February 27, 2025

S&P futures +0.5% after a mixed Wednesday where S&P and Nasdaq snapped their four-day losing streaks. Semis led, staples lagged. Asian markets mixed (Japan, China higher; Hong Kong weaker), while Europe down 0.6%. Treasuries lower, though rates still down for the week. Dollar +0.2%, Gold -0.9%, Bitcoin +2.4%, WTI crude +0.9%.

Key Themes:

- NVDA earnings dominate headlines after the company posted another strong beat and raise, citing “extraordinary demand” for its next-gen Blackwell platform, which is now fully ramped. The company emphasized a major AI acceleration, highlighting that DeepSeek’s new reasoning models require 100x more compute than traditional pre-training methods. Despite the bullish outlook, some investors focused on weaker-than-expected gross margin guidance, which pressured shares after hours.

- Tariff uncertainty: A flurry of contradictory trade headlines on Wednesday afternoon created confusion, though some strategists believe tariff threats remain primarily a negotiation tactic rather than imminent policy changes.

- Economic data: Q4 GDP revised to +2.3% (vs. prior +2.5%), with consumer spending up 4.2%. Durable goods, pending home sales, and jobless claims ahead.

- Washington: Trump meets UK PM Starmer, with Ukraine a key discussion point.

Corporate Highlights

CRM’s FY26 guidance came in soft. SNPS maintained its FY25 outlook despite weaker China trends. CRH pointed to strong demand and pricing momentum. SNOW’s FY26 product revenue guide was ahead of estimates. A trimmed its FY25 revenue guidance, citing FX headwinds. EBAY’s Q1 GMV outlook was weaker than expected. HEI posted a beat, with Defense strength a standout. PSTG was hit by weaker gross margins and slowing RPO growth. INVH saw new lease rate growth pressured, though some expect a reacceleration. UHS beat expectations and raised guidance. PARA missed on margins. URBN exceeded expectations on gross margin strength. SG reported soft comp growth and retail margin light. MGNI flagged a slowdown in advertiser spending due to the election cycle. TNDM fell sharply after a sales miss. GEF missed and noted no signs of demand inflection. VAC reported a Q4 EBITDA beat, but its 2025 guidance was weak. AI declined amid concerns over revenue mix. TDOC tumbled on core business headwinds

U.S. equities were narrowly mixed on Wednesday (Dow (0.43%), S&P 500 +0.01%, Nasdaq +0.26%, Russell 2000 +0.19%), with the S&P 500 and Nasdaq eking out small gains after a four-session decline. Afternoon selling pressure came after Trump announced new tariff plans, including a 25% broad tariff on EU imports and potential April 2 tariffs on Canada and Mexico. The AI growth narrative remained supportive, with NVDA expected to post another strong quarter, and reports that META is considering a $200B AI data center investment.

On the macro front, January new home sales plunged 10.5%, adding to concerns after weak housing starts and existing home sales. Fed officials Barkin and Bostic maintained a cautious stance, with Bostic emphasizing the need for restrictive policy due to lingering inflation risks. Treasuries rallied again, with the 7-year note auction stopping through at the lowest yield since September, following strong demand for 2- and 5-year notes earlier this week. Dollar +0.2%, gold +0.4%, Bitcoin -4.1% (back to $83K, lowest since Nov 11), WTI crude -0.5%, copper +1.3%.

Sector & Company Highlights

Technology (+0.89%)

- NVIDIA (NVDA): Expected to report strong earnings and raise guidance after the close, reinforcing AI-driven demand.

- Workday (WDAY) +6.2%: Q4 revenue, EPS, and backlog all ahead of expectations. FY26 subscription growth guidance reiterated.

- ZoomInfo (ZI) +23.1%: Q4 EPS and revenue beat; signs of stabilization after two years of declines.

- Keysight (KEYS) -6.9%: Beat Q1 earnings but disappointed with growth outlook despite AI tailwinds.

Consumer Discretionary (-0.39%)

- Lowe’s (LOW) +1.9%: Posted positive Q4 comps despite a challenging environment. FY25 guide slightly below expectations.

- TJX (TJX) +1.8%: Q4 comps up 5%, better than expected. Margins also improved, though FY25 guidance seen as conservative.

- Jack In The Box (JACK) +11.8%: Q1 EPS and comps beat. Company announced cost-cutting measures to improve free cash flow.

- Lucid (LCID) -13.6%: Q4 EPS and revenue ahead, but 2025 production outlook disappointed. CEO stepping down.

