Trading Signal:

S&P 500 upside break-out to all-time high, Sox Index to multi-month high, XLK/VGT flirting with ATH’s of their own confirming the bull trend on a positive close. Charts follow positioning update.

Elev8 Rebalance: Selling Staples to fund longs in Tech and Materials sectors

We recommend going long Technology Sector shares. Our model uses the Vanguard Information Technology ETF (VGT) for exposure. We recommend going long Materials Sector shares. We use the Materials Sector SPDR (XLB) for exposure there. We pay for it by selling out of our position in the Consumer Staples Sector SPDR (XLP).

Staples sector stocks remained under pressure despite entering the recent equity pull-back near oversold levels.

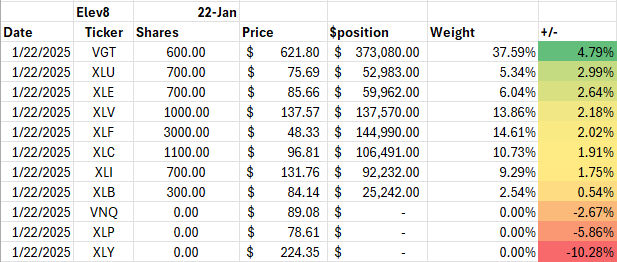

Elev8 New Positioning (Executing Today’s Close/Notional Prices Quoted):

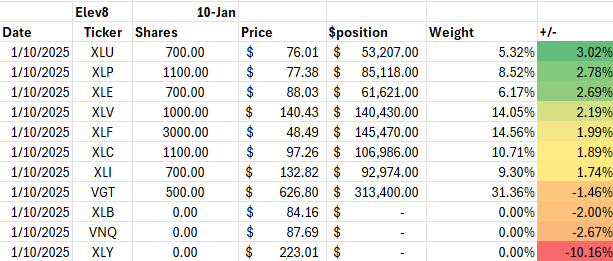

Elev8 Previous Positioning as of 1/10/2025:

Comment: Mea Culpa!

Didn’t take long for the first head-fake of the year. We got spooked by rising rates, stalling momentum and ongoing consolidations in former bull market leadership themes. Today, we have numerous signals that confirm the bull trend. The S&P 500 Technology Sector has made a new intra-day high, the SOX Index has broken out of a multi-month trading range and against a backdrop of an all-time high for the S&P 500.

The inflation narrative is likely to stay with us, but our model is trend-following for a reason and equities have confirmed their trend for the present.

S&P 500 Upside Break-out to new all-time high

XLK Flirts with a new all-time high of its own into the close of trading

SOX Index Multi-Month High establishes a bullish reversal

Data sourced from FactSet Research Systems Inc.