February 26, 2025

S&P futures +0.6%, rebounding after the S&P 500’s four-day losing streak, though the equal-weight S&P outperformed on Tuesday. Big tech, semis, EVs, and energy lagged, while staples, food & beverage, homebuilders, and REITs led.

Bonds & Commodities: Treasuries weaker after Tuesday’s rally. Dollar +0.15%, gold +0.3%, Bitcoin +0.9%, WTI crude flat, copper +3.5% on tariff headlines.

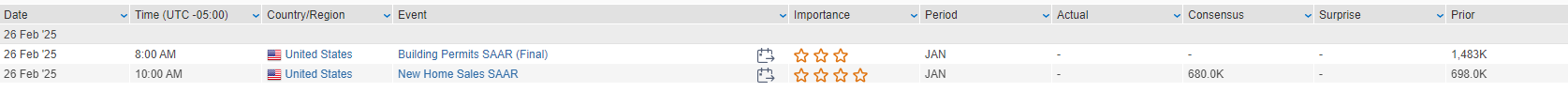

In Washington, the House GOP surprisingly passed its reconciliation blueprint, though challenges remain in the Senate. Trade concerns resurfaced after Trump ordered a probe into U.S. copper imports, fueling tariff uncertainty. Housing data remains in focus, with new home sales expected to decline 3.3% in January after weak housing starts and existing home sales. Investors are also watching Fed commentary from Barkin and Bostic, along with the Treasury’s $44B auction of 7-year notes, following strong demand for 2- and 5-year auctions earlier this week.

Corporate Highlights:

- Earnings strong: INTU, WDAY, LOW, AXON beat expectations.

- NVDA expected to report another “beat and raise” post-close.

- GM approved $6B buyback & dividend hike.

- FSLR guided higher, LCID raised 2025 production outlook.

- CCI taking $5B impairment for fiber business; exploring options.

- CALM announced $500M buyback & voting share conversion.

- GO plunged on margin miss & weak FY25 guidance

U.S. equities closed mixed on Tuesday, recovering from earlier losses amid broad risk-off sentiment. The Dow Jones (+0.37%) outperformed, while the S&P 500 (-0.47%), Nasdaq (-1.35%), and Russell 2000 (-0.38%) finished lower, with big tech facing renewed selling pressure. The VIX fell back below 20, signaling some stabilization in sentiment.

Market weakness was driven by growing skepticism over the soft/no-landing narrative, following weaker-than-expected consumer confidence data. February’s consumer confidence index dropped to 98.3 (vs. prior 105.3), marking its sharpest monthly decline since August 2021. Inflation expectations jumped to 6% from 5.2%, as concerns over tariffs and sticky inflation intensified.

However, Treasury yields continued to decline amid rising Fed rate-cut expectations. The 10-year yield fell below 4.30%, now down 26 bps over the past five sessions. A well-received $70B auction of 5-year notes further supported bond markets. The U.S. dollar index declined 0.3%, while gold (-1.5%) and Bitcoin futures (-6.2%) also pulled back.

Oil prices also came under pressure, with WTI crude falling 2.5% to below $70/barrel, its lowest level since December 26, amid concerns over U.S. economic growth and Russia-U.S. discussions on Ukraine.

On the geopolitical front, reports emerged of a U.S.-Ukraine minerals deal, signaling potential supply-chain shifts. Additionally, Germany is exploring debt brake reform options, which could influence European fiscal policy.

Washington remains in focus as House lawmakers debate a reconciliation plan, with Medicaid cuts among the biggest sticking points. Meanwhile, Trump 2.0 policy uncertainty—including tariff threats and fiscal policy divisions—remains a key overhang for investors.

Market Performance by GICS Sector

- Technology (Underperformed, -1.37%)

- Big Tech broadly lower, with Tesla (TSLA -8.4%) notably lagging on weak European sales (January registrations down 45% YoY).

- Nvidia (NVDA) reportedly seeing a jump in H20 AI orders from Chinese firms despite U.S. restrictions.

- Zoom (ZM -8.4%) fell after issuing a light FY26 revenue outlook, despite Q4 results exceeding expectations.

- Consumer Discretionary (Underperformed, -0.84%)

- Tesla (TSLA) market cap fell below $1T as European demand slumped.

- Home Depot (HD +2.8%) beat Q4 expectations, posting positive comps for the first time in two years, but issued a light FY25 guide.

- Planet Fitness (PLNT -9.2%) dropped after mixed earnings and disappointing 2025 store expansion guidance.

- Krispy Kreme (DNUT -21.9%) plummeted as Q4 results missed and guidance fell short, citing cybersecurity-related disruptions.

- Consumer Staples (Outperformed, +1.69%)

- Keurig Dr Pepper (KDP +2.4%) reported strong earnings and revenue, benefiting from momentum in carbonated soft drinks.

- Financials (Flat, -0.10%)

- Credit card companies, online brokers, and asset managers were broadly weaker amid consumer sentiment concerns.

- SBA Communications (SBAC +3.0%) posted strong Q4 earnings and increased its quarterly dividend by 13.3%.

- Industrials (Outperformed, +0.53%)

- Armstrong World Industries (AWI +5.2%) posted an earnings beat, with upbeat demand commentary supporting FY25 guidance.

- Civitas Resources (CIVI -18.2%) fell after missing Q4 estimates and guiding toward lower 2025 production.

- Healthcare (Outperformed, +0.86%)

- Eli Lilly (LLY +2.3%) announced price cuts on Zepbound and expanded a self-pay program for higher-dose vials.

- Hims & Hers Health (HIMS -22.3%) fell despite strong Q4 revenue, as investors worried about its outsized weight-loss drug exposure.

- Myriad Genetics (MYGN -14.8%) dropped on light Q1 guidance and ongoing reimbursement challenges.

- Real Estate (Outperformed, +1.15%)

- Homebuilders outperformed, benefiting from falling mortgage rates. LGI Homes (LGIH +2.5%) saw Q4 weakness but issued a more positive 2025 outlook.

- Materials (Outperformed, +0.80%)

- Cleveland-Cliffs (CLF -3.2%) flagged continued pressures from weak domestic auto production.

- Energy (Underperformed, -1.47%)

- Oil prices fell to 2025 lows amid demand worries and U.S.-Russia talks on Ukraine.

- Sempra Energy (SRE -19.0%) dropped after missing Q4 estimates and cutting 2025 guidance.

- Communication Services (Underperformed, -1.53%)

- Meta (META) fell for the sixth straight session as investor rotation out of AI-exposed stocks continued.

- Chegg (CHGG -31.4%) plummeted after issuing weak guidance and filing a complaint against Google AI for traffic declines.

- Utilities (Underperformed, -0.51%)

- Defensive utility names held up relatively well in a volatile session

Eco Data Releases | Wednesday February 26th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday February 26th, 2025

Data sourced from FactSet Research Systems Inc.