July 31, 2025

S&P futures up 1.0% in early Thursday trading, bouncing after Wednesday’s broad-based selloff that saw ~70% of the S&P 500 close lower. Laggards included energy, copper, logistics, packaging, builders, and HPCs. Outperformers were healthcare, semicap equipment, cruise lines, casual diners, casinos, tobacco, and apparel. Asian markets mostly fell with China and Hong Kong off >1%, while Japan rose >1%. Europe was narrowly mixed. Treasuries held steady after Wednesday’s backup in yields. Dollar index -0.1% after five-day rally. Gold +0.3%. Bitcoin futures +1.3%. WTI crude -0.3%.

Macro & Policy Drivers:

- Big tech earnings (MSFT, META) lifted sentiment, reaffirming AI secular growth.

- Trade news constructive: Trump finalized a deal with South Korea (15% tariff), expects more deals before 1-Aug reciprocal tariff deadline, and plans to speak with Mexico’s president today.

- Other headwinds include hawkish Powell press conference, dampened Fed rate cut expectations, month-end pension selling, and seasonal trends.

- Corporate buyback windows reopening and systematic fund flows in focus.

Earnings Highlights:

- MSFT (+): Boosted by 39% Azure growth.

- META (+): Strong engagement and advertising from AI tailwind.

- LRCX (+): Beat and raised, though higher China exposure flagged.

- QCOM (+): Beat; handset revenue light, iPhone share loss noted.

- ARM (~): In-line with mixed guide; flagged rising R&D, weaker handset demand.

- CVNA (+): Surged on big Q2 beat.

- F (-): Tariff and recall risks weighed on outlook.

- WDC (+): Beat and raised; positive HDD demand/pricing backdrop.

- EBAY (+): GMV ahead, strong guide.

- DXCM (-): Soft guide raise and CEO transition.

- FFIV (+): Beat and raised on software/systems strength.

- ALB (+): Beat; expects positive FCF.

- ALGN (-): Miss on tariff-related conversion challenges.

Upcoming Data Releases (Thursday–Friday):

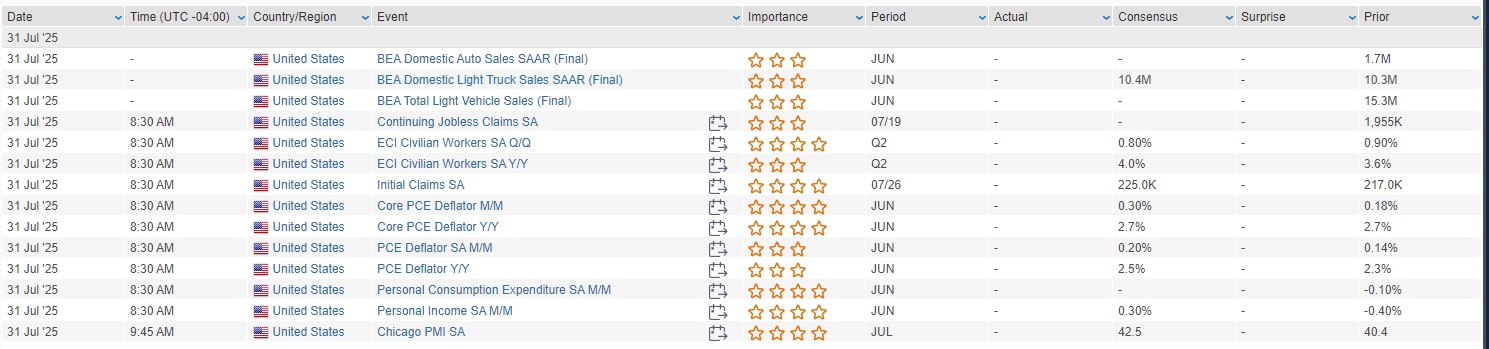

- Thu: Q2 Employment Cost Index (ECI est. +0.8%), core PCE (est. +0.3% m/m, +2.7% y/y), June personal income & spending, initial claims (est. 224K), Chicago PMI (est. 42.0).

- Fri: July jobs report (NFP est. +110K, unemployment 4.2%), ISM manufacturing, construction spending, final Univ. of Michigan sentiment.

U.S. equities finished mostly lower on Wednesday as the S&P 500 (-0.12%) declined for a second straight session, while the Dow (-0.38%) and Russell 2000 (-0.47%) also posted losses. The Nasdaq Composite eked out a gain (+0.15%), supported by strength in selective growth areas. The broader market was weighed down by a hawkish tone from Fed Chair Powell following the July FOMC decision, which kept rates unchanged at 4.25–4.50% but featured dovish dissents from Governors Waller and Bowman. Powell’s press conference pushed the odds of a September rate cut back to 50%, down from 61% intraday. Meanwhile, macro data came in strong: Q2 GDP rose 3.0% q/q vs 2.0% expected, led by consumer strength and import contraction; core PCE climbed to 2.5%, highest since Q4-24. ADP private payrolls also beat with a +104K print, and pending home sales surprised on the downside at -0.8% m/m. On the policy front, President Trump imposed new tariffs on India (25%), Brazil (an additional 40%, totaling 50%), and copper (50%, excluding refined products), while also eliminating the de minimis exemption for commercial parcel shipments. Treasury left refunding auction sizes unchanged but increased long-end buyback frequency from twice to four times per month.

