We introduced the Elev8 Sector Rotation Model in June. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for November and our resulting positions. We’ve streamlined the model slightly since inception to include up to 14 indicators that range from stock level technical, macro-overlays for equity trend, interest rate trend, commodities trend and USD trend, relative performance vs. the benchmark S&P 500 and overbought/oversold oscillators.

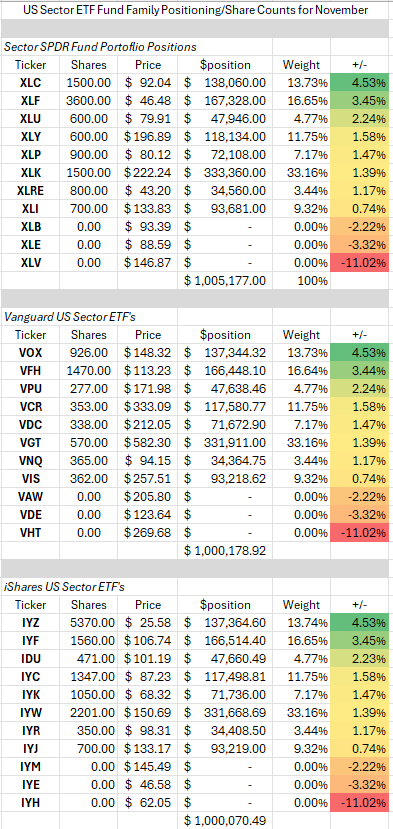

Sector Rotation Model Weights and Share Counts by Fund Family

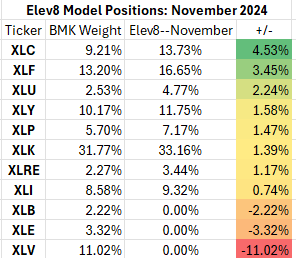

Elev8 Sector Rotation Model Portfolio: November Positioning vs. Benchmark (Simulated S&P 500)

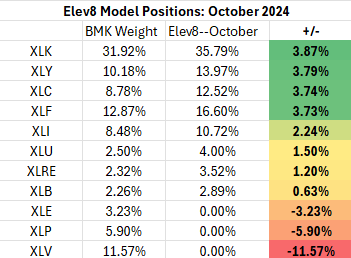

Previous Positioning as of last Rebalance: September 27, 2024

Our month-end review of our 14 Elev8 Sector Rotation Model inputs results in a paring of our long exposure in Technology and Discretionary Sector shares and increasing exposure to Communications Services. We’ve maintained our overweight position in Financials, Industrials, Utilities and Real Estate, and with weak earnings hitting the tape at the end of the month and Commodities prices retreating we have gone zero-weight both Energy and Materials to start the month. Our final zero-weight sector remains Healthcare, which, similar to Staples, is deeply oversold.

At a high level this allocation leaves us exposed to underperformance risk from a macro scenario of downside correction in equities particularly if inflation pushes rates higher as that happens. We are also negatively exposed to any potential spike in Oil prices in the near-term. In exchange for the risks, we are positioned for a continued bullish expansion while keeping some lower vol. stocks in the portfolio as we anticipate yields are overdone to the upside in the short-term. We are aligned generally with historical beneficiaries of rising equity prices and falling interest rates. We also continue to like Financials as a reflationary play from their trough in 2023. Please read through our model input commentary for details.

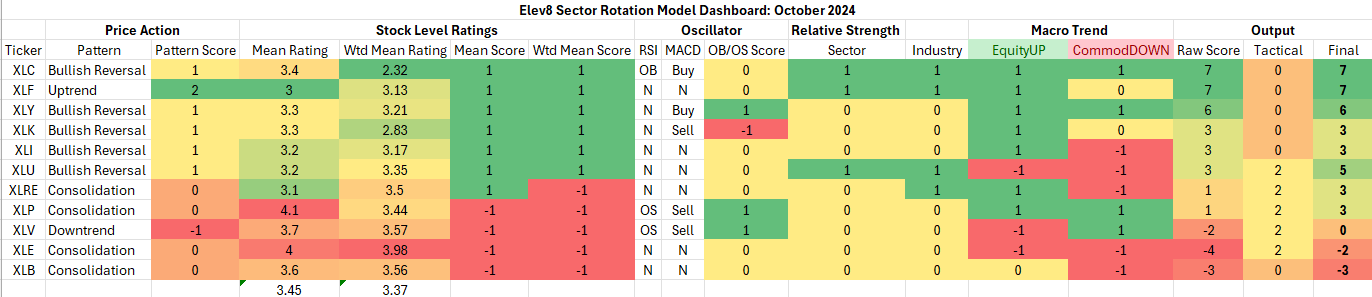

Model Inputs/Outputs: November

The table below shows the model’s scores for November. Communication Services, Financials, Discretionary and Technology had our highest, while we bumped up Utilities and other defensive exposures on a tactical basis due to Yields backing up into resistance and disappointing earnings results. Our zero-weight sectors continue to be Energy and Healthcare and they are joined this month by the Materials sector due to the weakness in Commodities prices despite the Fed’s support.

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buyàsell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Model Input Commentary

With equities strong in September generally, pattern scores have improved broadly as they reflect absolute price. Our “Mean Rating” and “Wtd Mean Rating”, reflect an equal and cap. weighted evaluation of every stock in each sector. They are then scored against the average score across all 11 GICS sectors to get a plus-1, minus-1 input into the scheme. This is the stock level message from each sector. It is confirmed in the model through a higher-level relative strength score at the sector and industry level which is a 3-level scheme (+1, 0, -1).

At the macro level, the established trends in place continue to be bullish equities, lower yields and lower commodities prices. We note that Commodities prices are rallying from deeply oversold conditions, but the downtrend price structure has us fading strength there until proven otherwise.

Under the “Output” section we have a “Tactical” column that adjusts certain sector scores for dislocations we perceive will affect the market in the near-term. This month we added an overlay that boosted min vol. and Commodities adjacent sectors, but our other inputs showed a weight of evidence against the latter group.

Conclusion

October saw the S&P 500 rack up more new all-time highs, now 47 for the year. However, the month ended with a thud as big Tech. came in with earnings reports that didn’t satisfy sky-high expectations. We expect a volatile start to November with the Presidential Election looming. We’ve trimmed our Technology long and added more min vol. exposure than last month as we expect rates to roll over. We continue to subscribe to the idea that we are in a long-term bull market and that the Fed is on course for a soft landing.