July 18, 2025

Futures are slightly higher, extending Thursday’s rally that saw the S&P 500 and Nasdaq close at record highs. Big tech led, along with strength in beverages, software, semis, and machinery. European and Asian markets are broadly higher. Treasuries are firmer with slight curve flattening. The dollar is down 0.4%, gold up 0.4%, Bitcoin futures –0.2%, and WTI crude +1.0%

Fed policy remains in focus after Governor Waller said a July rate cut is justified given cooling inflation and labor market risk, and that the Fed should look through tariff-driven price increases. Meanwhile, Fed Chair Powell released more HQ renovation details while facing political pressure, including a criminal referral threat from a member of Congress.

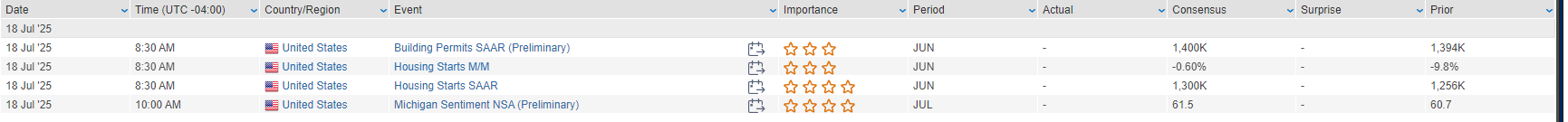

On the economic front, June housing starts and preliminary July University of Michigan sentiment are due this morning. Sentiment is expected to tick higher, though inflation expectations may rise slightly amid tariff developments. Next week’s calendar is light on macro but heavy on earnings, with Powell due to speak Tuesday.

Earnings & Headlines:

- Netflix (NFLX) slightly beat and raised guidance; seen as solid though expectations were high.

- Interactive Brokers (IBKR) beat on NII.

- Western Alliance (WAL) topped on NII but NIM was soft.

- Bank OZK (OZK) beat on loan and deposit growth.

- Chevron (CVX) rose after prevailing in mediation over Guyana assets, clearing way to acquire Hess (HES).

- Union Pacific (UNP) is reportedly in early talks to acquire Norfolk Southern (NSC).

- Sarepta (SRPT) trading lower on reports of a patient death.

U.S. stocks climbed Thursday (Dow +0.52%, S&P 500 +0.54%, Nasdaq +0.74%, Russell 2000 +1.20%), with the S&P 500 and Nasdaq closing at new record highs as gains were broad-based across cyclicals, tech, and financials. Treasury yields moved higher in a curve-flattening move, with the 30-year hovering just above 5%. The dollar gained 0.2%, gold fell 0.4%, Bitcoin futures slipped 0.1%, and WTI crude rose 1.6%.

Economic data continued to surprise to the upside. June retail sales rose 0.6% m/m—best since March—beating expectations across all major subgroups, including ex-autos and control group categories. Initial jobless claims fell to 221K, the lowest since April and down for the fifth consecutive week. The Philadelphia Fed manufacturing index jumped to +15.9 in July from –4, breaking a three-month streak of negative readings, though price pressures persisted with a 17-point rise in prices paid.

The Fed narrative remained steady, with Governor Kugler advocating for steady rates amid tariff-related inflation risk, while San Francisco’s Daly backed two cuts in 2025. Governor Waller, speaking after the close, said current policy is “entirely appropriate” but warned tariffs may add inflation pressure.

On the trade front, Trump reiterated that deals with India and the EU remain possible, though the EU continues preparing retaliatory tariffs, particularly on services. The U.S. announced a 93.5% tariff on Chinese graphite, escalating battery-supply chain tensions. Japan reported declining exports for a second month, and multiple companies noted impacts from U.S. tariffs.

Company-Specific News by GICS Sector

Information Technology (+0.89%)

- Taiwan Semiconductor (TSMC) rose 3.4% after a strong Q2 beat and raised FY revenue outlook, citing strong structural demand, though it flagged FX headwinds and trade risk.

- CoreWeave (CRWV) fell 7.6% after HSBC initiated with a Reduce rating and a PT of $32, citing concentrated revenue exposure and overvaluation after its IPO surge.

Financials (+0.92%)

- U.S. Bancorp (USB) reported light NIM and guided Q3 NII below consensus, though Q2 results otherwise solid.

- MMC reported a Q2 EPS and revenue beat.

Industrials (+0.87%)

- GE Aerospace (GE) beat on Q2 EPS, revenue, and free cash flow, with 20% order growth and raised FY guidance. Shares slipped 2.2% amid elevated expectations.

- CSX rose 3.7% amid reports that Union Pacific (UNP) is pursuing a takeover of an unnamed rival.

- Snap-On (SNA) gained 7.9% after a Q2 beat, led by U.S. strength in its Tools Group. Management highlighted resilience despite macro uncertainty

- Kratos Defense (KTOS) rose 8.5% on reports the Pentagon is ramping up low-cost drone production.

- ManpowerGroup (MAN) gained 2.9% following a Q2 beat and optimistic Q3 guidance. Management cited U.S. stabilization and continued AI investments.

Health Care (–1.18%)

- Elevance Health (ELV) sank 12.2% after missing Q2 EPS and cutting full-year guidance on rising Medicaid and ACA medical costs.

- Abbott (ABT) fell 8.5% despite in-line Q2 results. Organic growth missed due to COVID testing weakness and procurement issues in China.

- Sarepta Therapeutics (SRPT) surged 19.6% after announcing a major restructuring plan, including 36% workforce reduction and leadership changes.

Consumer Staples (+0.87%)

- PepsiCo (PEP) climbed 7.5% after a Q2 beat with strength in NA beverages and growth in EMEA/LatAm. It raised FY core EPS growth guidance.

- Mondelez (MDLZ) rose 3.5% following a Jefferies upgrade, citing strength in European demand and successful Easter sales.

- United Natural Foods (UNFI) rose 12.3% the prior session after raising FY revenue guidance.

- ADM and Ingredion (INGR) traded lower after Trump said Coca-Cola (KO) would switch back to using cane sugar in U.S. products.

Consumer Discretionary (+0.31%)

- Lucid (LCID) soared 36.2% after announcing a $300M investment from Uber, which also plans to deploy 20K Lucid vehicles in a robotaxi fleet starting next year.

- Steven Madden (SHOO) rose 6.3% on a Citi upgrade citing underappreciated benefits from the KG acquisition.

- Sonic Automotive (SAH) fell 10.4% on a JPM downgrade, citing auto tariff exposure and valuation.

- Dollar General (DG) slipped 3% after its CFO announced plans to resign.

Materials (+0.60%)

- Alcoa (AA) rose 2.9% after beating on Q2 earnings and noting strength in aluminum production, despite near-term tariff volatility.

Real Estate (–0.16%)

No major headlines, though rising yields and caution around valuations pressured rate-sensitive segments.

Utilities (+0.37%)

No sector-specific news, sector modestly higher with broader market but lagged cyclicals.

Communication Services (+0.36%)

- Lucid-Uber announcement also buoyed sentiment across mobility-linked tech.

- Anticipation continues ahead of Netflix (NFLX) earnings post-close.

- Meta settled a privacy case, though terms undisclosed.

Energy (+0.43%)

- Kinder Morgan (KMI) reported in-line Q2 earnings, highlighting project backlog.

- Global headlines noted Petrobras may redirect oil to Asia due to U.S. tariffs, and Iraq-Kurdistan crude exports are set to resume.

Eco Data Releases | Friday July 18th, 2025

S&P 500 Constituent Earnings Announcements | Friday July 18th, 2025

Data sourced from FactSet Research Systems Inc.