September 30, 2025

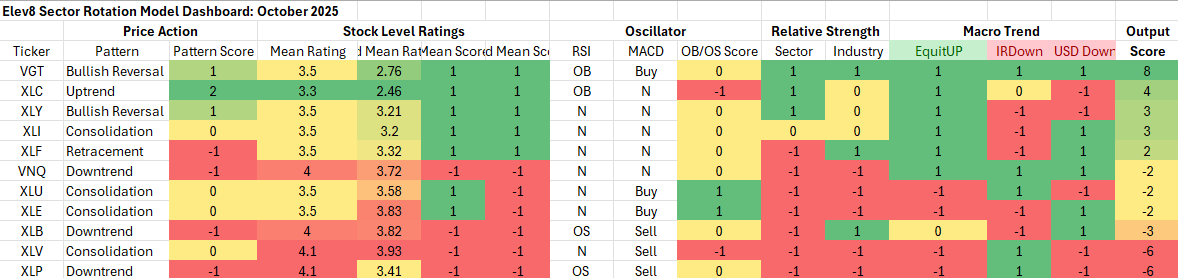

Elev8 Model Input Scores: October 2025

The table below shows the Elev8 model’s scores for October. Info Tech and Comm. Services sectors scored the highest in our model with overwhelming demand for AI and AI capex plays demonstrated in September. Investors took the Fed’s policy initiative as a cue to double-down on the AI complex. We are seeing a growing number of industries within the Tech Sector delivering strong results from these emerging trends. We are out of the Healthcare, Materials and Staples sectors in October. Both Low vol. and Commodities themes have been weak as investors focus on AI related growth opportunities.

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buy–>sell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Model Input Commentary

After outsmarting ourselves last month by lightening up on Tech sector exposure due to concerns about seasonal rotations, we are back in trend following mode for October. Bullish recognition of the AI trade’s expanding reach was clear in the data and the buying enthusiasm that pushed the Tech sector out to new highs. The Fed is supportive, tariffs and global trade policy is a potential fly in the ointment, but so far increased competition between the US and China has been a boon to stocks. Disaggregation of global trade may end up causing some issues, but with risk appetite high, speculation has been decidedly bullish. Our primary concern is the narrowness of the advance, but the areas under the most downside pressure are areas are model wants to short. We think our primary risks are related to the direction of equity prices. If we do get a correction we could see a sharp rotation into risk-off exposures which are deeply oversold. We’ve maintained a foothold in Utilities and market weight position in Real Estate for those reasons. Commodities prices remain locked in a sideways trend. We’ve rolled over some Energy sector exposure from last month.

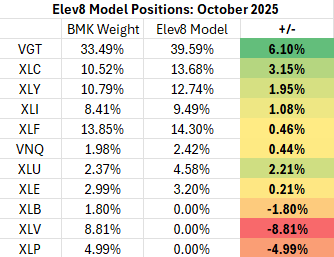

Elev8 Sector Rotation Model Portfolio: October Positioning vs. Benchmark Simulated S&P 500 (data as of 9/29)

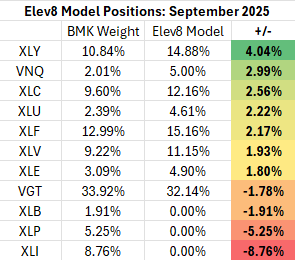

Previous Positioning as of last Rebalance: September 28, 2025

For October we’re leaning into the AI trade with VGT and XLC as our largest overweight positions. On the short side, low vol. exposures continue to score the lowest based on our model inputs. Staples is the weakest sector in our models followed by Materials and Healthcare. The model should outperform if investor risk appetite remains firm. We would likely have a tough month if there was a correction in the AI trade.

Conclusion

Despite the AI trade creating a rather narrow leadership profile for equities, the near-term operating results for AI exposed companies show powerful fundamental demand with enthusiastic buyers taking any signs of near-term weakness as a cue to accumulate. We are entering October positioned with the bull trend and long AI themes.

About Elev8

We introduced the Elev8 Sector Rotation Model in October of 2024. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for April and our resulting positions. The model includes up to 14 indicators that range from:

- Stock Level Technical Characteristics

- Macro-overlays:

- equity trend (S&P 500)

- interest rate trend (10yr US Treasury Yield)

- commodities trend (Bloomberg Commodities Index)

- USD trend (vs. EUR & Broad Currency Indices)

- Relative performance vs. the benchmark S&P 500

- Overbought/Oversold oscillator studies

We use the largest passive sector-based ETF by AUM ($) for each sector as our proxy for Elev8 sector positions. We select 8 out of 11 Sectors each month and have no exposure to the 3 with the lowest scores in our model.

Data from Factset Research Systems Inc.