Sector performance was led by Utilities (+0.69%), Technology (+0.43%), and Communication Services (+0.15%), while Materials (-1.99%), Real Estate (-1.43%), and Energy (-1.35%) posted the biggest declines. Defensive sectors outperformed cyclicals amid a risk-off tone, and higher-duration names benefited from late-day dip-buying in growth tech. Weakness in industrials, materials, and housing-linked names reflected tariff concerns and cautious macro outlooks.

Company-Specific Highlights

Information Technology

- TER (+18.9%): Beat earnings; cited strong demand in AI-related semiconductor testing; improving visibility.

- STX (-3.5%): Earnings beat, but guidance missed; concerns over global minimum tax and slowing HAMR ramp.

Consumer Discretionary

- WING (+26.9%): EPS, revenue beat; raised FY outlook and dividend.

- PTON (+18.8%): Upgraded by UBS on FY26 EBITDA optimism.

- HOG (+13.4%): Missed Q2; withdrew FY guide on tariff uncertainty; offloaded loan book in $5B PIMCO/KKR deal.

- CAKE (+5.2%): Modest comp beat; reaffirmed FY revenue outlook.

- VFC (+2.6%): FQ1 beat; North Face and Timberland momentum offset Vans drag.

- SHOO (-9.3%): Soft sales; ongoing macro and tariff-related uncertainty.

- NXT (-9.3%): AI/robotics business initiative announced; mixed analyst sentiment on backlog.

Health Care

- HUM (+12.4%): Q2 beat; raised guidance; managed care outlook improved.

- PEN (+11.9%): Strong Thrombectomy growth; raised full-year outlook.

- SRPT (+5.8%): FDA staff change seen as a positive.

- TEVA (+1.8%): Beat and raised low end of EPS guidance; lifted UZEDY outlook.

- UNM (-12.2%): Missed on earnings; higher disability claims pressured margins.

Communication Services

- FUBO (+17.5%): Raised Q2 EBITDA guidance well above consensus.

- EA (+5.7%): Q1 beat; full-year guide held steady.

- ETSY (+2.8%): Strong ad-driven revenue; buyer count slightly missed.

Industrials

- FTAI (+26.6%): Aerospace EBITDA up 81% y/y; raised FCF target.

- IEX (-11.3%): Q2 beat but soft guide; flagged order flow decline.

- ODFL (-9.7%): Weaker Q2; soft freight volumes and labor cost pressure noted.

- ITW (-2.3%): Organic growth mixed; EPS beat, but margin guide was trimmed for FY25.

- LSTR (flat): EPS beat; commentary cautious on truckload demand.

Materials

- HSY (+1.4%): EPS beat; cocoa costs mitigated; tariff-related EPS headwind acknowledged.

- SW (-1.7%): Mixed margins; no tariff impact yet seen on flows.

- MDLZ (-6.6%): NA organic growth weak; EM strength offset; FY guide reiterated.

Energy

- WTI crude settled +1.1% at $70 for the first time since June 20.

- No standout company-specific earnings drivers noted today; macro headwinds dominated.

Real Estate / Financials

- NTRS: Announced $2.5B buyback.

- June pending home sales declined more than expected; REITs and homebuilders under pressure.

Utilities

- Sector rose on defensive flows and favorable rate backdrop. No major earnings headlines

- ENTG (-14.5%): Q2 results solid, but Q3 guide soft; fab activity remains muted despite AI-linked strength.

Eco Data Releases | Thursday July 31st, 2025

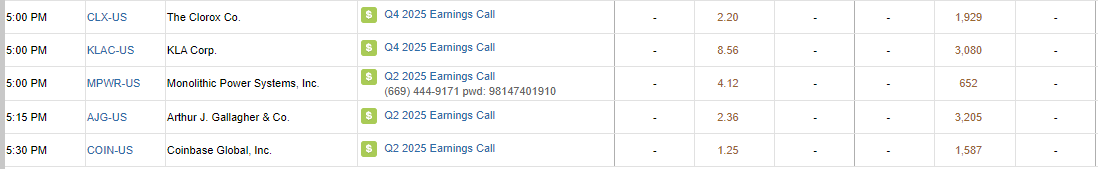

S&P 500 Constituent Earnings Announcements | Thursday July 31st, 2025

Data sourced from FactSet Research Systems Inc.