February 18, 2025

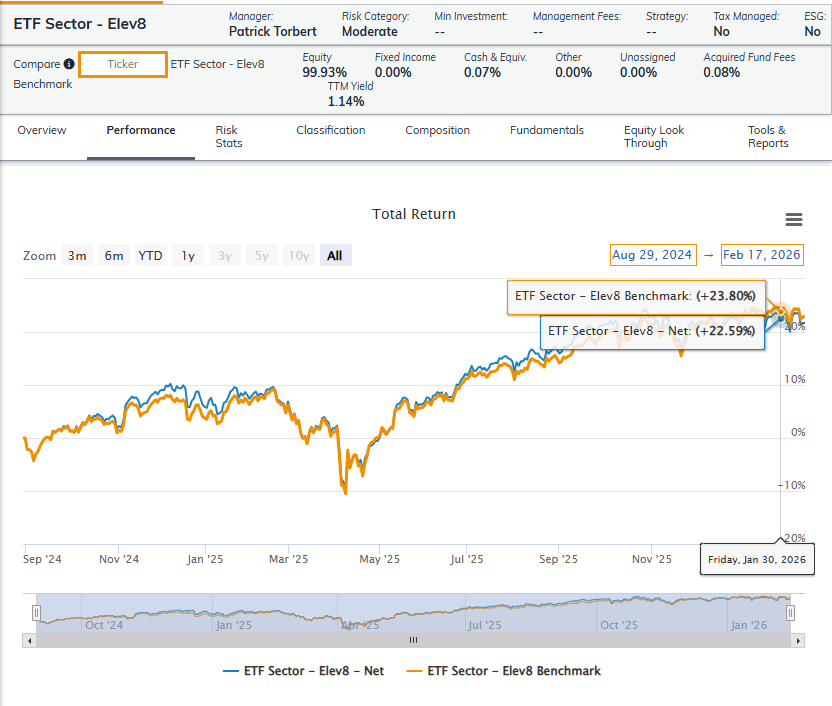

We introduced our Elev8 model in June of 2024 and have been running it in its current form since August 28, 2024. Each month we review the previous month’s positioning and performance to identify what worked and what needs improvement. A brief description of the Elev8 model and its inputs follows the review as an appendix.

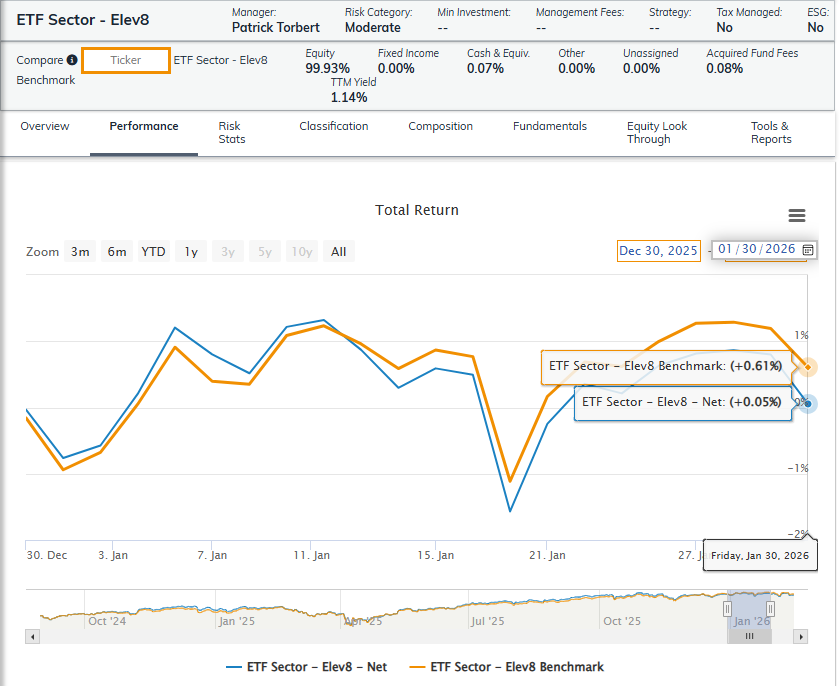

January was another tough month for performance. The key event that drove our misstep was the Trump Administration’s move to enter Venezuela and depose Maduro which hit the tape on Jan 2. Our Energy UW was a key contributor to another month short of our benchmark. As a result, the portfolio underperformed in January 2025 posting an excess return of -68 bps vs. our simulated S&P 500 benchmark.

We are seeing some of the pains of a trend-following model operating in a time of potential trend transition. The model inputs softened into December, but the Fed came in with a strong dovish signal. As the model moved back to align with easing, geopolitics took the macro picture and sector rotation in a different direction.

