July 17, 2025

S&P Futures are trading up 0.1% after Wednesday’s gains, with strength in pharma, insurers, asset managers, airlines, and homebuilders. Retail favorites and most-shorted names also outperformed. European markets are broadly higher after a solid session in Asia. Treasuries are weaker with long-end yields up ~2 bps. The dollar is up 0.3%, gold down 0.8%, Bitcoin futures –0.4%, and WTI crude +0.6%.

No new developments overnight on Fed Chair Powell, though Wednesday’s denied firing reports continue to spark concern. Trump said trade deals with India are close and an EU agreement is possible; the EU’s top negotiator is in Washington, though Europe is reportedly preparing retaliatory tariffs, especially on U.S. services.

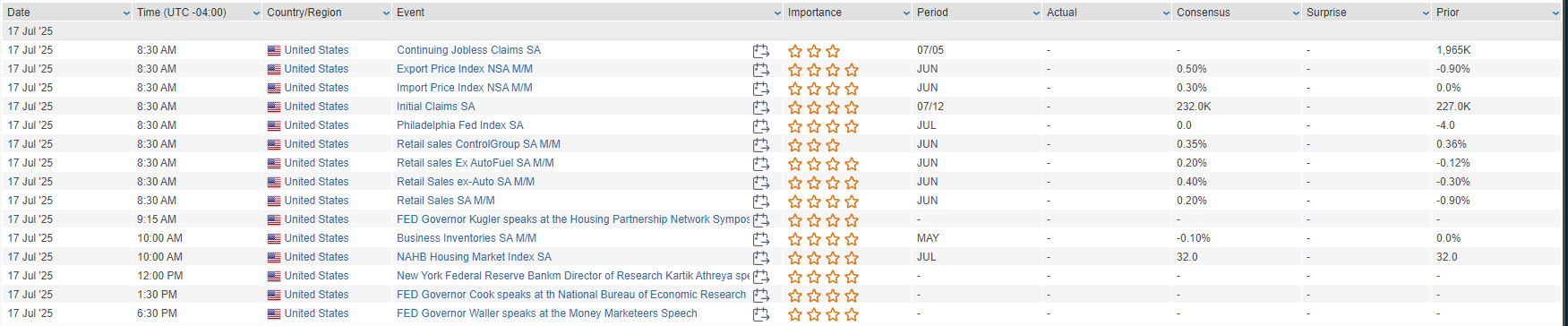

Markets await June retail sales (headline +0.2% m/m expected; control group +0.35%), Philly Fed, jobless claims, and import/export prices. Fed speakers include Kugler, Daly, Cook, and Waller (after the close). Friday wraps the week with UMich sentiment and housing starts.

Earnings Highlights:

- TSMC (TSM) beat on earnings/margins, raised FY revenue guidance but flagged softer Q3 margins.

- United Airlines (UAL) cut FY EPS outlook on soft revenue but cited improving July demand.

- Kinder Morgan (KMI) in line, noted strong project backlog.

- ADM and Ingredion (INGR) under pressure after Trump said Coca-Cola (KO) would resume using cane sugar in U.S. products.

- Alimentation Couche-Tard (ATD.CN) dropped its $46B bid for Seven & i (3382-JP).

- Netflix (NFLX) set to report after the close.

U.S. equities rose on Wednesday (Dow +0.53%, S&P 500 +0.32%, Nasdaq +0.25%, Russell 2000 +0.99%), with the S&P 500 finishing near session highs, modestly recovering from Tuesday’s losses. Treasuries were mostly firmer in a bull steepening move, the 30-year yield holding just above 5%. The dollar fell 0.3%, gold rose 0.7%, Bitcoin futures gained 2.2%, and WTI crude edged down 0.2%.

Markets absorbed a flurry of developments, including a cooler-than-expected June PPI, ongoing Fed speculation, and new trade policy signals. Headline and core PPI were both flat m/m, undercutting consensus, with core annualized PPI down to 2.7%—the lowest since July 2024. Goods prices rose 0.3%, while services fell 0.1%, showing possible tariff pass-through in categories like electronics and apparel.

Industrial production surprised to the upside, rising 0.3% m/m vs forecasts for no change. The Fed’s Beige Book showed a slight increase in economic activity, with labor markets steady and businesses citing continued tariff-related cost pressures.

