July 10, 2025

U.S. equity futures edging lower Thursday morning following solid gains on Wednesday, driven by strength in big tech (particularly Nvidia), small caps, and most-shorted stocks. Sector laggards included energy, managed care, telecom, and industrials. Overnight, Asian markets mostly traded higher, with South Korea, Australia, and Greater China leading, while Japan underperformed. European stocks also posted modest gains. Treasuries were slightly weaker, with yields rising by about 1 bp. The dollar ticked down, while gold and bitcoin rose and crude oil dipped modestly. Markets remain in a holding pattern ahead of next Tuesday’s June CPI release and the official kickoff of Q2 earnings season. Despite recent hawkish trade headlines — including Trump confirming 50% tariffs on copper and Brazil — investors appear more focused on potential trade resolution pathways. Favorable seasonality and a lower volatility backdrop (VIX <16) are also seen as technical supports for equities. On the data front, initial jobless claims and a $22B 30-year Treasury auction are on deck today. CPI data next week is expected to show modest monthly increases and headline inflation rising to 2.7% y/y.

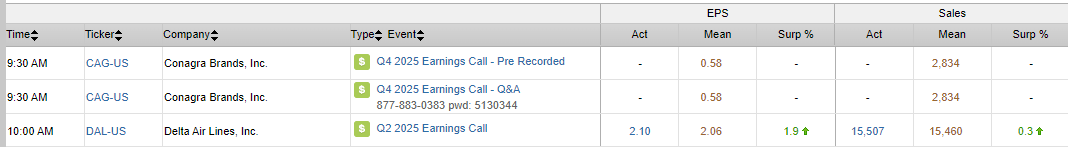

- DAL: Boosted FY guidance citing improved demand.

- AMZN: Reportedly weighing increased investment in AI startup Anthropic.

- OpenAI: Near launch of AI-powered web browser to compete with GOOGL Chrome.

- TSM: June revenue surged nearly 40% Q/Q, aided by strong AI-related demand.

- COST: June U.S. same-store sales rose 5.5%, in line with May.

- ADSK: Said to be exploring potential acquisition of PTC.

- DLTR: Replenished its $2.5B share repurchase authorization.

- AGCO: Announced a new $1B buyback program.

- KLG: Jumped on report that Ferrero is nearing a ~$3B takeover.

- RARE: Dropped on disappointing clinical trial results.

- AZZ: Delivered an earnings beat and raised full-year guidance

U.S. equities rebounded strongly Wednesday (Dow +0.49%, S&P 500 +0.61%, Nasdaq +0.94%, Russell 2000 +1.07%), trimming earlier weekly losses with the S&P 500 and Nasdaq finishing just below record highs. Strength in large-cap tech, semiconductors, and M&A optimism helped drive sentiment, while a solid 10-year Treasury auction and a modest drop in yields added support. The equal-weight S&P underperformed, reflecting heavy gains in the mega-cap names like NVIDIA, which surpassed a $4T market cap.

The June FOMC minutes revealed a range of views on rate cuts: while all participants supported holding in June, a few said cuts could come as soon as July if inflation and growth evolve favorably, while others see no cuts in 2025. The minutes also reiterated inflation remains elevated and highlighted ongoing concern about potential impacts from new tariffs. The 2Y yield slipped post-release as markets interpreted a mild dovish tilt.

On the Fed leadership front, Kevin Hassett and Scott Bessent have reportedly emerged as front-runners to replace Powell, with Warsh’s candidacy fading. Bessent is seen echoing Trump’s criticism of the Fed for keeping rates too high. President Trump reiterated his push for 300 bps of rate cuts and continued to issue tariff letters, though Wednesday’s announcements mostly targeted smaller trading partners. The White House also floated the possibility of new copper and pharma tariffs.

Economic data was light: May wholesale inventories were unchanged, while mortgage purchase applications reached the highest level since early 2023.

S&P 500 Sector Performance

- Outperformers: Utilities +1.00%, Tech +0.94%, Communication Services +0.93%, Consumer Discretionary +0.73%, Industrials +0.70%

- Underperformers: Consumer Staples -0.55%, Energy -0.50%, Real Estate -0.02%, Financials +0.30%, Health Care +0.43%, Materials +0.54%

Information Technology

- NVDA +1.8%: Surpassed $4T market cap. Reports say it plans a China-specific AI chip launch in September; Chinese data centers reportedly ordering over 115K Nvidia chips.

- AAPL: COO Jeff Williams to retire; Sabih Khan named successor. Also seeking U.S. media rights to Formula 1; White House adviser said Apple believes it’s too big to tariff.

- MBLY -7.1%: Guided Q2 revenue above consensus and launched 46M share offering for INTC; also disclosed a manufacturing deal with TSM.

- ADSK: Reportedly exploring acquisition of PTC.

- PENG +10.6%: Posted strong Q3 EPS; revenue light. Positive momentum in Integrated Memory noted.

- DOCS +2.9%: Upgraded to Outperform at Evercore ISI, citing conservative guidance and growth potential in PoC/formulary.

Health Care

- ILMN -1.8%: Downgraded to Sell at Citi on China risks, funding concerns, and competition.

- RYTM +36.6%: Reported strong results from obesity drug trial; achieved significant BMI reductions.

- VRNA +20.6%: To be acquired by MRK for $107/ADS in a ~$10B deal.

- PROK +16.4%: Positive Phase 2 results from kidney disease treatment trial.

- UNH -1.7%: DOJ reportedly investigating Medicare billing; FBI and HHS also involved.

Industrials

- CAT +2.0%: Upgraded to Buy at Melius Research on AI-driven data center power demand.

- PENG +10.6%: (Also listed in Tech) Beat EPS expectations; revenue slightly light.

- BALL -1.4%: Downgraded to Neutral at BofA due to exposure to beer and rising aluminum prices.

Consumer Discretionary

- AMZN -1.8%: Prime Day generated $7.9B in first-day sales (up 10% YoY), but one report flagged a 41% drop vs. 2024 due to comp complications.

- HIMS: Announced plans to expand into Canada in 2026.

- WPP -18.1%: Cut FY25 revenue and margin guidance; cited macro pressures and weak net new business.

- PVH -1.7%: Downgraded to Hold at TD Cowen over structural risks, inventory build, and tariff impacts.

Energy

- AES +19.8%: Exploring strategic options amid reported takeover interest from infrastructure investors.

- BE +18.2%: Upgraded to Overweight at JPMorgan; noted OBBB tax credit inclusion for fuel cells.

- MO -3.0%: Initiated Underperform at Jefferies; noted reliance on declining traditional oral tobacco segment.

Communication Services

- TMUS -1.6%: Downgraded to Underweight at KeyBanc on weak Fiber positioning and macro headwinds.

- META: Reportedly bought ~3% stake in EssilorLuxottica.

- WMG +1.7%: Upgraded to Neutral at BofA; cited cost savings, new DSP deals, and TikTok renewal.

- X (formerly Twitter): CEO Linda Yaccarino announced departure after two years.

Financials

- BNY Mellon: Named custodian for Ripple’s USD stablecoin reserves.

- Financial sector broadly mixed: Money center banks lagged amid early earnings previews.

Utilities & Materials

- RUN +6.8%: Upgraded to Hold at Jefferies citing IRA benefits and the Big Beautiful Bill’s supportive policies.

- FCX +2.5% (Tuesday): Benefiting from Trump’s proposed 50% copper tariff.

Eco Data Releases | Thursday July 10th, 2025

S&P 500 Constituent Earnings Announcements | Thursday July 10th, 2025

Data sourced from FactSet Research Systems Inc.