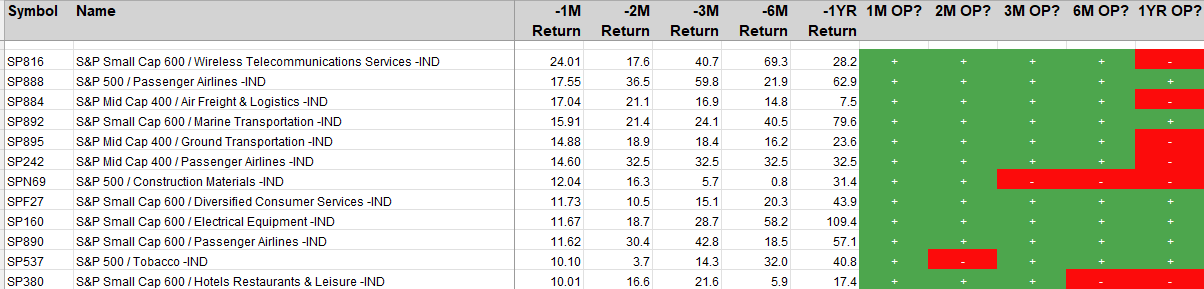

At a high level, the key takeaway is Small Cap. stocks are reacting positively to a Trump Presidency this morning. Airlines and other Transportation stocks are leading the charge, in part because the Trump Administration is seen as unlikely to strictly enforce anit-trust regulations in the Airline Industry and elsewhere. This has investors discounting positive M&A dynamics going forward and benefits potential targets in the Small and Mid Cap. space in the event that we start getting some industry roll-ups. Banks have surged higher as well for a similar reason.

Trailing 1-month performance of Russell Small and Midcap Indices have now outperformed by > 3% this month. Chart below.

6 of the 12 Top Performing GICS Industries this month are Transportation Related

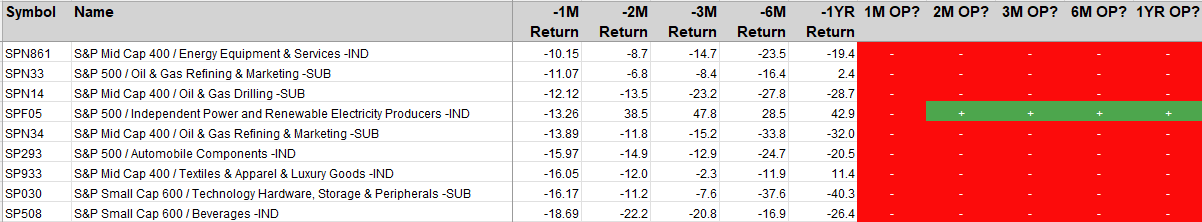

Most Laggard Industries Haven’t Changed Their Stripes, but the Large Cap. Independent and Renewable Power Industry is a new entrant on this list.

Key Takeaways

We think Small Cap. Stocks are likely to work into year-end as bullish election reactions typically last to the new calendar year. We think key pivots remain the forward direction of interest rates (higher today, but very overbought) and the resolution of consolidation in the Philadelphia Semiconductors Index (SOX). If rates stay high and Tech. stays on the sideline, this is a setup for cyclical value to work in the near-term until inflation concerns pop up again.

SOX Index Chart: 5500 is a Key Level for Bullish Reversal

US 10yr Yield Chart: Yields Getting Extended to the Upside?

10yr yield is though the 4.4% level we had been viewing as resistance. Pro-cyclical factors are aligning in the near-term. We wonder when concerns about the reignition of inflation will pop back up, but considering how many in the Financial realm were excited about the prospects of a Trump presidency, we are chalking up rising yields to an increase in risk appetite.

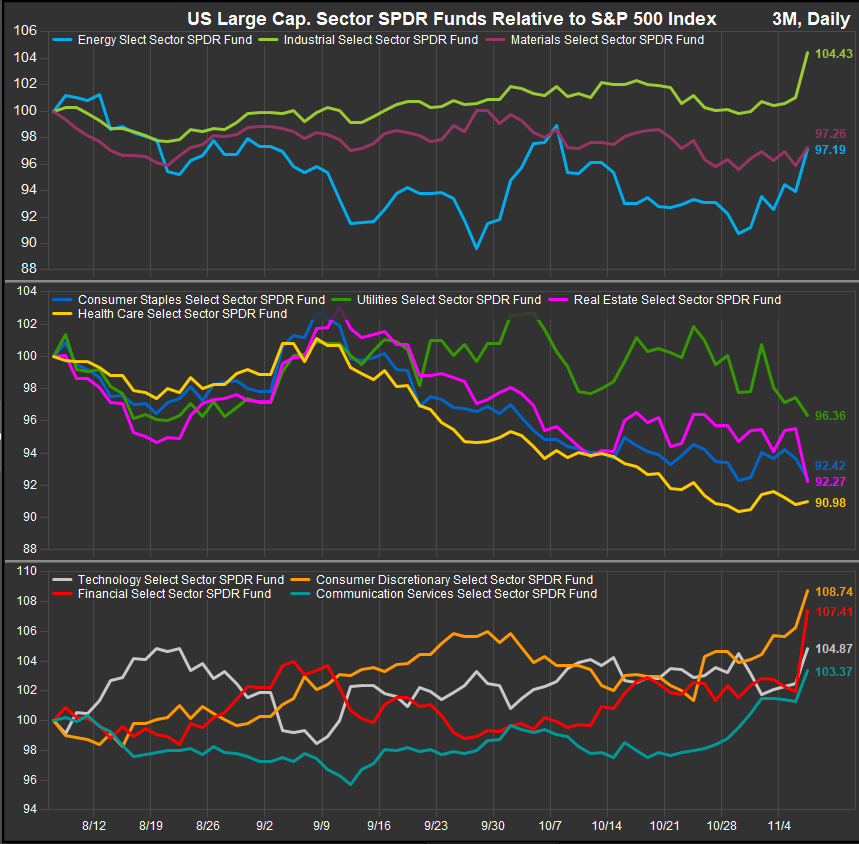

Large Cap. Sector Performance: Commodities and Bull Market Exposures Up, Lower Vol. Sectors getting redeemed

Based on early returns, our outlook on the Energy Sector in particular appears to be offsides. The trade for the near-term is to trim lower vol. exposure and embrace cyclicality.

Data sourced from Factset Research Systems Inc.