Fed leadership uncertainty resurfaced after reports suggested Trump was considering firing Chair Powell, citing HQ renovation costs as potential cause. Trump later denied the report, helping the dollar recover. Attention is turning to potential successors, with Hassett, Waller, Bessent, and Warsh in the mix.

Trade tensions remained in focus. Trump said pharma and semiconductor tariffs could arrive by month-end. He suggested starting low and ramping up, while also floating new tariff letters to smaller countries. The USTR launched a new Section 301 probe into Brazil, deepening global trade frictions. Despite the headlines, markets remain anchored by the TACO narrative (Tariffs Are Coming Optimism), though complacency concerns persist.

Thursday brings June retail sales, with consensus for +0.3% headline and +0.2% core ex-autos/fuel. Analysts noted card data was solid, though auto sales may drag due to depleted inventories and higher vehicle prices. Jobless claims, import prices, and housing sentiment also due Thursday, followed by consumer sentiment and housing starts on Friday.

Sector Highlights

Health Care (+1.22%)

- Johnson & Johnson (JNJ) rose 6.2% after beating Q2 earnings and raising guidance. Strong growth from Darzalex and Tremfya in pharma, and Abiomed in MedTech, supported results.

- Lantheus (LNTH) dropped 8.4% after CMS said it would continue reimbursing Pylarify on a mean unit cost basis. Analysts saw the decision as expected but still a near-term headwind.

- Dyne Therapeutics (DYN) jumped 12.7% after CEO John Cox disclosed a 100K share purchase.

- Tempus AI (TEM) rose 7.3% after receiving FDA 510(k) clearance for its ECG-Low EF software.

- HCA Healthcare (HCA) fell 2.5% after a downgrade at BofA, which cited Medicaid and ACA headwinds from the OBBB bill.

Financials (+0.66%)

- Bank of America (BAC) reported mixed results: EPS beat driven by trading and IB strength, but NII and NIM missed. Loan growth cited as a positive.

- Morgan Stanley (MS) beat on EPS and revenue, but shares fell 1.3% on underwhelming Q3 NII guidance.

- Goldman Sachs (GS) beat across IB, FICC, and equities, though the stock finished lower.

- PNC and MTB both reported solid fee income and credit metrics; however, MTB’s NII and NIM missed.

- First Horizon (FHN) rose 2.1% on a Q2 beat and lowered FY expense guidance.

- Blackstone (BX) gained 3.8% on news that Trump will allow 401(k) plans to invest in private assets.

- Brighthouse Financial (BHF) climbed 6.2% amid reports Aquarian Holdings is in exclusive talks to acquire the company.

- Global Payments (GPN) gained 6.5% after FT reported Elliott Management has taken a sizable stake.

Real Estate (+1.07%)

No major headlines, though the sector benefited from lower long-end yields and broader risk-on sentiment.

Industrials (+0.35%)

- Jacobs Solutions (J) rose 3% after a KeyBanc upgrade, citing progress in its restructuring and improved risk/reward outlook.

- Rockwell Automation (ROK) gained 1.5% following a BofA upgrade to Buy, highlighting traction in operational turnaround.

Information Technology (+0.27%)

- ASML fell 8.3% despite Q2 bookings beating; Q3 guidance missed, and the company pulled its 2026 outlook citing macro/geopolitical risks.

- Arm Holdings (ARM) rose 4.6% on a BNP Paribas Exane upgrade to Outperform.

- Rigetti Computing (RGTI) surged 30.1% after achieving a 99.5% median two-qubit gate fidelity milestone on its 36-qubit quantum system.

Consumer Staples (+0.18%)

- United Natural Foods (UNFI) rallied 12.3% after raising its FY revenue outlook despite lowering EPS guidance due to a cyberattack.

Consumer Discretionary (–0.02%)

- Ford (F) declined 2.9% after announcing $570M in costs tied to field service actions.

- UNFI‘s retail exposure also contributed to discretionary sentiment despite its revenue outlook boost.

Energy (–0.84%)

Sector underperformed as oil prices dipped and geopolitical uncertainty continued to weigh on investor sentiment. No major stock-specific headlines.

Materials (+0.30%)

Muted performance despite tariff concerns. Broader trade uncertainty and weaker sentiment in China-linked names like ASML weighed.

Utilities (+0.06%)

Communication Services (–0.15%)

Eco Data Releases | Thursday July 17th, 2025

S&P 500 Constituent Earnings Announcements | Thursday July 17th, 2025

Data sourced from FactSet Research Systems Inc.