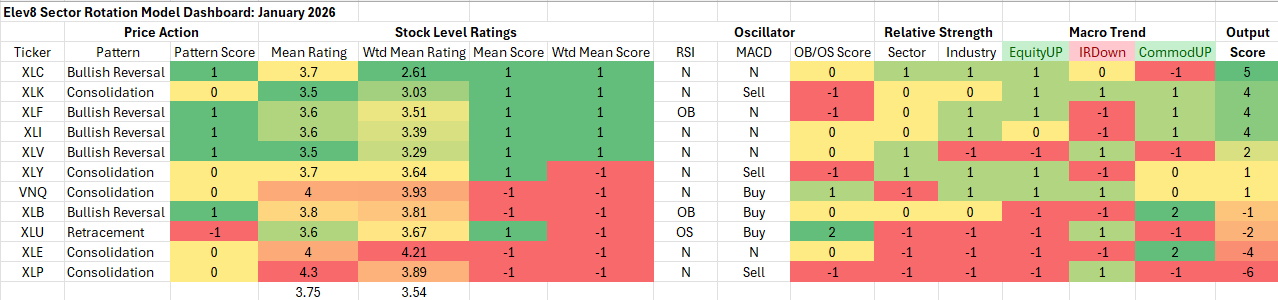

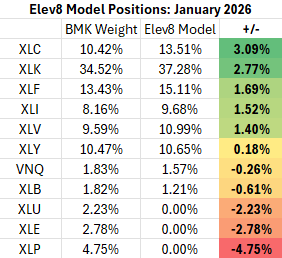

Elev8 Model Indicator Dashboard & Positions (January 2025)

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buyàsell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Performance Recap: Elev8 Performance vs. Benchmark (January 2025)

Performance Recap: Elev8 Performance vs. Benchmark (August 29, 2024 – January 31, 2025)

What didn’t work in January

As a trend-following model, Elev8 has an inherent weakness when in the short-term when trends change abruptly. The Energy sector’s performance in December (among the weakest) threw us off as crude prices moved lower into year-end. As a result, we took our Energy long off at exactly the wrong time. The Energy sector went on to outperform by 12.5% in January. The other side of the coin was we took our Energy long and rolled it back into Financials and Tech.

We also whiffed on the Consumer Staples sector which went from worst to first among the low vol. cohort in January on strength from COST and WMT. Both of those stocks had been in intermediate-term bearish retracement in our stock level process heading into the month.

We were able to mitigate some losses by going long the Industrial sector (+5.22%), Real Estate (+1.2%) and Comm. Services (+0.63%), but the misread on inflation kept us in the laggard column this month.

February Inputs & Positioning

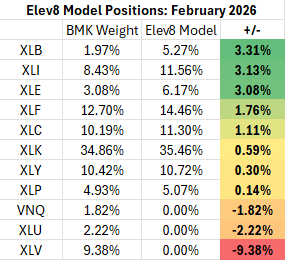

For February the model flipped bullish on the emergent commodities trend. We went long Staples as our defensive allocation, despite the month starting with inflation concerns trumping deflation due to upwards pressure on commodities prices. We maintain slightly above market weight allocations in Tech and Comm. Services based on strong long-term trends and the beginnings of near-term oversold conditions. We are out of low vol. sectors Utilities, Real Estate and Healthcare.

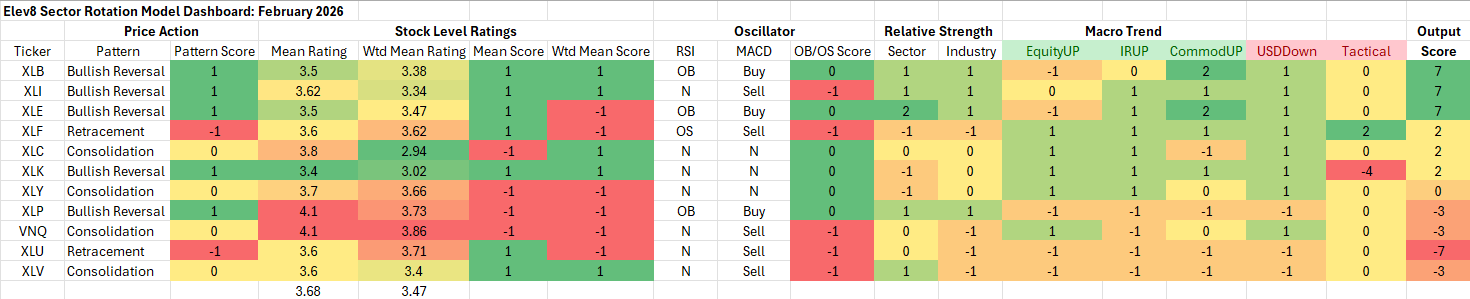

Elev8 Model Input Dashboard: February

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buyàsell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Elev8 Model Positions: February

Attribution provided by ETFAction, https://www.etfaction.com/

Other data provided by FactSet Research Systems Inc.

Appendix: What is the Elev8 Model

Elev8 Model

Elev8 is a sector rotation model that seeks to outperform the S&P 500 on a yearly basis by actively managing sector exposures relative to our simulated S&P 500 benchmark. The model seeks to generate alpha over its benchmark by allocating 100% of the portfolio to 8 of the 11 GICS Sectors comprising the S&P 500. It picks the 8 sectors that have the strongest scores in the model’s up to 14 inputs while having no exposure to 3 of the GICS Sectors that have the weakest scores in the model each month. The model can be above or below benchmark weight in the sectors it does have positions in.

Elev8 Model Inputs

- Stock Level Technical Characteristics

- Macro-overlays:

- equity trend (S&P 500)

- interest rate trend (10yr US Treasury Yield)

- commodities trend (Bloomberg Commodities Index)

- USD trend (vs. EUR & Broad Currency Indices)

- Relative performance vs. the benchmark S&P 500 at the sector and industry level

- Overbought/Oversold oscillator studies

- Tactical Overlays Include: Seasonality, Fiscal & Monetary Policy Interventions, VIX levels, Economic and Earnings alerts and considerations for exogenous events that are seen to be market moving.