August 1, 2025

S&P futures down 1% in early Friday trading, following broad weakness in Thursday’s session. Initial gains from upbeat MSFT and META earnings faded as pressure resumed in pharma, med-tech, biotech, banks, asset managers, and energy. Asian markets declined sharply overnight, led by South Korea (-4%) and Hong Kong (-1%). Europe also down over 1.5%. Treasuries weaker with yields up 2–3 bp, the dollar up another 0.2% (now +2.5% on the week). WTI crude -0.7%, Bitcoin futures -1.3%, gold +0.1%.

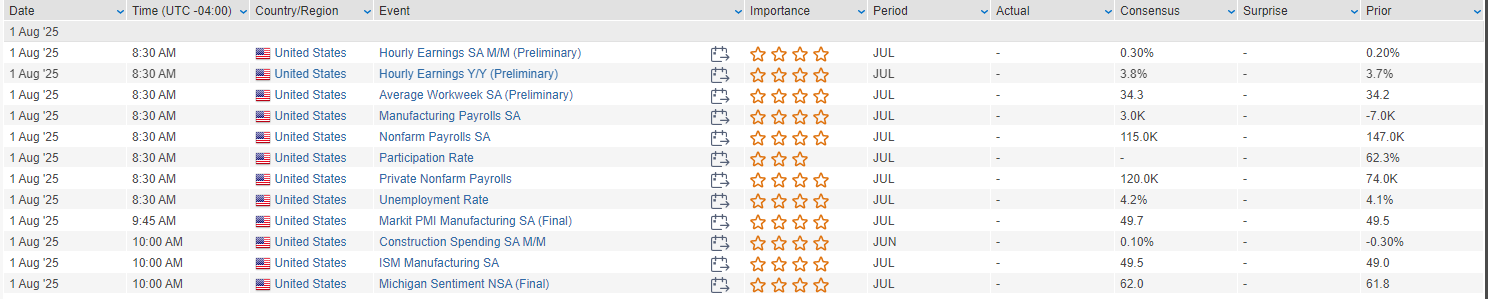

Macro backdrop remains risk-off heading into a packed data day:

- July NFP expected +105K (vs. June +147K); UR seen rising to 4.2%, AHE +0.3% m/m

- ISM manufacturing expected to rise to 49.5 (from 49.0)

- Other releases: construction spending, final July Michigan sentiment

Markets are digesting a last-minute flurry of tariff announcements, including increased effective rates and expanded sector exposure, dampening enthusiasm around the “TACO” trade. At the same time, mixed big tech earnings (AMZN weak on AWS margins; AAPL strong on iPhones) and Powell’s hawkish tone have revived concerns over valuation, higher-for-longer rates, and summer seasonality. Supportive themes include strong macro data, post-reconciliation fiscal clarity, continued earnings beats, and resumed buybacks.

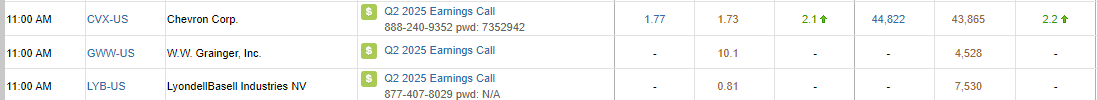

Earnings Highlights:

- Tech:

- AAPL up on iPhone and China strength

- AMZN beat, but AWS growth/margin underwhelmed

- KLAC beat on strong Process Control demand

- RDDT surged on user and ad momentum

- DXC beat, raised guide, touted AI integration

- Healthcare:

- SYK strong in MedSurg/Ortho but bar seen as high

- ILMN beat and raised despite weak academic trends

- Consumer:

- CLX organic growth solid

- BOOT beat and raised

- COLM fell sharply on U.S. weakness

- BZH missed, flagged tough Texas sales environment

- Industrials/Materials:

- IR raised FY EPS on FX; volumes steady

- EMN, HUN missed; weak construction demand persists

- Other Movers:

- COIN slipped despite in-line Q, Stablecoin traction noted

- FSLR beat, raised margins, sales, volume outlook

- FNMA, FMCC rallied on privatization chatter

- MODG down on CEO exit, delayed Top Golf spin-off

U.S. equities declined Thursday (Dow -0.74%, S&P 500 -0.37%, Nasdaq -0.03%, Russell 2000 -0.93%), closing near session lows as macroeconomic and trade-related developments weighed broadly on sentiment. A hawkish read-through from the Fed’s recent policy meeting, coupled with hotter-than-expected inflation metrics, tempered rate-cut expectations and underpinned a sixth straight gain in the U.S. dollar.

June core PCE rose +0.26% m/m (in line), but marked the highest monthly increase since February. Annualized core PCE came in at 2.8%, slightly above consensus. June personal spending rose +0.3% (vs. +0.4% expected), while personal income increased +0.3%, in line. Q2 Employment Cost Index surprised to the upside at +0.9% q/q (vs. +0.8% expected), reinforcing sticky wage growth narratives.

Trade policy remained a key focus ahead of Trump’s August 1 “snapback” tariff deadline. Mexico received a 90-day extension, while South Korea reached a deal involving a 15% tariff and major U.S. energy purchase pledges. However, new 25–50% tariffs were levied on India and copper imports, respectively, and Trump signaled executive action could target Canada and Taiwan next—fueling market jitters and pressuring materials.

