May 12, 2025

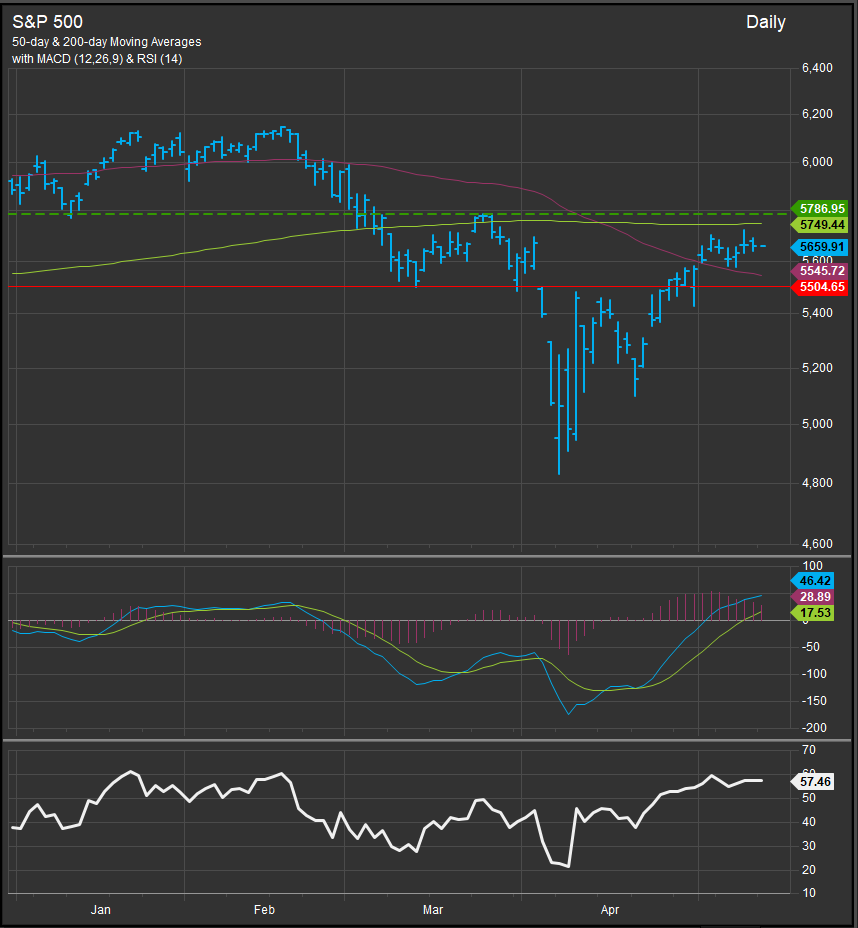

With the eMini trading up 2.7% in early trading we the S&P 500 is projected to register a bullish reversal in our work. The eMini bullish reversal threshold (chart below) is 5826.

The 5826 level corresponds with the 5786 level on the S&P 500 cash index (chart below). Above this level price congestion decreases and we’re more likely to see speculative entry into the market rather than selling.

Stock and bond volatility has continued to recede since equities reached their bullish pivot in early April (chart below).

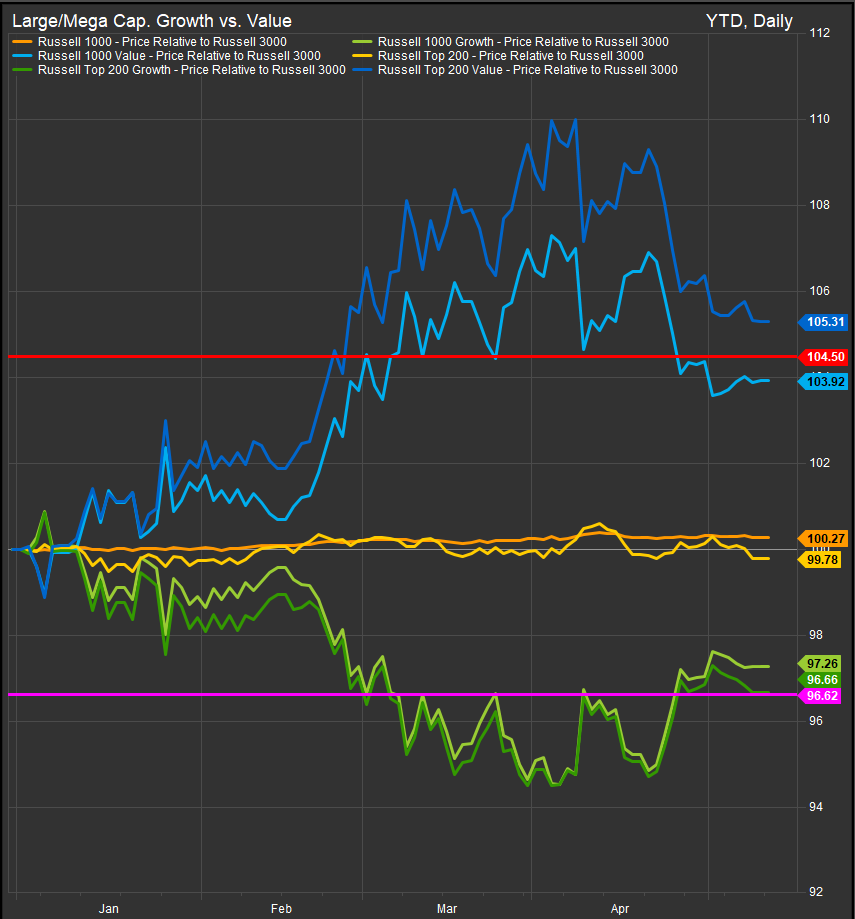

Our Large/Mega Cap. Growth/Value chart, which clearly illustrated the defensive rotation to Value stocks early in 2025 has now shown reversal favoring Growth stocks. We would expect continued Growth outperformance on bullish resolution for equities.

Conclusion

We think today’s price action represents an intermediate-term buy signal for equities and we should be looking to accumulate risk on exposures on any pull-backs in the rally. The risk profile has likely shifted back to a situation where inflation and rising rates will signal caution rather than global trade tariffs forcing recession.