July 22, 2025

S&P futures down 0.1% in Tuesday morning trading after a mixed, uneventful Monday where major indexes faded late but still closed at record highs. Telecom, industrial metals, and Mag 7 tech names outperformed; machinery, energy, pharma, builders, and small caps lagged. Asian markets were mixed with Hong Kong higher, while South Korea and Taiwan slipped on tech weakness. Europe down ~0.7%. Treasuries weaker, yields up 1–2 bp. Dollar flat. Gold down 0.3%. Bitcoin +1%. WTI crude -1%.

No clear macro catalyst, as markets wait on Big Tech earnings and the Aug. 1 tariff deadline. Optimism persists around the TACO narrative, strong U.S. macro data, and a low-volatility backdrop that’s supporting systematic and retail flows, with buybacks expected to ramp into month-end.

M&A chatter: Semafor said BNSF (BRK.B) may pursue NSC or CSX. Also, GS reportedly exploring deals, including talks with NTRS.

Macro calendar remains light. Richmond Fed index today; June home sales and a $13B 20-year auction Wednesday; claims, PMIs, and new home sales Thursday; durable goods Friday. Fed blackout continues, with no policy change expected next week, though possible dissents from Waller and Bowman. Market pricing in ~45 bp of rate cuts by year-end.

Earnings highlights:

- NXPI beat and guided up, but auto softness flagged.

- STLD EBITDA light on shipments.

- CCK beat and raised; beverage units were standouts.

- MEDP up on strong Q2 bookings/sales and guidance raise; lifted CRO peers.

- ZION core PPNR, NII, and fees ahead; credit solid.

- CALX beat/raised on large customer growth.

- AGYS slightly missed EPS; reiterated FY guide.

U.S. equities ended Monday mixed (Dow (0.04%), S&P 500 +0.14%, Nasdaq +0.38%, Russell 2000 +0.40%), with the S&P 500 and Nasdaq both setting fresh record closes despite late-session weakness. Big Tech outperformance, led by GOOGL, AMZN, and META, supported index gains. Treasury yields fell 5–6 bp at the long end, pushing the 30Y closer to 4.9%, while the dollar weakened by 0.5%. Gold rose 1.4%, WTI crude fell 0.2%, and Bitcoin futures declined 0.6%.

The session was quiet in terms of directional macro drivers. The lower yield backdrop reflected no spillover from Japan’s expected upper-house election results. The TACO trade narrative (Tariffs Are Coming Optimism) remains intact as investors monitor the run-up to the Aug. 1 deadline for U.S.-EU tariffs. Markets still anticipate ~50 bp of Fed easing by year-end, with positive sentiment also supported by strong early Q2 earnings metrics, accelerated depreciation incentives from the reconciliation bill, and AI monetization tailwinds.

Trade negotiations with the EU are in focus this week, with high-stakes meetings underway. The U.S. is pushing for near-universal tariffs of 15–30%, while the EU is preparing countermeasures including retaliatory tariffs, digital service levies, and procurement restrictions. German officials signaled increased support for EU-wide retaliatory action, suggesting diminishing odds for a deal. Meanwhile, U.S.-China trade headlines were quieter, though SCMP reported Trump and Xi may meet at APEC in October, and rare earth exports from China to the U.S. surged 667% m/m in June.

The U.S. economic calendar remains light until midweek, when June existing home sales and a $13B 20-year Treasury auction are due Wednesday. Thursday brings initial claims, flash PMIs, and new home sales, followed by durable goods orders on Friday. No Fedspeak is expected during the blackout period ahead of the July FOMC meeting, though Powell will speak Wednesday at a capital framework conference.

Early Q2 earnings season metrics have exceeded expectations. FactSet notes blended S&P 500 earnings growth of 5.6%, with 83% of reporters beating consensus and average EPS surprises running nearly 8% above forecasts. However, positive surprises have not consistently translated into upside stock moves, as valuations remain elevated following a strong Q2 rally. Major macro themes include healthy consumers, benign credit, robust M&A pipelines, and optimism around accelerated depreciation benefits and AI-driven CapEx.

S&P 500 Sector Performance

- Outperformers: Communication Services +1.90%, Consumer Discretionary +0.60%, Materials +0.54%, Real Estate +0.35%, Utilities +0.29%

- Underperformers: Energy (0.96%), Healthcare (0.61%), Industrials (0.60%), Financials (0.29%), Consumer Staples +0.04%, Tech +0.13%

Information Technology

- MSFT (0.0%): In focus amid reports of a global hack on SharePoint collaboration software.

- NVDA (-0.2%): The Information reported limited availability of H20 AI chips with no near-term plans to resume production.

- EQIX +1.5%: Boosted by reports Elliott Management has increased its stake, pressuring management for changes.

- CRWV +1.5%: Price target raised at Barclays on stronger May/June channel checks, ahead of Q2 earnings.

