Macro Signal = Bearish

Stronger non-farm payrolls this morning have precipitated an upside break-out in the US 10yr Yield above April 2024 highs. We have been looking for this development to take some risk off the table as we had started the year skeptical of the move. Our skepticism had stemmed from weak commodities prices and a mixed fundamental picture, but with economic prints coming in on the stronger side, we are getting a clearer picture. We think higher rates sets up a strong potential for a deeper equity correction and we are repositioning to add lower beta exposure on that conviction.

Rates Break-out

We ID’d the 4.68-4.7% level as an important resistance level. With stronger payroll prints this morning, that level has been violated to the upside.

Equities Breaking Down Ahead of the Open

The chart of the Emini S&P 500 is showing a MACD sell signal as the trend indicator moves from positive to negative. A move below the 5855 level in today’s trading would act as near-term confirmation.

Elev8 Rebalance: Selling Discretionary, Technology and Real Estate to Fund Energy, Healthcare and Utilities Longs

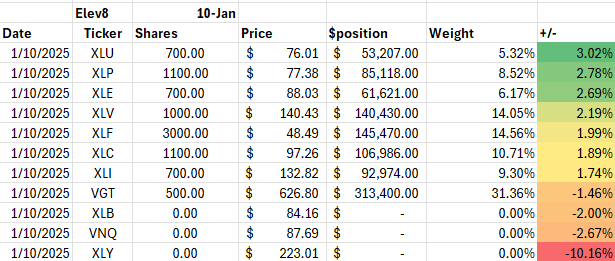

Elev8 New Positioning (Executing Today): (1/8/2025 prices shown)

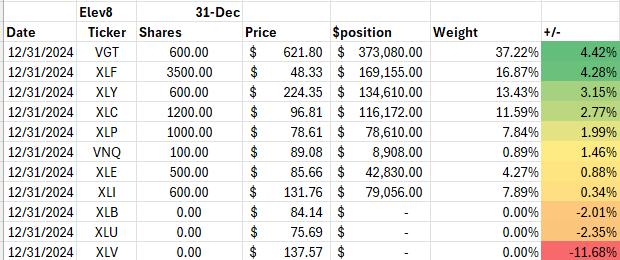

Elev8 Previous Positioning as of 12/31/2024:

Comment

We started January giving the benefit of the doubt to the longer-term bull market trend, but rising rates have now been confirmed by economic data coming in definitively stronger than expectations. This puts the Fed in a bind and takes dovish policy off the table for the time being. We have noted that several consumer linked indicators have been deteriorating over the 2nd hal of last year including credit card and consumer loan delinquencies and an overall lack of buying in the housing market and housing related equities. Dovish policy was supposed to offer a boost there, but that scenario has been pushed out to a later time at best.

We are taking risk off the table for the time being and will plan to revisit at month’s end.

Data sourced from FactSet Research Systems Inc.