We run the Elev8 Portfolio to keep you up to date with actionable signals and changes in outlook. Following the resolution of Tuesday’s US Presidential Election, we are adding exposure to the Energy Sector and the Industrial Sector and funding the trade by selling out of our Real Estate Sector position and moving to underweight from overweight the Utilities Sector vs. the S&P 500 benchmark weight.

The bullish change comes as the US Energy Sector, proxied here by the XLE SPDR Large Cap. Energy Sector ETF, has effected an “island reversal” on its price chart (see below). This is a bullish reversal pattern that we respect in our process.

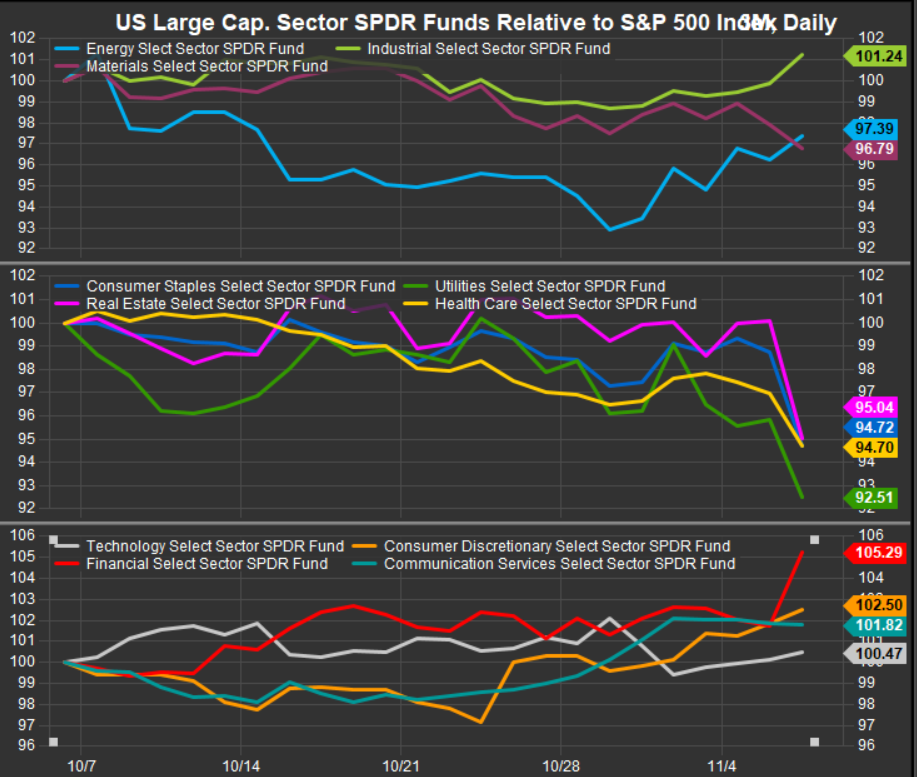

We were also anticipating the need to add Energy exposure in the event that Donald Trump regained the presidency which has also transpired. A look at sector relative performance over the past 1month vs. the S&P 500 shows a clear leadership tilt towards historically higher beta sectors. Low vol. sectors (chart, middle panel) are rolling over in unison.

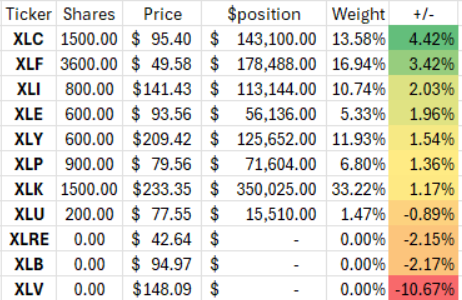

Our new positioning as of market close on November 6, 2024 is as follows:

Our previous positioning, established market close October 31:

We are now materially underweight the lower vol. sectors at the portfolio level, while we have shored up our commodities exposure with overweight positions in Energy and Industrials offsetting our short in Materials exposure. We are positioned for higher prices in the near-term as we believe investors will rerate several areas of the market, particularly those that historically have been heavily regulated by the federal government.

Our risks coincide with the reemergence of the recession trade. Given the exuberant reaction to an upcoming Trump Presidency, we assume those concerns are for another day.

Data sourced from Factset Data Systems