- AVTR -7.2%: Named Emmanuel Ligner as new CEO, effective August 18.

Communication Services

- GOOGL +1.9%: Benefited from a profile highlighting YouTube as the most-watched video platform on U.S. televisions.

- META +1.9%: Ongoing AI hiring spree drawing positive media attention; company declined to sign EU AI code of practice.

- DJT +3.1%: Announced it holds ~$2B in Bitcoin and crypto-related securities, ~two-thirds of liquid assets.

Consumer Discretionary

- DPZ -0.5%: Q2 EPS missed, though revenue and comps beat.

- DLTR +2.0%: Upgraded to overweight at Barclays, citing consumer trade-down tailwinds for 2H25.

- XYZ +7.2%: Jumped after announcement it will replace HES in the S&P 500 this week.

Financials

- IVZ +1.4%: Upgraded at TD Cowen; noted decision to transition QQQ from UIT to open-end structure.

- No major banks moved significantly, though sector underperformed modestly (-0.29%).

Health Care

- GMED -7.9%: CEO resigned to join XRAY; CFO/COO Pfeil to succeed.

- SRPT -5.4%: FDA placed LGMD trials on clinical hold, said firm refused request to pause sales of Elevidys.

- BRKR -12.1%: Guided Q2 EPS ~21% below Street; flagged weak academic and biopharma demand.

Materials

- CLF +12.5%: Revenue miss, but positive EBITDA vs. expected loss; cost performance to improve into 2H25.

Eco Data Releases | Tuesday July 22nd, 2025

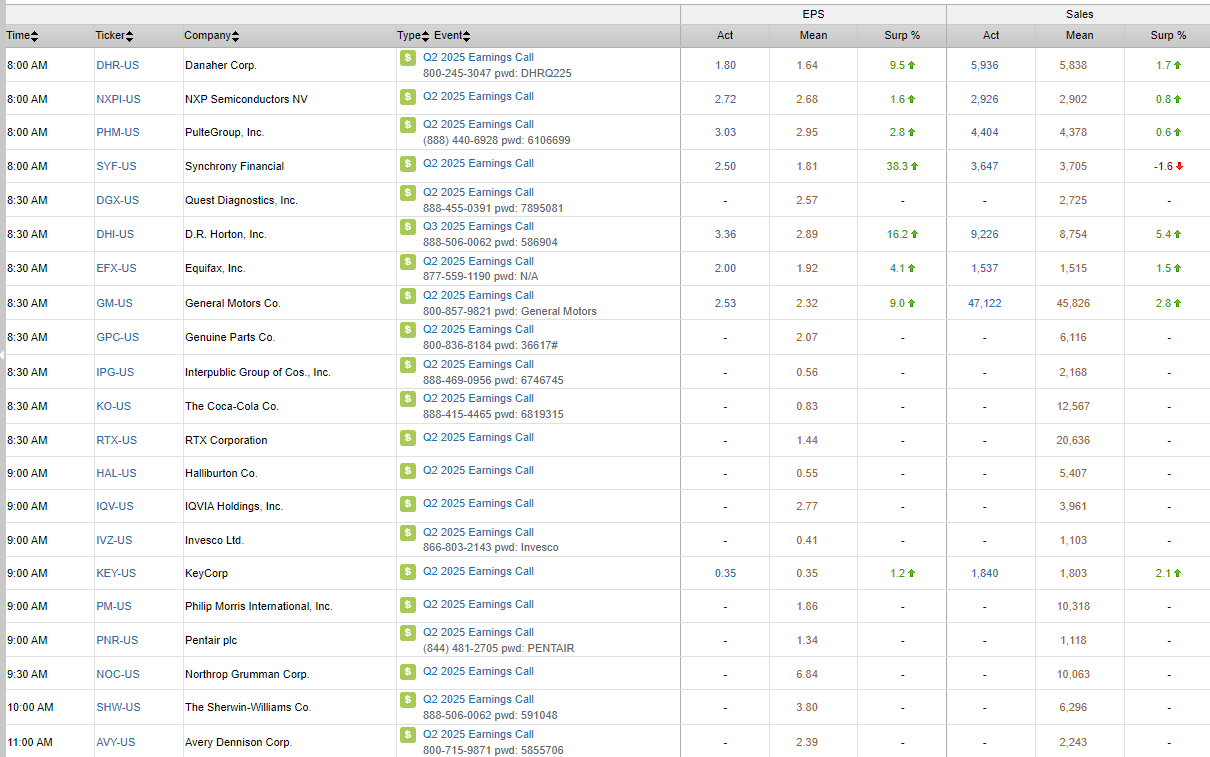

S&P 500 Constituent Earnings Announcements | Tuesday July 22nd, 2025

Data sourced from FactSet Research Systems Inc.