June 30, 2025

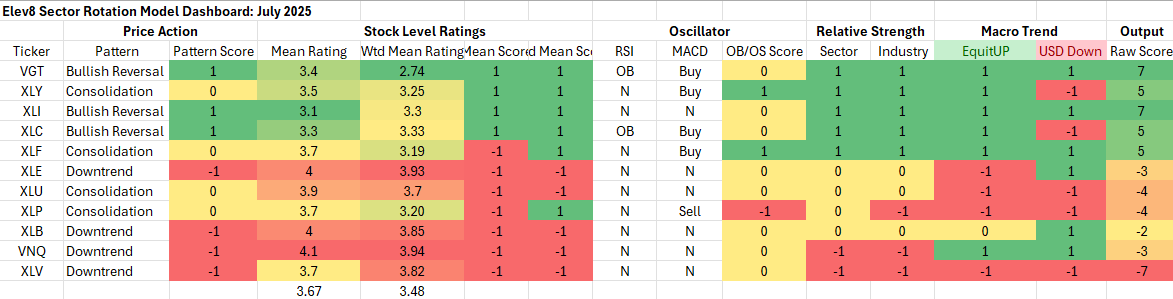

Elev8 Model Input Scores: July 2025

The table below shows the Elev8 model’s scores for July. Info Tech and Industrials sectors scored the highest in our model this month. We’ve rolled over our zero weight positions from June to July and we are out of the Healthcare, Materials and Real Estate sectors in July for the 3rd month in a row. Our Elev8 inputs are as follows:

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buyàsell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Model Input Commentary

The S&P 500 traded to new all-time highs in June reconfirming the bull trend for equities. The risk-on trade has been obvious since the early April lows for the index. USD continues to demonstrate weakness against other major currencies keeping us interested in the Energy Sector as a tactical play. Interest rates is proxied by the US 10 year yield and commodities prices represented by the Bloomberg Commodities Index have traded sideways over the last two months and aren’t affecting our input decisions in July.

Macro analysis and stock level Characteristics which comprise our top down and bottom-up process have us constructive on equities moving forward. Our stock level process which follows a trend following philosophy has the highest scores for Technology consumer Discretionary, Industrials and Comm Services stocks. Our oscillator studies Generated tactical buy signals for Consumer Discretionary and Financials entering July

At the macro level, we’re expecting a bounce from equities to continue. Interest rates have settled into their sideways range between 4.2 and 4.7% and commodities prices remain contained with crude prices rolling over at the end of June. We continue to see a preference for larger stocks over smaller and Growth over Value when equity prices are moving higher at the index level. Industrials and Financials are at potential accumulation points within stronger intermediate term trends after both sectors retrace some gains in June.

Low volatility (Staples, Utilities and Healthcare and commodities adjacent (Energy and Materials) sectors scored the lowest in our model for July. These sectors have very narrow upside participation at the stock level and very few long-term winning stocks. We kept Energy sector exposure as a hedge against exogenous shocks to the commodities complex. Inflation concerns and the emergence of a strong bull recovery have us underweight low vol. sectors entering July.

NOTE: We do have a logistical constraint to our portfolio. We instituted a base $10,000 cash portfolio alongside our model to track and model trading costs. Because of this, we don’t always have the ability to precisely match the model scores to the fund’s weighting position.

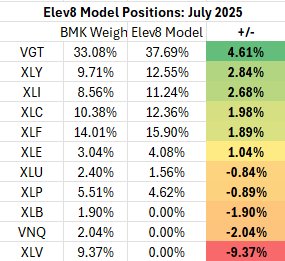

Elev8 Sector Rotation Model Portfolio: July Positioning vs. Benchmark Simulated S&P 500

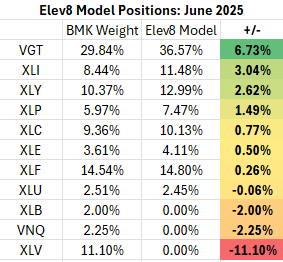

Previous Positioning as of last Rebalance: May 30, 2025

For July we’ve broadened out our Exposure to sectors that historically outperform when the S&P 500 is in an uptrend. Our largest overweight remains in the Technology Sector, but we’ve added exposure to Financials, Industrials, Discretionary and Comm Services stocks as each of those sectors historically outperforms when the S&P 500 is in an uptrend. As mentioned previously we start July underweight each of our legacy low vol. sectors given that the developing scenario for equities is set up as an inflationary bull trend. The cadence of economic data over the next three months will be important Given near term weakness in the ISM manufacturing survey. Also of significance, in both 2023 and 2024 equities staged a post July correction that resolved into an accumulation opportunity in the fall. We may be in line for a similar setup in 2025 Given current risk on sentiment and upcoming seasonal dynamics.

Conclusion

US equities are poised to finish June with the S&P 500 trading to all-time highs. The price action reconfirms the bull trend that began in early 2023. Despite inflation concerns from global trade dynamics and escalating tensions in the Middle East, interest rates, crude prices and commodities prices more generally have stayed contained below our guardrails for inflation. We remain constructive on US equities generally and our positioning aligns with sectors that historically outperform when equity prices are rising.

About Elev8

We introduced the Elev8 Sector Rotation Model in July of 2024. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for April and our resulting positions. The model includes up to 14 indicators that range from:

- Stock Level Technical Characteristics

- Macro-overlays:

- equity trend (S&P 500)

- interest rate trend (10yr US Treasury Yield)

- commodities trend (Bloomberg Commodities Index)

- USD trend (vs. EUR & Broad Currency Indices)

- Relative performance vs. the benchmark S&P 500

- Overbought/Oversold oscillator studies

We use the largest passive sector-based ETF by AUM ($) for each sector as our proxy for Elev8 sector positions. We select 8 out of 11 Sectors each month and have no exposure to the 3 with the lowest scores in our model.

Data from Factset Research Systems Inc.