August 4, 2025

S&P futures are up 0.7% in early trading, rebounding from Friday’s selloff that left all major indexes down over 2% for the week (Russell 2000 -4%). Overnight, Asian markets were mixed (Japan down, Hong Kong and Korea up ~1%), while Europe is up over 1%. Treasuries are weaker, with yields up ~3 bp following Friday’s rally (largest yield drop since Aug ‘24). The dollar is down 0.3%, gold up 0.4%, Bitcoin +0.7%, and WTI crude -1.3% after another OPEC+ output increase (+547K bpd).

Markets are trying to bounce, though no specific catalyst. Cautious weekend headlines cited softening labor trends, tariff drag, and a seven-week Fed lull as overhangs. Offsetting this are strong Q2 earnings, improving revisions trends, AI growth optimism, tariff mitigation efforts, and some fiscal clarity.

Macro Outlook:

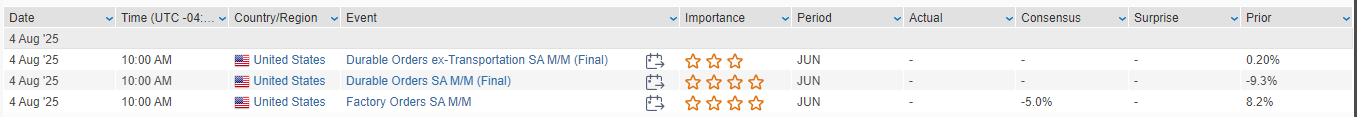

- Today: June factory orders.

- Tuesday: June trade balance, July ISM services (est. 51.5).

- Thursday: Q2 productivity, unit labor costs, jobless claims, NY Fed inflation expectations.

- Fed speakers: Cook, Collins, Daly (Wed), Bostic (Thu), Musalem (Fri).

- Politics: Trump expected to name new Fed governor and head BLS statistician.

Corporate Highlights:

- BRK.B: Q2 EPS beat despite soft revenue; $3.8B KHC impairment noted.

- AAPL: Tim Cook held a rare all-hands meeting to emphasize AI and product strategy.

- APH: Nearing ~$10.5B deal to acquire COMM’s broadband/connectivity unit.

- BA: St. Louis defense plant workers strike for first time in nearly 30 years.

- UNP/NSC: Shippers urge regulators to scrutinize merger.

- BP: Announced largest oil/gas discovery in Brazil’s Santos basin in 25 years

U.S. equities closed lower Friday (Dow -1.23%, S&P 500 -1.60%, Nasdaq -2.24%, Russell 2000 -2.03%), capping a down week across all major indices. The selloff was largely driven by weaker-than-expected macro data, rising Fed rate-cut expectations, and renewed tariff tensions.

Labor Market Weakness:

July nonfarm payrolls rose just 73K (vs. Street ~110K), with downward revisions of 258K to May and June. The three-month average gain now stands at just 35K—the lowest since 2020. The unemployment rate ticked up to 4.2%, and average hourly earnings were in line at +0.3% m/m. Healthcare hiring remained a bright spot, but declines were broad, including in federal jobs. The print significantly shifted Fed rate cut odds, with 90%+ probability now priced in for a September cut, up from below 40% before the release.

ISM Manufacturing Disappointment:

The July ISM Manufacturing Index fell to 48.0, under consensus (49.5) and June’s 49.0. Employment fell further into contraction (43.4), while new orders and production modestly improved. Broad tariff-related input cost uncertainty was cited as a major challenge by survey respondents.

Fed Commentary and Resignations:

FOMC dissents from Waller and Bowman were explained Friday. Both cited weakening labor conditions and diminishing inflationary risks as justification for immediate rate cuts. Gov. Kugler’s resignation, effective August 8, could further shift the Fed’s internal balance toward doves, particularly amid rising pressure from President Trump, who also called for the BLS Commissioner to be fired.

Tariff Escalations:

Trump announced a new tiered tariff structure:

- 10% baseline on countries with trade surpluses

- 15% for those with trade agreements/moderate deficits

- 25–39% for countries with no agreement and high deficits (e.g., India, Switzerland, Taiwan)

He also hiked Canada’s non-USMCA tariff rate to 35%, citing the fentanyl crisis. These moves reinvigorated concerns about global supply chains and trade friction, casting doubt on the so-called TACO (Tariff-Aware Cooperative Optimization) narrative.

