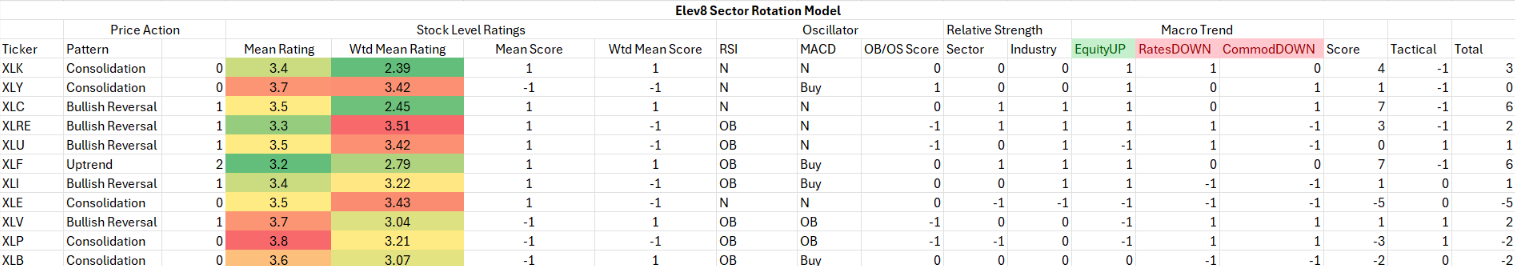

We introduced the Elev8 Sector Rotation Model in June. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for September. We’ve streamlined the model slightly since inception to include up to 14 indicators that range from stock level technical, macro-overlays for equity trend, interest rate trend, commodities trend and USD trend, relative performance vs. the benchmark S&P 500 and overbought/oversold oscillators.

The table below shows the model’s scores for September. Financials and Industrials and Technology Sectors score the highest in our model for September. The two former sectors are tracing out bullish reversals and the latter is oversold in a strong longer-term uptrend.

Under the “Output” section we have a “Tactical” column that adjusts certain sector scores for dislocations we perceive will affect the market in the near-term. There are two tactical considerations for September. The one is negative seasonality which we think could affect historically bullish exposures negatively.

Model Inputs: September

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buy–>sell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold

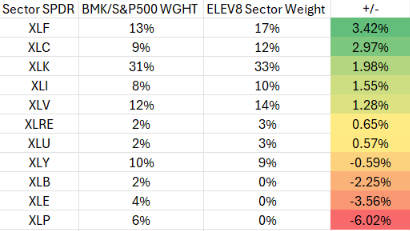

Elev8 Sector Rotation Model Portfolio: September Positioning

Elev8 SRMP: August 2024 Performance (-47bps)

Our trend following model is scuffling a bit in the near-term as there have been some very violent rotations over the summer in response to forward interest rate policy expectations. Those have changed from hawkish to dovish since June and we have seen a bid for laggard sectors that hurt the model’s performance. We have run this process for more than 10years with generally positive results and we expect active risk management will keep our misses small enough that we can regain our footing in short order.

Conclusion

We knew there would be violent rotations given the bifurcation of the market since early 2023. Our strategy broadly has been to allocate for a broad bull market in alignment with the prevailing trends. Our tactical strategy is to miss small until we hit big. Mega Cap. Tech has posted strong earnings so far this season, but against very high expectations. The coming election offers a period of some uncertainty and volatility, but the Fed is no longer a headwind, and we expect the bull market cycle to continue.