We introduced the Elev8 Sector Rotation Model in June. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for January and our resulting positions. We’ve streamlined the model slightly since inception to include up to 14 indicators that range from stock level technicals, macro-overlays for equity trend, interest rate trend, commodities trend and USD trend, relative performance vs. the benchmark S&P 500 and overbought/oversold oscillators.

We use the largest passive sector-based ETF by AUM ($) for each sector as our proxy for Elev8 sector positions. We select 8 out of 11 Sectors each month and have no exposure to the 3 with the lowest scores in our model.

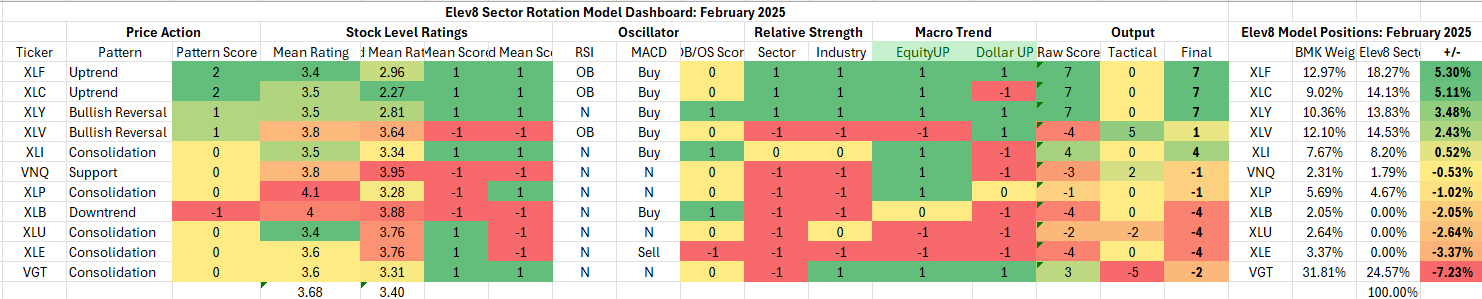

Elev8 Model Input Scores: February

The table below shows the model’s scores for February. Communication Services and Financials continue as overweight positions. We are back to a long position exposure for Consumer Discretionary stocks as our rising rate signal appears to have been a head-fake with the benefit of hindsight

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buyàsell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Model Input Commentary

With equities strong through November generally, pattern scores have improved broadly as they reflect absolute price. Our “Mean Rating” and “Wtd Mean Rating”, reflect an equal and cap. weighted evaluation of every stock in each sector. They are then scored against the average score across all 11 GICS sectors to get a plus-1, minus-1 input into the scheme. This is the stock level message from each sector. It is confirmed in the model through a higher-level relative strength score at the sector and industry level which is a 3-level scheme (+1, 0, -1). XLP, for example, is buoyed by exceptional performance from just 2 stocks, COST and WMT, but since they are major players, they have an outsized influence on sector performance in aggregate. A similar phenomenon occurs within the Comm. Services Sector as Alphabet, Meta and Netflix wield outsized stock-level influence.

At the macro level, the established trends in place continue to be bullish equities and lower commodities prices. Yields climbed steadily in December and are finally showing some upside exhaustion Given the enduring weakness in commodities prices, we are anticipating yields to move lower this month rather than higher which is a contributing factor to our overall bullish positioning.

Under the “Output” section we have a “Tactical” column that adjusts certain sector scores for dislocations we perceive will affect the market in the near-term. This month we have a tactical bet against the Technology Sector. Whether it is rising rates or challenges from Chinese rivals like “DeepSeek”, the knives are out for AI in the near-term and we are anticipating a deeper correction. February is also a weak seasonal month on the calendar historically. Both factors combine to have us taking some risk off the table.

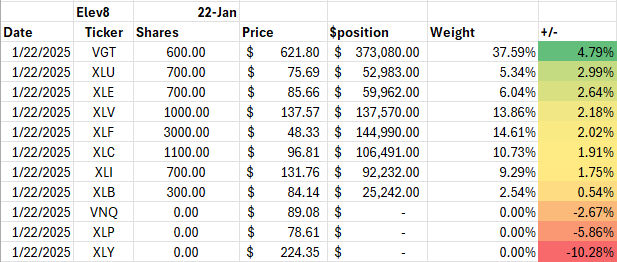

NOTE: We do have a logistical constraint to our portfolio. We instituted a base $10,000 cash portfolio alongside our model to track and model trading costs. Because of this, we don’t always have the ability to precisely match the model scores to the fund’s weighting position.

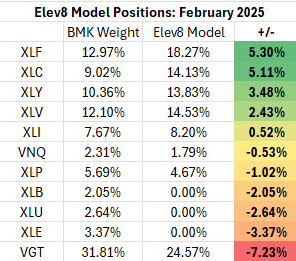

Elev8 Sector Rotation Model Portfolio: February Positioning vs. Benchmark Simulated S&P 500

Previous Positioning as of last Rebalance: January 22, 2025

Our month-end review of our 14 Elev8 Sector Rotation Model inputs results in a paring of our long exposure in Technology and Re-establishing a LONG position in the Discretionary Sector. We’ve maintained our overweight position in Financials, Comm. Services, Industrials, and Healthcare. With rates retreating, the bid has come off for Commodities and commodities adjacent sectors Energy and Materials are back to having the weakest scores in our process. We have also moved off our long in Utilities as the sector is exposed to AI-related risks that we had not previously been aware of.

At a high level this allocation leaves us exposed to potential underperformance risk from rising commodities prices and from a potential rebound in Technology shares. Our biggest short is in the Technology Sector as we’ve seen a number of previous bull market leading themes steadily roll over. This dynamic started with the Software industry and has now taken over the Semiconductor industry as well.

Elev8 Model Performance: January

The Elev8 model underperformed in January by -85bps (estimated). We will have a full attribution report out next week. With equities in consolidation the model started the month positioned for bullish resolution. We took off some risk exposure when rising rates broke through our 4.7% level on January 10 only to be whipsawed as equities traded up to a new all-time high. That all-time high had us close out our short, only to be walloped by the “DeepSeek” revelations 3 days later. A false macro signal and an exogenous shock have us digging out of a hole to start February.

As far as lesson’s learned, we are looking to add a buffer around our macro signals going forward to try and prevent whipsaws from false signals. We will be implementing a 2-day/2% buffer around our support and resistance levels for our macro inputs. This should help us lower the amount of signal we are getting when our macro inputs are in consolidation.

Conclusion

We started 2025 stepping on a figurative rake. Trend following strategies like Elev8 can run into some problems when established trends (like our current equity bull trend) consolidate. We have several areas in the equity market and the US economy that are at pivots (Growth vs. Value, inflation, employment). What we think is happening is AI skeptics are asserting themselves, and, given solid economic data prints, we would expect cyclicals ex-Tech to lead moving forward.

Data from Factset Research Systems Inc.