Rates & Commodities:

Treasuries rallied across the curve, led by the short-end: the 2Y yield fell 25bp (largest move in three years). The dollar weakened 1.2% but remained up on the week. Gold rose 1.5% and WTI crude fell 2.8%, although still up 3.3% for the week. Bitcoin dropped 3.1%.

Information Technology (S&P -2.07%)

- AAPL -8.3%: Q3 beat expectations with 13.5% iPhone revenue growth and 13%+ Services growth. China revenue posted its best two-year growth, and margins beat. However, early gains faded amid caution on AI ramp, capex, and market-wide macro weakness.

- KLAC: Beat driven by strong Process Control demand.

- DXC: Beat and raised FY guidance, citing AI integration as a growth tailwind.

Communication Services (S&P -1.65%)

- RDDT +17.5%: Q2 beat across the board. U.S. digital ad growth +84% y/y. DAU and ARPU beat; Q3 guide ahead.

- ROKU -15.1%: Q2 beat, FY25 guide raised, buyback announced. But hardware revenue projected to decline.

- SATS -17.4%: Revenue miss and OIBDA fell 37%. Subscriber base eroded.

Consumer Discretionary (S&P -3.59%)

- AMZN -8.3%: Q2 revenue and income beat, but AWS growth of 17.5% was underwhelming vs. Azure/Google Cloud. AWS margin contraction and high bar for retail volumes added to pressure.

- COLM -12.9%: Results ahead but U.S. trends weak. Guidance flagged 2H slowdown and tariff headwinds into 2026.

- MODG: CEO resignation and delay of Top Golf spin-off.

- MTZ -8.0%: Beat, raised FY guidance on volume; EBITDA margin cut.

Consumer Staples (S&P +0.53%)

- KMB +4.8%: Organic sales +3.9% vs. 1.3% est.; margin tailwinds and lowered tariff headwinds cited.

- CL, CLX: Positive organic growth beats, reiterating improved FY outlooks.

Health Care (S&P +0.58%)

- SYK -3.8%: Beat and raised guidance. Strength in MedSurg/Ortho, but scrutiny on knee business and high execution bar.

- UTHR +7.1%: Announced $1B accelerated share repurchase.

- ILMN -7.8%: Beat and raise, but consumables strong while instrument placement soft, esp. U.S. academia/government.

- MRNA -6.6%: Cut top end of FY revenue guide by $300M on U.K. delivery delays.

Industrials (S&P -1.46%)

- FLR -27.0%: Missed big on EPS/revenue; cut FY25 guide; cited infra project weakness and delayed capex.

- GWW -10.3%: Missed EPS; tariff inflation hurt price/cost timing; cut guidance.

- IR: Raised EPS guidance on FX tailwind; volume guidance held steady.

Materials (S&P -0.75%)

- EMN -19.0%: Q2 miss and sharply lowered Q3 guide. Tariff uncertainty and demand concerns weigh.

- LYB -7.8%: EBITDA light; flagged soft O&P and Tech performance. Capex cuts support balance sheet.

- AVTR -15.5%: Weak bioscience performance and margin miss; cut FY guidance.

Energy (S&P -1.77%)

- FSLR +5.3%: Beat and raised guidance; new tariffs on Vietnam/Malaysia/India seen as tailwind. Caution on Q/Q backlog declines.

- WTI crude: -2.8% on the day, but +3.3% weekly. Volatility driven by Middle East tensions and tariff risks.

Financials (S&P -1.76%)

- RKT +12.0%: Beat on NII, loan sales, and servicing. Strong origination volume. Q3 guide ahead.

- COIN -16.7%: Missed on revenue and EBITDA; weak retail volumes and user activity.

- FNMA +10.2%: Reports of Trump administration exploring public offering and monetization plans for FNMA/FMAC.

Real Estate (S&P -0.26%)

- REITs broadly outperformed in risk-off rate rally. GSEs (FNMA/FMCC) rallied on privatization headlines.

Utilities (S&P +0.11%)

- Held up as a defensive play amid rate-cut sentiment and macro worries. No major stock-specific news.

Eco Data Releases | Monday August 4th, 2025

S&P 500 Constituent Earnings Announcements | Monday August 4th, 2025

Data sourced from FactSet Research Systems Inc.