- Steven Madden (SHOO) -8.1%: Q4 revenue and EPS beat, but FY25 guidance flagged tariff impact.

Consumer Staples (-1.86%)

- Grocery Outlet (GO) -30.2%: Margin miss and weaker FY25 guidance weighed heavily on stock. Store openings reduced.

- Vita Coco (COCO) -11.7%: Q4 revenue slightly ahead, but FY25 guidance below expectations. Uncertainty around tariffs flagged.

- Boston Beer (SAM) – Stepping up advertising investments in 2025.

Healthcare (-0.69%)

- Alcon (ALC) +2.4%: Q4 revenue slightly ahead. Announced $750M buyback.

- Masimo (MASI) +12.4%: Q4 beat with strong cost control and Healthcare segment growth.

- United Therapeutics (UTHR) -10.8%: Q4 EPS missed, R&D expenses higher than expected.

Industrials (+0.06%)

- Axon (AXON) +15.3%: Q4 earnings and guidance above expectations; expanding total addressable market.

- General Motors (GM) +3.8%: Announced a $6B buyback and dividend hike.

Financials (-0.21%)

- Advance Auto Parts (AAP) -17.8%: Q4 comps fell less than expected, but FY25 guidance was mixed.

Utilities (+0.38%)

- NRG Energy (NRG) +10.6%: Q4 EBITDA beat and announced a JV with GE Vernova to expand power generation.

Energy (-0.49%)

- First Solar (FSLR) +6.4%: Q4 EPS missed on margins, but revenue beat. FY25 guidance viewed positively.

Communication Services (+0.09%)

- AppLovin (APP) -12.2%: Hit by two short-seller reports alleging AI advertising misrepresentation.

Eco Data Releases | Thursday February 27th, 2025

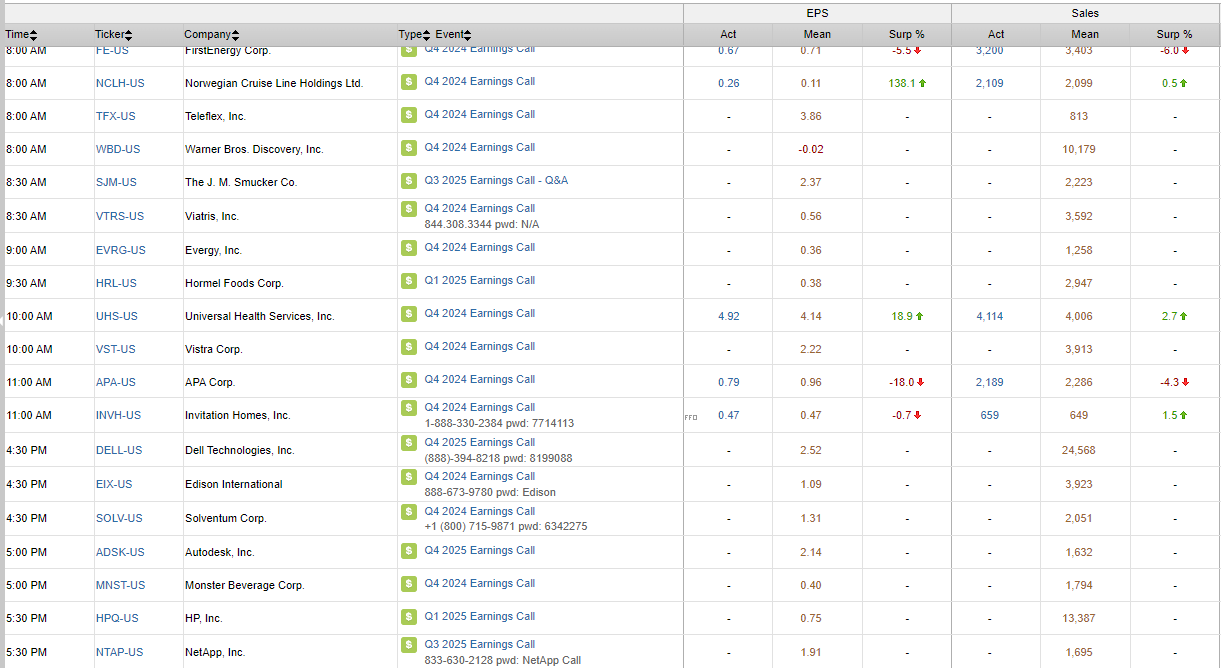

S&P 500 Constituent Earnings Announcements | Thursday February 27th, 2025

Data sourced from FactSet Research Systems Inc.