Elev8 Sector Rotation Portfolio: October Attribution Report

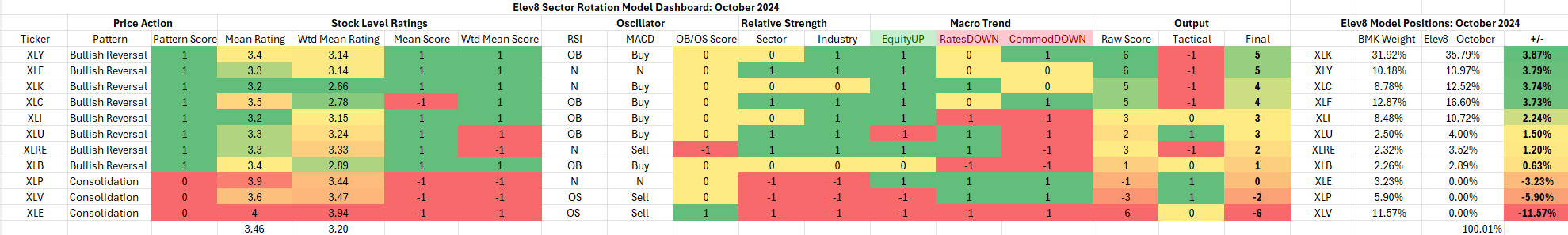

Our Elev8 Model logged a successful month in October outpacing the S&P 500 by 61bps for the month. Our positioning was informed by 3 main components. The technical setup for each of the 11 GICS Sectors, our macro overlay, which considers the trends in equities, interest rates, commodities and USD, and a tactical overlay triggered by bearish seasonals for October.

Despite a boost from the tactical overlay, underwhelming technical inputs and the bullish S&P 500 trend had us assigning zero weight positions to Healthcare (XLV) and Staples (XLP) ETFs. Our core model inputs had us skeptical about the prospects of the Materials (XLB) and Energy (XLE) Sectors as well due to the very weak trend in Commodities prices heading into October.

Given the Fed’s announcement and following our model scores heading into October we split the difference on Commodities exposure by assigning a tactical long to XLB and keeping XLE a zero-weight position. The Model inputs to start October are below.

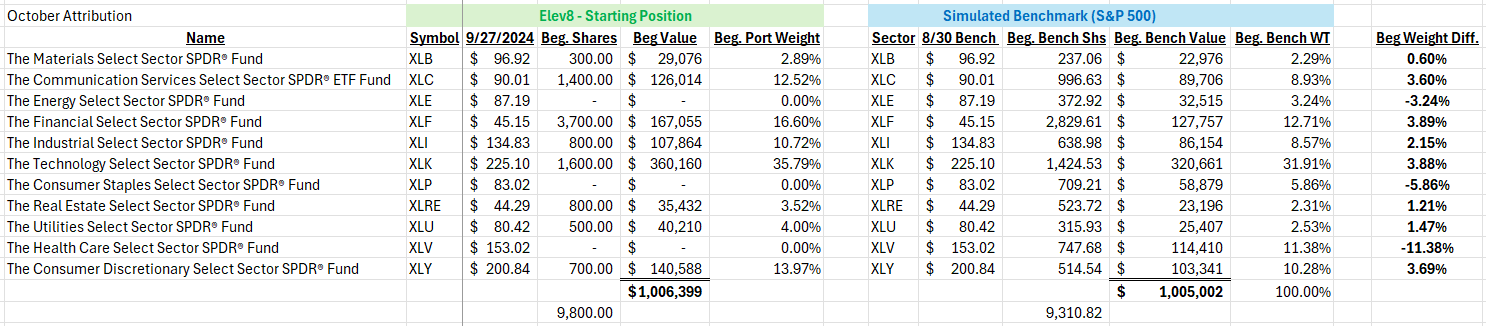

The beginning positions were as follows. NOTE: Weightings are slightly different as the model inputs track to theoretical positions with fractional share totals while the actual portfolio is cash and must round up or down for its individual positions.

Our biggest bets were historically bullish exposures Information Technology (XLK), Discretionary (XLY), Financials (XLF) and Comm. Services (XLC). We complimented that core positioning with longs in Utilities (XLU) and Real Estate (XLRE) to notionally lower the volatility profile of the portfolio, and we had longs in Industrials (XLI) and Materials (XLB) to provide some exposure to oversold Commodities prices.

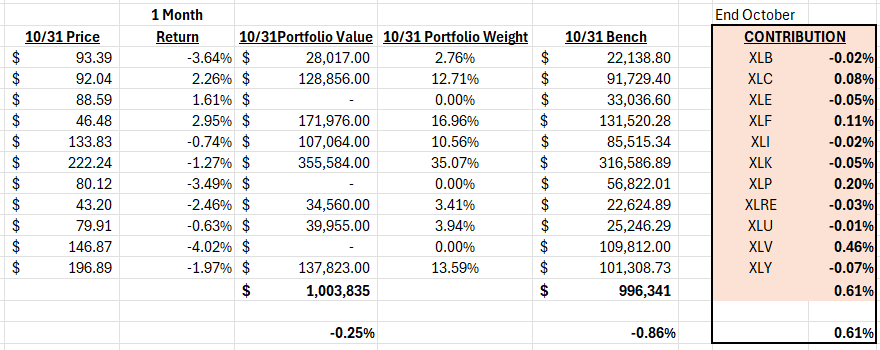

The portfolio navigated the month without triggering any rebalance signals and the monthly results are below. The Elev8 model posted an excess return over the benchmark S&P 500 of +61 bps for the month of October. We simulate the S&P 500 as our benchmark with SPDR ETF positions that match the index weight so we can track attribution to the instrument level in our attribution tool. Month end portfolio results and sector attribution are below.

At the sector level, our model succeeded vs. the benchmark by avoiding lower volatility sectors Healthcare (XLV) and Staples (XLP). We would have been better served shorting Materials and going long the Energy Sector, but we were able to minimize exposure due to the small size of the Energy Sector. Financials and Comm. Services were also positive contributors while our Technology and Discretionary positions both underperformed for the month. In the end it was what we didn’t own benefited the portfolio most.

We start November with paired back positions in the Technology Sector (XLK) and the Discretionary Sector (XLY). We’ve gone long the Staples Sector (XLP) as it finished October at oversold levels, but we’ve maintained a zero-weight position in Healthcare (XLV). We are starting to see a loss of buyer enthusiasm for the XLK. It is historically the bull market exposure that produces the most alpha, so we give it the benefit of the doubt while its prospects are ambiguous. We have gone back to zero-weight in both XLB and XLE for November as Commodities prices remain the weakest macro trend over the intermediate-term.