April 30, 2025

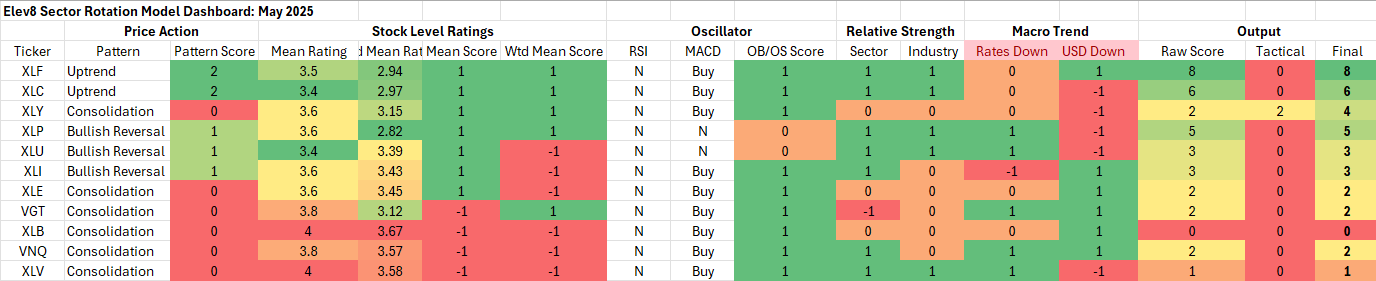

Elev8 Model Input Scores: May 2025

The table below shows the model’s scores for May. Financials, Comm. Services and Staples scored the highest based on our inputs as we enter the new month. We’ve moved from underweight to market weight the Info Tech Sector as we expect continued reflation from recent corrective action through early April. Our three zero-weight sectors are Materials, Real Estate and Healthcare. Given our bet on reflation, we allocated a greater exposure to the Discretionary sector than the model recommends. Our risk allocation was to be budgeted between Tech and Discretionary, but the constraints of our cash portfolio made that unfeasible, so our tactical allocation goes to the Discretionary position.

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buy-sell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Model Input Commentary

After a material correction in the S&P 500 from February through early April, we are seeing signs of bottoming for the index. Mag7 stocks have retraced gains from the 2nd half of 2024 and are generally at accumulation points on their respective stock charts. We think reflation will provide some tailwind to Growth sectors at the expense of Value and Low Vol. exposures. We are trying to balance out that expectation for rotation while staying as true to our trend following process as possible. We’ve sold out of the Healthcare sector as it registers the weakest score among legacy defensive sectors. Our reflation thesis has us favoring Industrial exposure while weak Crude prices have us trimming our long Energy sector position.

At the macro level, we’re expecting a bounce from equities to continue into May. Commodities prices have stayed range bound while Crude prices have moved lower. Given a muddied backdrop for earnings and guidance, we’re expecting some deflationary dynamics to emerge in the near-term. If the near-term data releases remain firm that should equate to an environment that favors Growth. When we analyzed all our individual stock inputs to the model, we found the Info Tech Sector is still acting sluggishly. Semiconductors, whether gaged by NVDA or the SOX Index remain at support. AI competition remains a concern even if the broader trade war dynamic is receding. We are neutral on the sector for May, still looking for clear signs of bullish reversal.

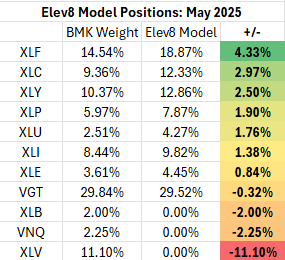

NOTE: We do have a logistical constraint to our portfolio. We instituted a base $10,000 cash portfolio alongside our model to track and model trading costs. Because of this, we don’t always have the ability to precisely match the model scores to the fund’s weighting position.

Elev8 Sector Rotation Model Portfolio: May Positioning vs. Benchmark Simulated S&P 500

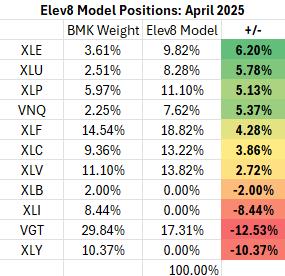

Previous Positioning as of last Rebalance: March 31, 2025

We are moving about halfway out of our defensive stance in May as we are cautiously optimistic about a continued bullish reversal for the S&P 500. Reconciliation on global trade is the bull catalyst in the near-term, but we are less sure that the AI theme will lead the potential next leg of the bull market. For May we are neutral on Tech, but long Discretionary, Financials Industrials and Comm. Services.

Conclusion

The argument for reflation is that too much bad news was priced in during the almost 20% peak-to-trough decline that unfolded from February to April. Now that proposed compromises on global trade have forestalled the most bearish scenarios, we’re looking for reflation to continue. Our concern is there are more headwinds to the domestic AI trade now that the Trump administration has foregrounded China as our primary trade war adversary. We’re more constructive on equities than we were a month ago, but we want to be vigilant for a potential realignment of leadership.

About Elev8

We introduced the Elev8 Sector Rotation Model in June of 2024. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for April and our resulting positions. The model includes up to 14 indicators that range from:

- Stock Level Technical Characteristics

- Macro-overlays:

- equity trend (S&P 500)

- interest rate trend (10yr US Treasury Yield)

- commodities trend (Bloomberg Commodities Index)

- USD trend (vs. EUR & Broad Currency Indices)

- Relative performance vs. the benchmark S&P 500

- Overbought/Oversold oscillator studies

We use the largest passive sector-based ETF by AUM ($) for each sector as our proxy for Elev8 sector positions. We select 8 out of 11 Sectors each month and have no exposure to the 3 with the lowest scores in our model.

Data from Factset Research Systems Inc.