July 9, 2025

S&P futures are up 0.1% after a mixed session Tuesday, where small caps, value, and unprofitable tech outperformed, while money center banks lagged amid early earnings previews. Treasuries are little changed, the dollar index is up 0.1%, gold is down 0.4%, Bitcoin futures are up 0.2%, and WTI crude is up 0.5%.

No major developments on trade following recent hawkish signals, though the extended tariff deadline has shifted market focus toward the Q2 earnings season kickoff. Fed speculation continues, with Kevin Hassett’s nomination prospects reportedly improving while Warsh’s are fading; Bessent remains a contender. Attention remains on longer-term yields creeping back to May discomfort levels, with macro resilience and global deficit concerns both influencing the move. Overseas, China’s worsening PPI deflation is in focus.

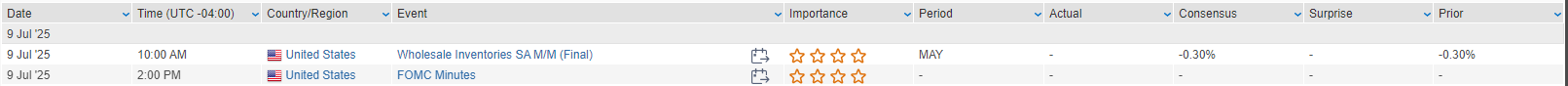

The economic calendar is light, with May’s final wholesale inventories out this morning and June FOMC minutes due at 2 PM. Markets are watching for signs of division within the Fed amid political pressure to cut rates. A $39B 10-year Treasury auction is also set for today.

- AAPL: COO Jeff Williams to retire; Sabih Khan named successor. Also pursuing U.S. media rights for Formula 1.

- META: Acquired nearly 3% stake in EssilorLuxottica.

- UNH: Facing DOJ investigation over Medicare billing.

- SBUX: Fielding interest in its China unit from potential buyers.

- MBLY: Guided Q2 revenue above consensus; announced 45M share offering for holder INTC.

- AES: Jumped on reports of exploring strategic options amid infrastructure fund interest.

- VRNA: Gained on report MRK is nearing a ~$10B acquisition.

- WPP: Dropped after cutting guidance, citing macroeconomic headwinds.

- RXST: Fell sharply after slashing Q2 and full-year revenue guidance.

U.S. equities ended mixed Tuesday in a quiet, range-bound session. The S&P 500 and Nasdaq were little changed while the Russell 2000 outperformed (Dow -0.37%, S&P 500 -0.07%, Nasdaq +0.03%, Russell 2000 +0.66%). Leadership rotated to energy, materials, healthcare, and small caps, while money-center banks, REITs, insurers, grocers, and HPCs lagged. Treasuries were slightly weaker, but yields came off session highs. The dollar index was unchanged, gold fell 0.8%, Bitcoin futures gained 0.7%, and WTI crude rose 0.6%.

Trade policy remained in focus, with President Trump announcing a 50% tariff on copper, pushing copper futures up over 17% intraday. He also threatened a 200% tariff on pharmaceuticals (with a long implementation timeline), and noted semiconductor tariffs are imminent. Trump reaffirmed that the Aug. 1 deadline for reciprocal deals will not be extended and mentioned possible tariff letters to the EU within days, with rates up to 70% for some countries. Reports suggest a preliminary US-EU deal may exempt commercial aircraft and include carve-outs for German automakers, though internal EU disagreements persist.

On the data front, the June NFIB Small Business Optimism Index ticked lower to 98.6, with taxes, labor quality, and high costs cited as top concerns. The NY Fed Consumer Expectations Survey showed inflation expectations down at the one-year horizon (to 3.0%) and flat at longer-term outlooks. Consumers’ expectations for job loss fell, income expectations rose modestly, and spending growth expectations dipped. The $58B 3-year note auction tailed and drew below-average demand; $39B in 10s is up today, with $22B in 30s on Thursday.

Stock-Specific Highlights by GICS Sector

Information Technology (+0.39%)

- GFS +7.0%: Announced plans to acquire MIPS, a supplier of AI and processor IP.

- DDOG -4.5%: Downgraded to Sell at Guggenheim amid concerns that major customer OpenAI may be developing an internal solution.

- SWK +3.5%: Upgraded to Peer Perform at Wolfe; noted reduced EPS downside risk, end-market stabilization, and potential from Fed easing.

Consumer Discretionary (-0.64%)

- HSY -3.2%: Appointed Kirk Tanner (ex-CEO of Wendy’s) as successor to Michele Buck.

- AMZN -1.8%: Early Prime Day sales down 14% YoY, though comparisons are muddied by the longer event window.

- RIVN +3.0%: Benefited from news that a Rivian-backed small EV startup received a $1B valuation following a Greenoaks Capital investment.

Financials (-0.90%)

- KEY +1.0%: Upgraded to Buy at UBS and Outperform at Autonomous; praised capital positioning, loan growth, and capital markets exposure.

- BAC -3.1%: Downgraded to Hold at HSBC; underperformance and a more balanced risk-reward profile cited.

Health Care (+0.43%)

- MMSI +4.6%: Named Martha Aronson as new CEO (effective Oct. 3); also guided Q2 revenue above consensus.

- PGNY: Higher after positive Q2 commentary (no specific move reported in summary).

Energy (+2.72%)

- FSLR -6.5%, ENPH, RUN, SEDG: Lower after Trump signed an Executive Order ending subsidies for foreign-controlled clean energy sources.

- FCX +2.5%: Gained after Trump’s 50% copper tariff announcement, which drove copper futures sharply higher.

- XOM, CVX: Steady as CVX moves to finalize its HES deal and XOM flagged potential Q2 EPS upside in 8-K.

Industrials (+0.01%)

- BLD +3.8%: Announced $810M acquisition of Progressive Roofing, expected to be immediately accretive.

- CACI -3.1%: Downgraded to Market Perform at Raymond James on valuation concerns.

- HON: Evaluating strategic alternatives for several business units, including Productivity Solutions.

Materials (+0.53%)

- FCX (see Energy): rose on copper tariff news.

Real Estate (-0.15%)

- No notable movers reported.

Utilities (-1.07%)

- No notable movers reported.

Consumer Staples (-1.09%)

- HSY (see above): CEO transition drove weakness.

Communication Services (-0.53%)

- META: Hired a top AI exec from AAPL, escalating the AI talent race.

- SOFI +3.7%: Rolled out new private investment access for retail clients, including funds tied to SpaceX and OpenAI.

Eco Data Releases | Wednesday July 9th, 2025

S&P 500 Constituent Earnings Announcements | Wednesday July 9th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.