July’s Chicago PMI surprised to the upside at 47.1 (vs. 42.0 expected), while initial jobless claims held steady at 218K, slightly better than expected. Friday’s July employment report looms large, with expectations centered on 115K NFP growth and a tick higher in unemployment to 4.2%.

Month-end flows were flagged as a headwind, though offset by the reopening of corporate buyback windows and systematic fund activity.

Information Technology (S&P -0.31%)

- Microsoft (MSFT +4.0%): Beat on top/bottom line; Azure growth of +39% y/y cc outpaced expectations by ~450 bps. Guidance for Q1 Azure growth at +37%, with commentary highlighting continued supply constraints amid robust demand.

- Qualcomm (QCOM -7.7%): EPS beat, but handset revenue disappointed. Analysts focused on QCT margin guidance and iPhone modem share concerns.

- Western Digital (WDC +10.2%): Strong FQ4 beat with bullish Q1 guide; demand strength in HDD market and favorable mix shift noted.

- PTC (PTC +6.1%), FFIV (F5 +4.8%): Both beat and raised guidance, citing stabilizing macro conditions and hybrid cloud/AI tailwinds.

- ARM (Arm Holdings -13.4%): In-line results, but weak royalty revenue and operating income miss. EPS guide for Q2 below Street; concerns on expense ramp weighed.

Communication Services (S&P +2.08%) – Sector Leader

- Meta Platforms (META +11.3%): Beat across the board. Sales +22% y/y, ad pricing +9%, video engagement +20%. Narrowed FY25 capex guidance but hinted at ~$100B FY26 capex ramp, seen as justified by strong monetization trends.

- Roblox (RBLX +10.3%): Strong beat on bookings, DAUs, and engagement. Raised FY25 bookings guidance; analysts highlighted platform stickiness.

- Comcast (CMCSA +2.3%): EBITDA and revenue beat; broadband and wireless net adds positive surprise. Residential GTM pivot and content strength flagged.

Health Care (S&P -2.79%) – Sector Laggard

- Cigna (CI -10.2%): Mixed guide with cautious commentary on membership declines. Evernorth strength offset by weaker outlook.

- UnitedHealth (UNH -6.2%): Downgraded at Baird over Optum Health concerns.

- Dexcom (DXCM -9.3%): EPS beat, but FY guide implied 2H deceleration.

- Bristol Myers Squibb (BMY -5.8%): EPS/revenue beat, but cut FY25 EPS guide. Drug pricing policy risk amplified by Trump admin letters demanding pharma changes within 60 days.

Consumer Discretionary (S&P -0.38%)

- Carvana (CVNA +17.0%): Q2 revenue/EBITDA beat; record retail unit sales. Tariff resilience cited. Q3 unit volume seen increasing.

- Norwegian Cruise Line (NCLH +9.2%): Despite revenue miss, maintained FY guide. Strong onboard spend and forward bookings noted.

- Shake Shack (SHAK -14.6%): Q2 beat but comps missed. FY25 guide raised but analysts questioned 2H acceleration drivers.

Consumer Staples (S&P -0.59%)

- Sprouts (SFM -4.1%): Beat on Q2 but moderation in comps flagged. Guidance raised, but Street saw a high bar into print.

- Masco (MAS +3.7%): Revenue and EBITDA beat; reinstated FY EPS guidance above consensus.

Financials (S&P -0.62%)

- Lincoln National (LNC +11.4%): Big Q2 beat driven by Group Protection; improving disability trends supported outlook.

- MasterCard (MA +1.3%): Q2 beat and raised FY guide. July volume rebound noted post-soft June.

- Asset managers broadly underperformed.

Industrials (S&P 0.00%)

- C.H. Robinson (CHRW +18.1%): Q2 EPS beat; margin tailwinds from cost controls and NAST performance.

- Xylem (XYL +10.7%): Organic growth above Street; raised FY guide. Energy metering demand highlighted.

- Huntington Ingalls (HII +7.9%): Beat and raised FCF guidance; segment margins solid.

- AGCO (AGCO +10.6%): Beat on EPS; raised FY guide while baking in tariff risks. Euro strength a tailwind.

- Carlisle Cos. (CSL -13.6%): Weak Q2 results and lowered guide on project delays and construction slowdown.

Materials (S&P -0.99%)

- International Paper (IP -12.9%): Revenue beat but EPS miss; flagged cost pressures and outage headwinds. Tariff-exposed segment under scrutiny.

- Vulcan Materials (VMC -4.6%): Weather-driven earnings pressure.

- Copper stocks pressured by Trump’s new 50% import tariff on unrefined copper, sparking worst one-day decline since 1989.

Energy (S&P -0.60%)

- Crude oil down 1.1% to settle below $70/bbl on demand concerns and trade policy fears.

- Ford (F) flagged recall and tariff risks. Broader auto and industrial EV segments (incl. ICE autos, suppliers) showed some resilience.

Real Estate (S&P -1.74%)

- General underperformance amid rising rate expectations and month-end rebalancing pressures.

Utilities (S&P +0.59%)

- Safe-haven flows and defensive bid helped sector outperform in a risk-off session.

Eco Data Releases | Friday August 1st, 2025

S&P 500 Constituent Earnings Announcements | Friday August 1st, 2025

Data sourced from FactSet Research Systems Inc.